StocksToTrade Review (2024): Is This Trading Platform Worth It?

![StocksToTrade Review ([year]): Is This Trading Platform Worth It?](/_next/image/?url=https%3A%2F%2Fcolorful-action-2ff8f86b45.media.strapiapp.com%2FStocks_To_Trade_Review_2023_jpg_449a45c240.webp&w=1920&q=80)

It’s another one of those making money online programs that is centered around selling a clapped out membership that supposedly makes you money by gambling with pump and dump stock and crypto bros.

But hey, if you wanna risk throwing your life savings away on something good ole’ Elon could fuck up with tweet…

Then hey, by all means, don’t let us stop you from creating yet another screw up your parents give you shit about.

It’s supposed to show you how to become a 6-figure day trader…but it’s truly out of reach for most people like you constrained by budgets and student loans.

That’s just the truth…you won’t get rich by chasing the next hot trend on reddit.

And while we have to be honest for this review…

StocksToTrade does come with some very helpful information to make money online and land some massive trade profits…

But it’s outdated AF!

At the end, we’ll answer some of the most frequently asked questions regarding StocksToTrade and pussy footin’ cheap trades in general.

And most importantly, we’ll show you the exact system we used to build our own internet marketing business to over $40,000 a month in mostly passive income.

This system made us swear off Crypto and Stocks for good, because it uses some of the same skills but in a much more powerful and profitable way!

But more on that later.

For now let’s hop into all things StocksToTrade!

DISCLAIMER:

This StocksToTrade review has been thoroughly researched with information and testimonials that are available to anyone in the public. Any conclusions drawn by myself are opinions.

Essential and relevant updates are routinely provided.

It's cloud-based software, making it accessible anywhere and anytime.

It is a friendly software for both novice and experienced traders.

$179.95 monthly is quite costly for beginners or the average trader.

Some have reported software lags.

Unavailability on Mobile and Web

Why Listen To Us

My name is Josiah, and this is my Dad, Joel.

I built that site in 2020, and it still makes me $1,500 per month. It’s a basic 5 page website I built based on a template the program provides.

The best part to me? My dad and I get to do it all together!

So between the:

Ease of reaching $5-$10K per month in income online

Straightforward-ness of the system to do it

Fact that I get to do it w/ my family

Is why I recommend local lead generation as my #1 business model for making money online.

Sure, it takes some work and dedication – but anyone that tells you that there’s a business out there that requires no work is selling you a lemon.

I’m not saying you need to sign up for the same program I did, but I would definitely recommend giving the business model a peek!

About StockstoTrade

StockstoTrade is a trading platform where you can do all things related to stocks such as the ones mentioned above.

