How To Start A Bookkeeping Business In 2024

![How To Start A Bookkeeping Business In [year]](/_next/image/?url=https%3A%2F%2Fcolorful-action-2ff8f86b45.media.strapiapp.com%2FStart_A_Bookkeeping_Business_c16ca382b5.webp&w=1920&q=80)

If you’re good at math and have outstanding attention to detail, then a career as a bookkeeper might be right for you.

It is possible to work as an independent bookkeeper.

However, if your goals are to be more involved in your business, such as managing your workload and income, it might be worth considering starting your own bookkeeping company.

In this review, we’re gonna go over everything you need to know about starting a bookkeeping business.

For that matter…

What you’ll read in this article is exactly the same information that has helped more than 71% of our readers with their questions about how to be a bookkeeper.

Now, I should point something out first.

Even, though you might have some pre-conceived notions about bookkeeping… when you’re done with this review, you’ll feel pretty confident that whatever decision you make will be the best one for you.

On top of that…

Towards the end of this article, I’ll answer some of the most common questions on how to start a successful bookkeeping business…

But most importantly, you’ll see the exact system that a lot of other people have used to build their own internet business to over $40,000 a month in mostly passive income.

So, let’s jump right in…

DISCLAIMER:

This review has been thoroughly researched with information and testimonials that are available to anyone in the public. Any conclusions drawn by myself are opinions.

Why Listen To Us

My name is Josiah, and this is my Dad, Joel.

I built that site in 2020, and it still makes me $1,500 per month. It’s a basic 5 page website I built based on a template the program provides.

The best part to me? My dad and I get to do it all together!

So between the:

Ease of reaching $5-$10K per month in income online

Straightforward-ness of the system to do it

Fact that I get to do it w/ my family

Is why I recommend local lead generation as my #1 business model for making money online.

Sure, it takes some work and dedication – but anyone that tells you that there’s a business out there that requires no work is selling you a lemon.

I’m not saying you need to sign up for the same program I did, but I would definitely recommend giving the business model a peek!

What Does A Bookkeeper Do?

Bookkeepers play a vital role in any business operation. A bookkeeper is hired to manage the company's finances.

They can help small-business owners manage and organize their cash flow. This is one of many essential indicators that a business' health will be.

They often assist small-business owners in preparing critical financial statements, including the balance sheet and profit & loss statement.

Remember that bookkeepers cannot file taxes, audit like certified public accountants, and are not the same as accountants.

Bookkeepers are not required to hold an accounting degree. They can earn certifications through training, but they can also get experience on the job in bookkeeping to set up their business.

Bookkeeping services typically include:

- Manage business finances using business accounting software.

- Manage accounts payables and receivables.

- Provide assistance to businesses by providing an overview of their finances to help them understand how they spend their money.

- Generate financial statements.

Costs To Start A Bookkeeping Business

Bookkeeping businesses tend to have low startup costs, especially if they start out in a home rather than renting office space.

You can expect to spend around $10,000 to open a new business from your home office. Small businesses that are set up in rented offices will incur higher startup costs. This could be as high as $20,000.

Typical startup costs for a bookkeeping service include:

- Filing cabinets, office furniture

- Equipment such as computers or printers

- Bookkeeping software

- Office supplies

- Office phone and internet service

- Signage

- Working capital for the first three months of salary, internet, and other utilities.

Steps To Starting A Bookkeeping Business

It's not difficult to learn how to start your own bookkeeping business. These are the steps you need to get your bookkeeping business started quickly.

1. Pick Your Market And Niche.

The work of a bookkeeper can be applied across many industries. All businesses need to track their finances and optimize their financial performance.

A specialty may be necessary to differentiate your business from its competitors and help you market it better.

This can help build your credibility in that market as well as improve your skills. It's easier to pinpoint your target audience if there is a specific niche.

Also, it is essential to research the market to find established bookkeeping businesses and industries that serve your niche.

2. Write A Business Plan.

No matter what business type you have, every business owner needs to make a plan. This also includes bookkeepers.

A business plan is a plan that outlines your company's goals and objectives. It's a comprehensive document that covers what you do, how your market works, and your business's competitive advantages.

The plan will include projections and growth plans. This document can be lengthy, but it's essential. It will help you stay focused and allow your business to run smoothly from the start.

Two parts of your business plan deserve extra attention.

Choose A Business Name.

Your business name is likely to be the first impression clients get about your company. What do you hope your name will communicate? Are you referring to your expertise, a particular area, or your personal style?

To avoid confusion:

- Make sure no other business is using your name.

- Run the name through a few people to gauge their perceptions.

