Rich Dad Poor Dad Review (2024): It Made Robert Kiyosaki A Legend

![Rich Dad Poor Dad Review ([year]): It Made Robert Kiyosaki A Legend](/_next/image/?url=https%3A%2F%2Fcolorful-action-2ff8f86b45.media.strapiapp.com%2FRich_Dad_Poor_Dad_jpg_5fdb3ad775.webp&w=1920&q=80)

Rich Dad Poor Dad Review

Rich Dad Poor Dad is a personal finance book released in 1997 by Robert T. Kiyosaki. Selling over 40 million copies in the United States and around the world, it has become a favorite covering topics such as Money, Social Security, Personal Investments, Cash Flow, Real Estate and Financial Freedom.

Many people have enjoyed reading this book and have followed Robert Kiyosaki's advice when it comes to personal investments.

A lot has transpired in the financial world over the last 20 years, and it would be interesting to know if some of Kyosaki's forecasts turned out to be true.

This Rich Dad Poor Dad review will cover this personal finance book to see if it really lives up to its name.

You'll discover a lot of the nuts and bolts that come with personal finance and wealth building.

And at the end, you'll find answers some of the most frequently asked questions regarding Rich Dad Poor Dad and financial freedom in general.

But most importantly, you'll see the exact system many others have used to build their own internet marketing business to over $40,000 a month in mostly passive income.

This system made them swear off things like conventional real estate and stock investments for good, because it uses some of the same skills but in a much more powerful and profitable way!

Kiyosaki appears to be a divisive figure in that you either love or hate his point of view.

For example, the review of Kiyosaki's work by Simple Dollar has a lot of personal prejudice, which is a bit unfair.

In a more objective stance, you'll see an assessment of the book based on others' business experience.

Rich Dad, Poor Dad should be seen as a generic start — a summary of investment/ startup opportunities — instead of a list of things to undertake as an entrepreneur.

Robert Kiyosaki highlights six crucial principles throughout the book.

These distinctions between his "poor" dad (his biological father) and the "rich" dad who taught him how to do business and become successful and rich are as follows:

- The rich don’t work for money, the money works for them.

- The value of learning financial literacy

- Taking care of your own affairs aka "Minding your own business"

- Taxes and corporations

- The rich create money.

- Learning not to work for money

- Rich dad poor dad mistakes

DISCLAIMER:

This Rich Dad Poor Dad review has been thoroughly researched with information and testimonials that are available to anyone in the public. Any conclusions drawn by myself are opinions.

Why Listen To Us

My name is Josiah, and this is my Dad, Joel.

I built that site in 2020, and it still makes me $1,500 per month. It’s a basic 5 page website I built based on a template the program provides.

The best part to me? My dad and I get to do it all together!

So between the:

Ease of reaching $5-$10K per month in income online

Straightforward-ness of the system to do it

Fact that I get to do it w/ my family

Is why I recommend local lead generation as my #1 business model for making money online.

Sure, it takes some work and dedication – but anyone that tells you that there’s a business out there that requires no work is selling you a lemon.

I’m not saying you need to sign up for the same program I did, but I would definitely recommend giving the business model a peek!

Chapter/ Section Summaries

Rich Dad Poor Dad has eleven chapters including an introduction. However, most of the book is devoted to the first 6 lessons or chapters.

In this review, you'll learn about the Intro and its 7 chapters, including its good points and bad points.

- Introduction

- Chapter 1: The Rich Don’t Work for Money

- Chapter 2: Why Teach Financial Literacy?

- Chapter 3: Mind Your Own Business

- Chapter 4: The History of Taxes and the Power of Corporations

- Chapter 5: The Rich Invent Money

- Chapter 6: Work to Learn – Don’t Work for Money

- Chapter 7: Overcoming Obstacles

Introduction

The author of Rich Dad Poor Dad, Robert Kiyosaki, had two major important father figures in his life.

His "Poor Dad," a man who is extremely brilliant and well educated, was Kiyosaki's biological father.

Poor dad felt that he needed to study hard and get high marks and find a nice job. However, the poor dad did not become financially stable despite these seemingly beneficial traits.

His "Rich Dad" was actually his best friend's father.

He possessed the same work ethic as his real dad, but there is a twist.

Financial education is something that the Rich Dad believed in. Early on, he understood that money should be working for you, not the other way around.

And despite being a dropout since the eighth grade, he became a millionaire eventually by finding a way to make money work for him.

The book is told from Kiyosaki's point of view on how Rich Dad made money and the wrong financial decisions the Poor Dad made.

Chapters 1-6 account for almost two-thirds of the Rich Dad, Poor Dad book and cover the major lessons his Rich Dad taught him by example.