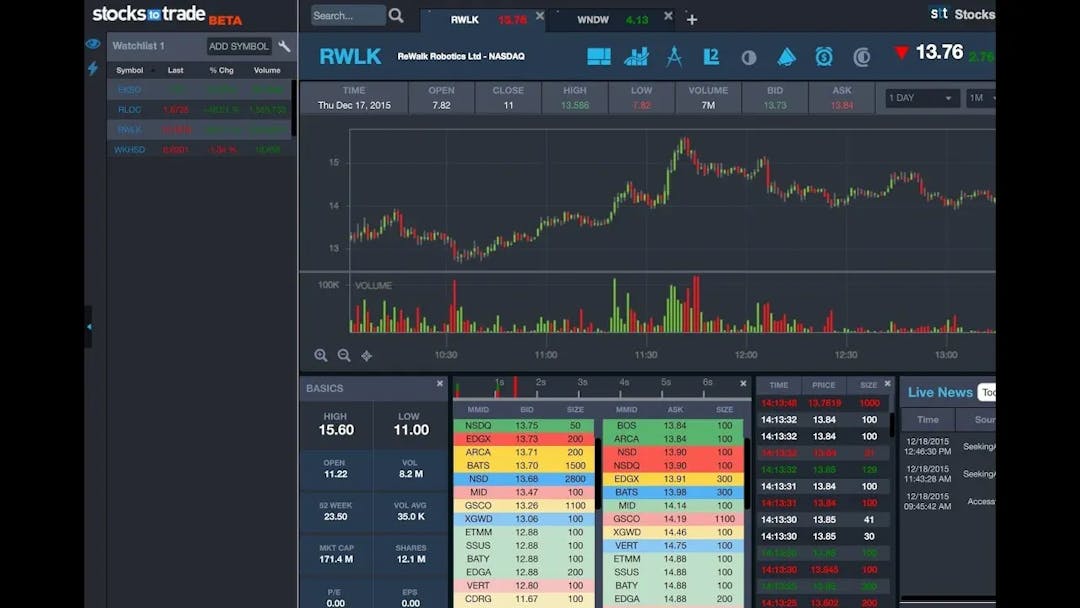

Charting, level 2, watch lists, news, training, paper trading, and social media all rolled into a single platform - all these are integrated into this stock market scanner which is designed to help your trading become easy and convenient.

Because traders involved in both day and swing trading designed this software, the tools and features you'll find in StockstoTrade are seamlessly integrated that even new traders in the industry can learn to use.

You can find all these in one platform, except the broker.

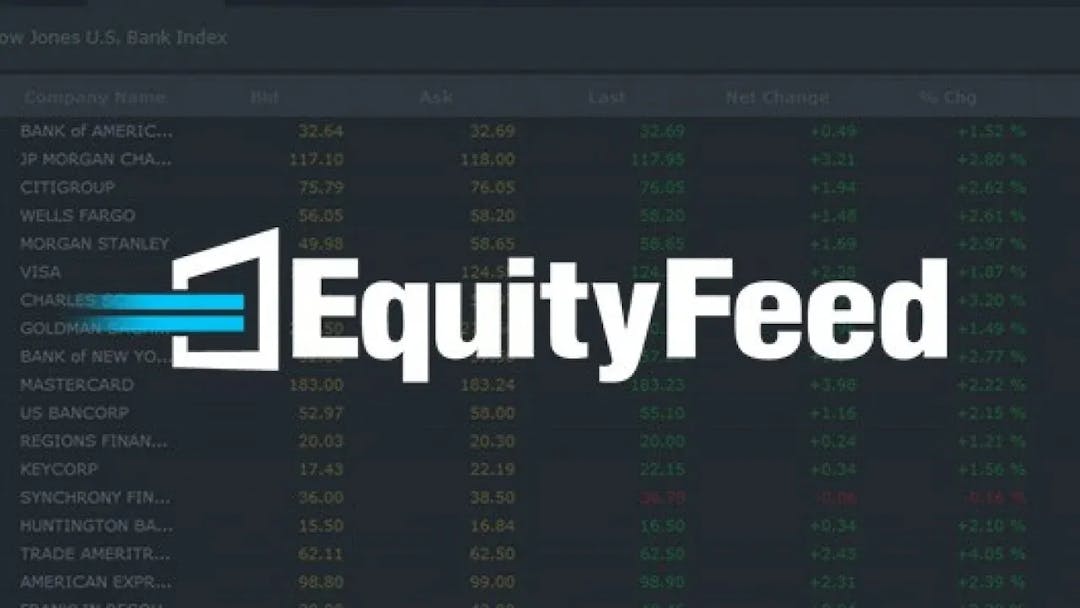

StockstoTrade initially resembled an EquityFeed and over time, developed its own distinct features and become an entirely new trading platform.

To date, StockstoTrade plans to bring existing online brokers and the platform to seamlessly work together and help subscribers to make trading decisions a little less difficult.

Who is Timothy Sykes?

Popular for his penny stock trading scheme, Tim Sykes and his impressive team of traders developed an all-inclusive research and stock scanner platform designed to help new and seasoned traders alike in finding trading opportunities.