- Once you have the names of your finalists, make sure they are in your secretary's business name databases.

Consider Certification.

It is not necessary to be certified to operate a business in bookkeeping, as we said above. You might want to become a certified private bookkeeper. This certification signals to clients professional-level skills and maybe an essential way to distinguish yourself in a crowded market.

You can also obtain certification within certain software products.

3. Register Your Business And Get Insured.

Once you have selected a business name, the next step in your business registration process is to make it official. The exact procedure will depend on how you intend to structure your business and where you plan to go. Check out the specific rules on how to register your corporation with your secretary.

Choose A Business Entity.

When you register your business and open up shop, a major step is selecting a business structure. This will determine how taxes you pay as a small business owner, how much liability protection your business has, and how you structure your business.

For the initial stages of your bookkeeping company, you may only be working alone. You may have a limited liability company (LLC) or a sole proprietorship when you start looking for business entities. If you think that you might require some help later on, this could be a great option.

Obtain Insurance.

Although it isn't mandatory, you might want to get insurance for bookkeeping businesses. It can protect your business from potential financial liability. Bookkeepers typically have business insurance policies that cover professional liability and general responsibility.

4. Choose Your Bookkeeping Software.

This one is simple: Your bookkeeping system will be the backbone of your business. There are many different options for the best bookkeeping software. Be sure to look at them all.

QuickBooks Online is an excellent option for anyone who is overwhelmed.

Xero may be another popular option. However, there are many bookkeeping applications to choose from.

These programs are available for certification, which can help you be an expert in your field and allow you to market yourself.

5. Set Up Your Business Infrastructure.

If you're looking to start a bookkeeping service, there are several vital pieces of infrastructure that you'll need. The following are some of the things you should consider when setting up your bookkeeping business:

Website

Your website is the best place for potential clients to learn about you and share their experiences. A website is essential if you have a completely virtual bookkeeping business.

This can help clients see your expertise. You can create your website with ease, thanks to a variety of website builders.

Client Database Management

You must keep track of all clients you have as you grow your client base. You can set up your workflow with a CRM or project management tool.

Other options include specific accounting practice management software. Some even integrate with QuickBooks Online.

File-Sharing

If you expect your clients to send you information such as receipts, statements, or other documents, it might be worth looking into the share file tool.

Dropbox is a popular alternative. With Dropbox, you can create shared folders that you both and your clients can access.

Business Bank Account

To ensure that your business finances are separate from your personal, you'll need to open a bank account. This is vital for both personal liability and taxes.

Begin with a small business checking account. As your business grows, it may be possible to add a savings account to allow excess funds to earn interest.

Look around before you make a decision about where to deposit your hard-earned money.

6. Price Your Services.

A small-business owner faces the most significant challenge when deciding how much to charge. Too little can mean that you aren't getting fair compensation for the work you do.

Too much can make it hard to compete against other bookkeeping businesses.

PayScale, an online platform that tracks rates and salaries of bookkeepers, shows that the average hourly rate is $17/hour ($10 for the low end and $24 for the high end).

Look into for-hire and freelance websites like Fiverr. People list their rates on these sites. Look for bookkeepers with similar skills and experience to help you decide what price range you should charge.

Be aware that your years of industry experience, specializations in certain industries, certifications you hold, and the area you work in should affect how much you charge.

If you feel that you are not being priced accurately, you can change your rate.

7. Find Your Customers.

Marketing is essential regardless of the business type. The smartest small-business marketers will know who their customers are and direct them to advertise.

The unique selling proposition you create for your company is essential.

Are you highlighting your experience?

Your area of expertise?

Your emphasis on local business This will help you think up creative ways to market yourself. You can use direct mail, radio ads (or other media), email campaigns, and social media ads.

Remember the power that word-of-mouth referrals have. Don't be embarrassed to ask for them.

8. Understand Your Funding Options.

It's unlikely that you will need large amounts of capital if your business is small. If you do open a brick-and-mortar office, you may explore other funding options.

However, for now, you'll probably want to get a credit card for your business to finance your bookkeeping.

This will allow you to have the money you need to start your company and keep track of your business expenses. This is not only necessary for separating your personal and professional finances, but it will also assist you in your tax season bookkeeping.

There are many business credit cards available. Some offer 0% interest rates. Make sure to pay the balance off before the introductory period ends. The variable APR will then kick in.

How Much Can You Potentially Make Owning A Bookkeeping Business?

Bookkeepers will generally either charge an hourly rate of work or a monthly fixed price. It might seem appealing to set your rates low at first to attract the first few clients.

But, this could cause you to lose clients. Pricing is a complex task. However, it's not necessary to price too low.