Chapter 1: The Rich Don’t Work For Money

People frequently misinterpret the title of this chapter, believing it to suggest that the wealthy do not work.

The opposite is true, in fact.

Rather than viewing the chapter title as "The Rich Don't Work for Money," Kiyosaki really meant is, "The Rich Don't Work for Money."

It is worth noting that by emphasizing the word "money," this part puts on a completely different take.

The fact is that a lot of wealthy individuals work quite hard, but do so in a different way than the majority of people.

Rich people – and people who want to become rich – work and learn every day how to put money to work for them.

As Rich Dad says, “The poor and middle class work for money. The rich have money work for them.”

Kiyosaki also notes that having a regular job is just a short-term solution to the long-term problem (or challenge) of creating wealth and financial freedom.

Chapter 2: Why Teach Financial Literacy?

Rich Dad Poor Dad's chapter 2 illustrates the distinction between an asset and a liability.

Chapter 2 shows how much money you are not making but how much money you are keeping.

An asset has value that creates income or something that appreciates, which you can readily buy and sell in an existing market.

- Assets produce income

- Assets appreciate

Conversely, liabilities drain your wallet because you need to pay off the related costs or fees that go with them.

Kiyosaki sparked a lot of controversy with this phrase when Rich Dad Poor Dad first debuted in 1997.

This is because a residential house is by definition not an asset until they appreciate sufficient enough to cover the ownership costs.

Rental property, on the other hand, is an asset since it may produce adequate passive income to offset the operational and financing costs of the property.

Chapter 3: Mind Your Own Business

This chapter has two major points.

- First, repay your financial obligations aka debts and begin to venture into income-worthy investments assets as quickly as possible.

- Next, maintain a strong financial health by investing as much as possible your money in assets

Kiyosaki points out here that most individuals conflate their occupation with business.

In other words, they devote all their life working for another company and in the process, make them richer.

Sadly, most people realize this when it's already too late. Shifting to a whole new mindset is quite tough for those who are stuck in the never-ending rat race.

One of my favorite quotes is:

“The primary reason the majority of the poor and middle class are fiscally conservative is that they have no financial foundation. They have to cling to their jobs and play it safe. They can’t afford to take risks.”

Chapter 4: The History of Taxes And The Power Of Corporations

It is crucial to remember that Rich Dad Poor Dad is first and foremost a motivational book. That's Kiyosaki's book's primary intent, and not to offer any financial advice.

Kiyosaki, for example, recounts the time he purchased a Porsche and regarded it as a business expense, using pre-tax dollars.

If there is a far less costly make and model, that would have been a much better option because an investor might undergo an IRS audit for a high-end luxury automobile purchase.

However, aside from the Porsche, the arguments raised in this chapter are about how to play it smart in this game.

The rich understand the power of company structures and the tax code and use every legal means they can to minimize their tax burden.

Try to make a comparison on how companies and investors that own corporations i.e., C Corps, S Corps and LLCs, pay taxes versus how the majority of people pay theirs.

Corporate-structured business owners:

- Earn

- Spend

- Pay taxes

Employees working for businesses:

- Earn

- Pay taxes

- Spend

Note that people who work for another spend after tax, whereas owners gain and spend before taxes are paid.

According to Kiyosaki, there are four primary components of "Financial IQ" covered in Chapter 4: accounting, investment strategy, market law and law.

The awareness of legal and tax benefits is, as Rich Dad Poor Dad teaches us, an important part of establishing long-term wealth:

“For instance, a corporation can pay expenses before paying taxes, whereas an employee gets taxed first and must try to pay expenses on what is left. . . Corporations also offer legal protection from lawsuits. When someone sues a wealthy individual, they are often met with layers of legal protection and often find that the wealthy person actually owns nothing [in their own name]. They control everything, but [personally] own nothing.”

Chapter 5: The Rich Invent Money

Inventing money involves creating ways or transactions for which others have no skills, resources, expertise, or contacts for.

Chapter 5, Rich Dad Poor Dad shares two kinds of investors:

- Investment packages are purchased by people who allow fund managers or developers to manage their money. This is the method most individuals use, like purchasng ETF shares or investing in a crowdfunding enterprise for property.

- Professional investors take care of their own investments, explore the market to acquire worthwhile deals, and engage specialists to do daily monitoring. Three things are in common for professional investors:

- Identifying possibilities not noticed by others

- Raising investment funding

- Working with other smart individuals

Here is one of this chapter's notable concluding remarks:

“Some people argue that there aren’t real estate bargains where they are, but there are prime opportunities everywhere that are overlooked. Most people aren’t trained financially to recognize the opportunities in front of them.”