Tim Sykes built this platform with penny-stock traders in mind which is why it has become more popular than ever. It is cloud-based and accessible via browser from any internet connection.

He is that whiz kid who grew his $12,415 Bar Mitzvah gift into an impressive $5 million when he was just a teenager.

In 2007, Tim suffered huge losses as a hedge fund manager under the Sykes’ Cilantro Fund Partners hedge fund. His trading career spiraled down which was a shock to many.

That was a year after he was cited by Trader Monthly magazine as one of the hedge fund industry's youngest and most promising young stars.

His genius has led him to grace New York's Financial district, Wall Street, even as a young man.

His trading decisions took a turn after this massive loss and learned from it. Hence, the birth of the penny stock trading strategy.

Today, Tim is a well known trading coach who has taught countless stock traders under his trader training program.

His chart-topping success was featured in major television shows such as CNN, CNBC, Forbes, Bloomberg, including Larry King and Steve Harvey's shows.

He also appeared in a six-part documentary called “Wall Street Warriors."

What is Tim Sykes Trading Strategy?

Tim's focus is on the technical analysis of stocks, exercising his incredible talent for forecasting smart trades. His expertise lies on determining penny stocks to trade, moving in careful discretion as to when to buy and sell stocks.

Typically, he won't hold these stocks for over two days.

We've learned from Tim's strategy that short selling penny stocks is possible. Because penny stock prices shoot up mostly because of hype, the hype eventually dies down and causes the stocks to crash.

When this happens and you miss to profit from it, you can settle to short sell the stock and profit from the drop instead.

What this means for you and everyone else is that regardless of how the stocks are performing, everyone can definitely still make a profitable gain out of it.

Pretty awesome, right?

StocksToTrade Features and Trading Tools

Charts

The charts are loaded with various tools and indicators, giving the users a selection of candlestick, bar, and line charts with diverse timeframes to choose from.

As a result, it enables you to assess and examine market data on multiple timeframes so you can have an all encompassing perspective on price action.

It also works for the swing and intra-day trading. Drawing tools are designed to manually draw trend lines on the charts and channels.

This pretty much helps you spot patterns that are forming.

What's more, you can easily link these charts to other windows.

Technical Indicators

Besides the technical price, the charts also come with momentum indicators.

Some of these are stochastic, moving averages, MACD, Bollinger bands, and pivot points.

With all these multiple indicators at play, it is just right that the software is designed to allow you to have proper visuals.

And through their excellent customization panel, you can change the settings, i.e. colors of the indicators, as you see fit.

Level 2 Data

One of the key features that users get from stt is access to Level 2 market data, otherwise known as Market Depth data.

Level 2 data pertains to the stock's bid info and ask prices. It keeps a record of quotes submitted by traders to a stock exchange. It is a very effective and useful tool to gain insight on how the stock dynamics can affect the price.

What's great about StockstoTrade is that they made this feature available to all their subscribers. With other platforms, only professional traders get access to this feature.

Another notable benefit of Level 2 Data is that you can display it together with other charts which is such a major convenience when you reference against your technical analysis, allowing you to determine with much ease the stocks' resistance and support levels.

This ultimately leads you to make smart trading decisions

Stock Scanner and Stock Screener

Scans and stock screener is used for more complex stock scans, resembling EquityFeed's filter builder.

Not all will find the stock screener

You will have to do a lot of menu scrolling and and go through various steps when defining a single filter. STT's efficient visual layout of the stock screener makes it pretty easy and direct to monitor the parameters which have been previously defined.

The stock scanner and screener is an excellent scanning tool that gives you an extensive coverage of stocks, allowing you to get hold of important market data for your further analysis

Some of them are:

- Top gainers

- Top losers

- Stocks breaking out

- Stocks pulling back

- Stocks rebounding

- Stocks with the largest recent gains

Watch List and News

Watch lists and news are inclusive when you subscribe to StockstoTrade.

Stt does not give you an alert whenever watch list stocks are breaking via resistance levels or technical support. They can, however, be displayed on screen at any given time so you can monitor the stocks.