The average earnings for bookkeepers are $42,806 per annum, which works out at just over $21/hour. The amount of money you can expect from your business will depend on many factors.

Your income is affected by your location, what clients you have, how much work you take on, and how high your rates are.

As they can decide their rates and take on more work, freelance bookkeepers earn more than corporate bookkeepers. Your business can be a profitable and rewarding venture if your drive is strong.

Things You Should Understand Before Starting A Bookkeeping Business

To run your own business successfully, you need to establish systems and processes. These systems are consistent and prevent you from omitting crucial details.

They can also increase efficiency and help to ensure that everyone works together.

Bookkeepers often offer additional services to small business owners, including billing services, payroll services, tax preparation, tax returns, and more.

Consider working for a small bookkeeping business to get experience before starting your own company.

This can be a great introduction to the industry's difficulties and will understand how well-run businesses function. As you learn on the job, your skills will be enhanced, and you can apply them to your own company.

The Bottom Line

A final tip on starting a bookkeeping company: Make sure you are growing as much as the businesses around you. This doesn't mean that you must take on more clients. Instead, it means that you should expand your network and knowledge.

Keep up-to-date with your skills, increase your knowledge of your preferred platforms, and keep abreast of any changes in their features.

It is possible to attend professional events such as conferences or networking events. Remember that investing in your company is also investing in yourself.

What Is Our #1 Recommendation For How To Make Money In 2024?

Our review team has come across a program in the real estate industry that is next level!

Although it’s not real estate in the traditional sense, it’s all digital.

Where running a bookkeeping business falls short is in profitability.

You can’t realistically expect to be able to make any REAL passive income when you’re only bringing in maybe $42,806 per year.

But what if you leverage it?

With this Digital Leasing program, you can have the ability to completely walk away from manual labor!

Sound too good to be true?

Of course it does!

But it isn’t… in fact, business owners wish they had this skill!

All you have to do is build and rank a website and forward the jobs off to a business owner in town, you could even email it to them!

This works for literally any service based business, tree service, plumbing, towing, etc.

How do you get paid and how much?

Simple, after you forward the jobs off to a business owner and he makes some money off of them, you simply ask to make the deal beneficial for each other.

A fair price to charge per lead, depending on the industry is 10-20%… let’s just use the tree service industry for example and go by worst case scenario.

Let’s say you build and rank the site and only 20 jobs a month come in. The average tree service job is anywhere from $500-$2000!

That means at bare minimum you have an asset worth $1000 a month!

See why they call it Digital Leasing now?

That’s a rent payment.

The great thing is how easy it is to scale. You don’t have to answer the phone…all you have to do is get the phone to ring.

Remember all the small profit margins with bookkeeping?

This program actually allows you to collect huge profits, all without working in a brick and mortar business all day.

Truly passive income!

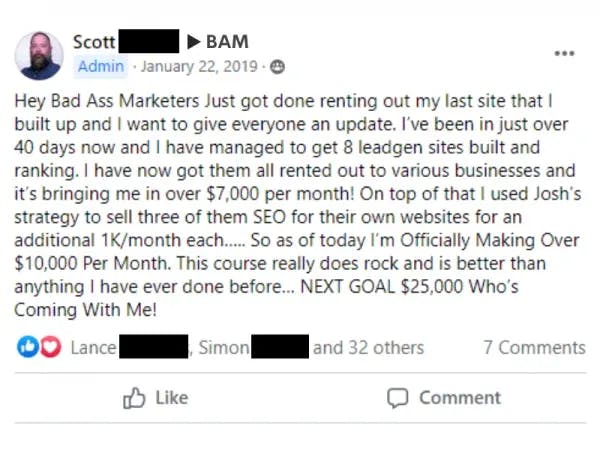

The training program takes making money online to a whole other level. The owner of the program walks you through how to build and rank a site hand in hand, with the occasional voice over when he is sharing his screen.

You will learn the importance of keywords, website name, how to send call notifications via email, backlinking, etc.

Once the training program is completed you will also have access to a Facebook group where you can ask questions and be in a community with others on the same journey as you.

Unlike bookkeeping, where you have to keep trading your time for money over and over…. You can finally get on the financially free side of life.

A business will always want more leads and another job. In fact it doesn’t even matter that the job isn’t coming from their website name… they see it as it is… expanding Digital Leasing.

Unlike bookkeeping, more people have been able to become financially free as well.

Digital Leasing allows you to have passive income with most of your day being spent OUT of the brick and mortar landscape.

Now, I know you probably have tons of questions… So, check this out to learn more.

#1 Business Recommendation

We each make around $10,000 per month with the help of this system.

yes, show me more