And on a separate window, the news can be displayed. You can also link them to other windows.

Filtering the news by topic, keyword, and stock is possible as it gets updates from Wall Street Journal, MSN Money, Twitter, Finance, Yahoo, Finvix, and Seeking Alpha.

With social media in mind, the developers integrated a filter for Twitter to identify any activity related to the criteria of the user. More often than not, some important news may first circulate on social media before spreading to the markets.

StocksToTrade Differentiators

In comparison, StocktoTrade offers more features than its competitors.

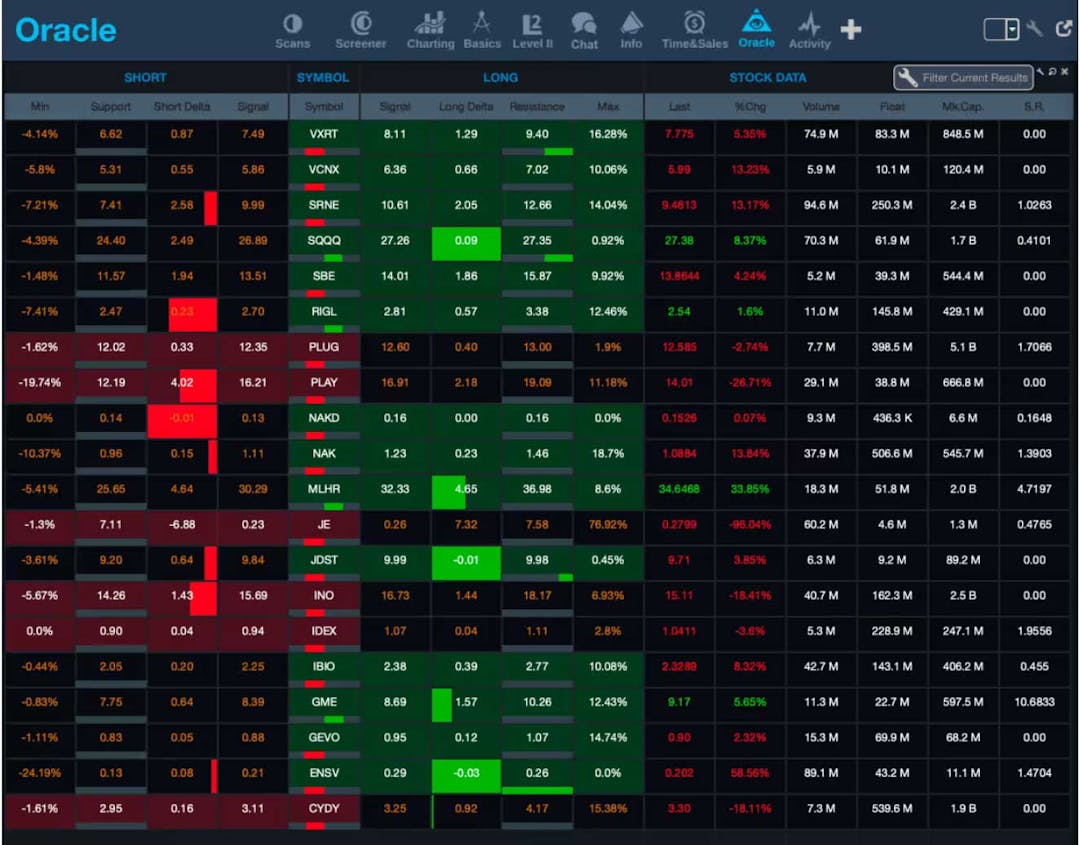

Noteworthy features included in a StockstoTrade membership are level 2 data, OTC, the Oracle scan, a paper trading simulator, and Pink Sheets scans.

Meanwhile, you get to enjoy live webinars, video lessons by expert traders, and training sessions when you upgrade to the StockstoTrade Pro plan.

How much does StocksToTrade (stt) cost?

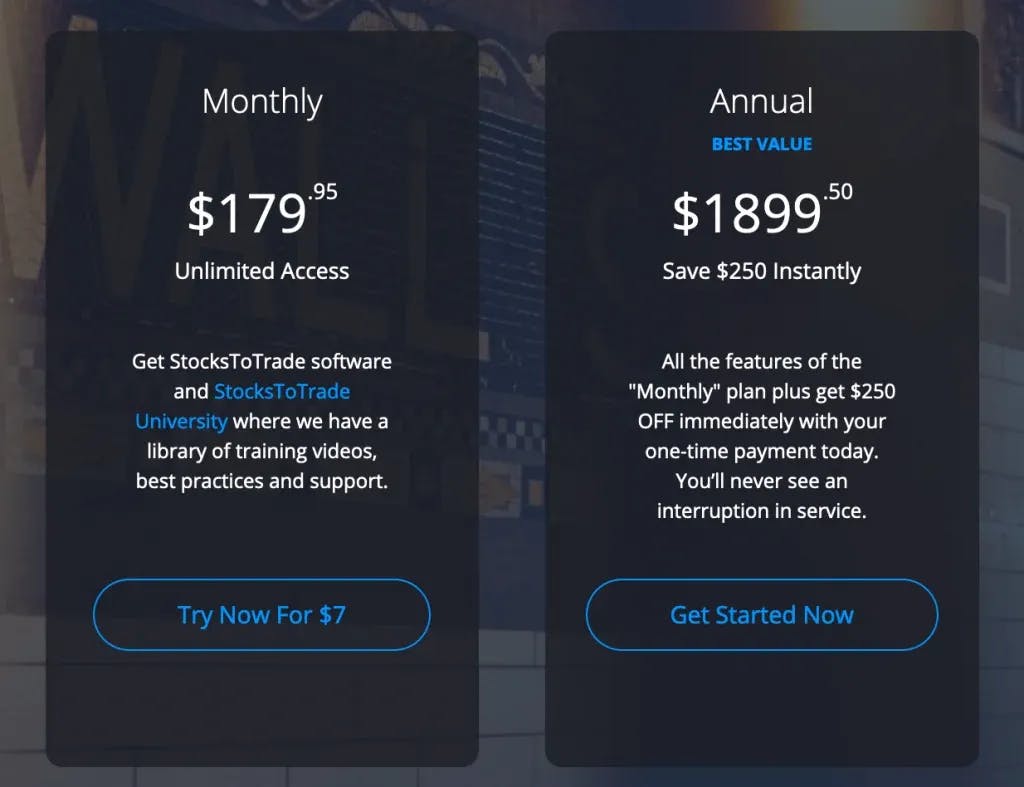

A 14-day free trial costs $7. Monthly subscription plan is at $179.95 and the yearly service at $1899.50

Is StocksToTrade Free?

It's definitely not free.

As mentioned, it would cost you $179.95 per month to get full access of StockstoTrade features and tools. If this sounds too expensive, you can first take the trial package for only $7 valid for 14 days.

Some of the key features and tools you get to enjoy in a StockstoTrade membership are:

- Unlimited Custom Watchlists

- Proprietary Stock Selection Tool

- Trading Plan Tool

- Real-Time Charts

- Screener+ Tool

- News Screener Tool

- Paper Trading & Broker Integration

- All-In-One Time Saving Features

If you want to up the ante with your trading skills, then you can try the StockstoTrade Pro. It is an advanced program to improve your skills in making a trade.

Extra features include a live chat room hosted by Tim Bohen, stt Pro's moderator and trading expert, where he livestreams the stock market and simultaneously gives his real time analysis both in audio and video.

The price for the stt Pro is disclosed only when you avail the software.

StocksToTrade Alternatives

EquityFeed and Trade Ideas are the two alternatives to StockstoTrade.

EquityFeed

As everyone may already know, StockstoTrade somewhat held a semblance to the EquityFeed trading platform with a subpar performance back when it was just starting

Both platforms now have greatly improved over time.

To date, EquityFeed holds almost all tools and features that StockstoTrade currently has, but a little cheaper.

It is notable for its reliability, ease of use, and speed. Some of its tools are data scanners, charting, news scanners, integrated trading, and level 2 among others.

Trade Ideas

Trade Ideas is the next likely alternative.

If you are the type who uses StockstoTrade for scanning purposes, then Trade Ideas can match that with their pre-built scanning feature.

Take note that Trade Ideas is not a comprehensive trading tool like StockstoTrade. It is good for scanning only and we will not suggest using it for level 2 data, charting, and others.

Day Trading And StockstoTrade Tools

Day trading is the buying and selling of a security in a single trading day, most commonly done in stock markets and foreign exchange.

Typically, a day trader is both well-funded and well-educated who uses trading strategies that are short-term.

It involves a lot of risks and is certainly not everyone's cup of tea. It requires fully established day traders to be successful in it, with a comprehensive understanding and expertise on the dynamics of the stock market and strategies that are profitable in the short term.

StockstoTrade platform can be a conduit for your day trading venture. Considering the risk involved, it can definitely help you make progress with its cutting-edge tools. StockstoTrade gives you two steps ahead of the game.

Can You Trade On StocksToTrade?

After one whole year of developing and upgrading, StockstoTrade platform now has a broker integration system in place!

Launched last September 25, StocktoTrade can now work with most brokers online.

You can integrate your broker with StockstoTrade and executes trades right from the platform!

In case you don't have one, they provide a broker deal to their members through Tradier, a brokerage firm that offers low charges and transparent pricing options.

But it's tough to make money!!

Yeah, that sounds like a dick thing to say, but if you're gonna put in the amount of grueling work to become an day trader (which, trust us, isn't easy), you might as well bring in some REAL money.

The program that helped skyrocket our online business to $40,000+ per month teaches some of the investment skills, but shows you how to monetize them in a much, MUCH more profitable way.

Is Stocks To Trade A broker?

No. StockstoTrade is not a broker.

It has an exclusive offer for its active members via Tradier: For only $14.99 per month, you will enjoy unlimited trades with a $500 minimum account requirement.

Is There Broker Integration?

Yes! Traider was recently launched during the last quarter of the year after a year-long of being in the works.

Is StocksToTrade Worth?

StockstoTrade gives you the features of old platforms and at the same time, offers relevant new add-ons. One of them is their alert system service which keeps track both the stock market and social media.

It is important to note, however, that every platform is independent, which means you need to subscribe to them separately to use them.

I find the platform beneficial on three fronts:

Multiple Trading Platforms

tockstoTrade allows you to streamline multiple trading platforms. While this is true, you still need to master how each platform works.

If you fail to do this, StockstoTrade, now matter how excellently designed, would be of no use to you completely. In the end, it's your skills, good trading habits, and persistence as a trader that would generate profitable results.

That means you need to be always on the look out in the market place to keep track of smart trading opportunities, including those that you are not yet 100% sold out .

This is possible through StocktoTrade's Oracle which provides you a list of companies that will likely make a move on the basis of potential momentum.

Paper Trading StockstoTrade

Another key advantage of using StockstoTrade is that you get paper trading whether you are an experienced trader or a new one.

Its goal is to make both users familiar with the StockstoTrade platform.

Because stt uses advanced indicators, paper trading is a crucial step that users need to take to fully maximize the platform's benefits.

This would prove useful especially for novice traders who do not have years of trade experience because this would monitor your progress and hence identify where you're weak.

In this way, you will be able to make necessary adjustments to your trading strategies and conduct in-depth analysis of your next steps, enabling you to compare them with the platform's strategies that are pre-built in the system.

Chart Analysis

The platform has efficient news indicators.

Great thing about StockstoTrade is that its features are not limited to one type of trader which makes it friendly to all kinds of traders.

In translation, this means that depending on what type of trader you are, you can customize the charts as you see fit for you.

STT has a lot of dynamic features that any trader will find helpful. This is why it's a tool for everyone regardless of your trading background.

These features, however, do not come cheap. And it's one of its downsides. Besides the 14-day trial at $7, they also offer a 7-day trial valued only for a dollar.

This is the best way, we'd say, before you invest heavily in this platform.

Now let's have a quick rundown of its pros and cons :

Pros

- Essential and relevant updates are routinely provided.

- The platform boasts of dynamic and efficient rading features and tools.

- It is designed for both swing and intra-day trading.

- It provides sound paper trading simulator.

- It allows users to customize for building scans.

- It is a cloud-based software, making it accessible anywhere and anytime.

- It is a friendly software for both novice and experienced traders.

- It has an intuitive site.

Cons

- $179.95 monthly is quite costly for beginners or the average trader.

- Software lags have been reported by some.

In Conclusion It's Not A Scam...But...

Overall, StockstoTrade is a great tool that can increase your chances of success in the stock market both as a long-term investor and stock trader. It's the best conduit to perform your stock market's technical analysis.

It's a software that provides traders extensive range of tools. To help you get started, you could try their 7-day trial for only a dollar to have a feel of the product.

The business model they teach however is DEFINITELY not worth it.

Does that answer your question?

It is entirely possible to build a profitable, successful online business without day trading though.

Our #1 Recommendation To Make Money Online In 2024

Our review team has come across a program in the real estate industry that is next level!

Although it’s not real estate in the traditional sense, it’s all digital.

Where StocksToTrade falls short is in scalability.

There’s only so much time in a day and there’s only so much money you have to start with.

Let’s face it, unless you have a lot of money to start with, you don’t stand to make much money with Stocks.

But what if you could make even more money off of little local websites without having to worry all day about losing your money in the blink of an eye?

With this Digital Leasing program, you can make recurring monthly income without worrying about losing all your money overnight!

Sound too good to be true? Of course it does! But it isn’t…in fact, business owners wish they had this skill!

All you have to do is build and rank a LOCAL website and forward the jobs off to a business owner in town, you could even email it to them!

This works for literally any service based business, tree service, plumbing, towing, etc.

How do you get paid and how much?

Simple, after you forward the jobs off to a business owner and he makes some money off of them, you simply ask to make the deal beneficial for each other.

A fair price to charge per lead, depending on the industry is 10-20%…let’s just use the tree service industry for example and go by worst case scenario.

Let’s say you build and rank the site and only 10 jobs a month come in. The average tree service job is anywhere from $500-$2000!

That means at bare minimum you have an asset worth $500 a month!

See why they call it Digital Leasing now? That’s a rent payment.

The great thing is how easy it is to scale. You don’t have to worry about the constant and crazy market volatility that Stocks entails.

So, getting back to StocksToTrade, if you take one of their picks...you could lose BIG TIME.

The course we recommend actually allows you to collect HUGE FLAT RATE DEALS. Truly passive income!

The training program takes making money online to a whole other level. The owner of the program walks you through how to build and rank a site hand in hand, with the occasional voice over when he is sharing his screen.

You will learn the importance of keywords, website name, how to send call notifications via email, backlinking, etc.

Once the training program is completed you will also have access to a Facebook group much better than the StocksToTrade group in our opinion. This group is much more active.

Unlike StocksToTrade, where you’re profiting maybe $10 per trade, you could be getting 10-20X THAT.

A business will always want more leads and another job. In fact it doesn’t even matter that the job isn’t coming from their website name…they see it as it is…expanding Digital Leasing.

Unlike StocksToTrade, more people have been able to walk away from their 9-5 job as well.

Digital Leasing allows you to have passive income with most of your day being spent ENJOYING your money, NOT losing it.

Now, we know you probably have tons of questions…

#1 Business Recommendation

We each make around $10,000 per month with the help of this system.

yes, show me more