Chapter 6: Work to Learn – Don’t Work for Money

Poor dad was bright and very well schooled and labored for money since job security was on top of his list.

But the complete opposite is true for the Rich Dad. By trying to learn, he became a millionaire.

In the words of Kiyosaki:

“I recommend to young people to seek work for what they will learn, more than what they will earn. Look down the road at what skills they want to acquire before choosing a specific profession and before getting trapped in the Rat Race.”

Kiyosaki, in reality, did just that. After finishing his undergraduate degree, he enlisted in the Marines and obtained the key business skills of leadership and management.

After his time in the Marines, he did not let his fear of rejection get the best of him and so he applied for Xerox and became one of the company's top five salespersons and then left eventually to start his own company.

Rich Dad's Chapter 6 Poor Dad outlines the synergy of managerial abilities necessary for corporate success:

- Cash flow management

- Systems management

- People management

Chapter 7: Overcoming Obstacles

Our current educational system is seriously flawed, as Robert mentioned numerous times throughout the book.

Our education system is largely meant to develop employees and might impact an entrepreneur negatively.

As Kiyosaki says, he does not propose that individuals avoid higher education; he suggests that it's not supportive of "street smarts."

Financial literacy is rarely covered in school and only at fundamental levels when mentioned. It's not taught in schools.

As a result, the poor and middle classes go in debt. Medicare and Social Security in the United States may run out of funds if millions of individuals require financial or medical support.

Education costs continue to rise significantly more quickly than inflation. And the education system's flaws have become increasingly apparent.

The statements of Robert on this subject are on-point.

Being An Entrepreneur Is Less Risky.

The prevalent notion is that owning a company poses more risks than working for another company.

But honestly, running a company develops in you self-reliance that you don't gain when you are under someone.

The sad truth is the system creates more dependent people with today's "cradle to grave" mindset.

Many people consider risk as something to fear until they venture out to start their own business. After that, they consider "risk" more of a "challenge".

Your Primary Residence Is Not An Asset.

Your main residence, generally, has been considered an asset for many years.

Robert contradicts this. He believes that your main residence isn't an really an asset because it generates no positive cash flow.

This has been confirmed by the housing bubble and collapse.

“Rich people acquire assets. The poor and middle class acquire liabilities, but they think they are assets.”

If you're focusing on positive cash flow, you're still making money each month, although rental properties have decreased in value.

In his book, Robert even says that property value does not always increase.

Kiyosaki further shares that investing in business opportunities that create cash flow to help pay off your "doodads" is a wise move.

This is an excellent approach, in my opinion, in looking at how to buy your toys.

What Is An Asset Or Liability?

“An asset is something that puts money in my pocket. A liability is something that takes money out of my pocket.”

Many critics of Kiyosaki argue that this statement does not comply with general accountability norms. And Robert recognizes it.

The point that many fail to see is to concentrate on cash flow to get rich.

“Wealth is a person’s ability to survive so many number of days forward… or if I stopped working today, how long could I survive?”

Complaints About the Book

According to several reports, Robert's "Rich Dad" does was just a made-up character or image.

This is probably correct, although the majority of personal finance books have been works of fiction. I'm reminded of the book, "Wealthy Barber."

Some people argue that Robert portrays his book as a non-fiction when it is not, as most people agree

It's odd that John Reed's website criticizes Robert's work while simultaneously selling his own.

Robert underestimates the importance of risk in his investment recommendations.

This is partially correct, but he recommends that you completely understand your assets before jumping in.

According to Robert, investment is unsafe only if you don't completely know and understand what you're doing.

Book Review: Summary

Even though this book is still highly regarded, particularly for new businesses, it does present some problems.

Many of the themes he covers, in retrospect, stand the test of time.

However, treat it with some grain of salt.

It should be read if only to persuade you to think outside the box than a paid employee. The rich put their money where it can work for them - real estate deals for example.

If you decide to read his works, put these 2 books at the top of your list:

- Rich Dad, Poor Dad

- Rich Dad's Cashflow Quadrant

The rest of his books are essentially a repeat of these two. There is no need for to attend any of his local workshops.

If nothing more, these personal finance books should be a staple in your library solely because its content helps you to have a mindset that's unlike the norms.

What Is Our #1 Recommendation For Making Money Online In 2024?

Our review team has come across a program in the real estate industry that is next level!

Although it’s not real estate in the traditional sense, it’s all digital.

Now, Rich Dad, Poor Dad does touch a little bit on real estate, but it doesn't go into much detail about it. Because in order to make a good amount of money with real estate, you have to have multiple properties.

And who has the capital for that right away?

But what if you went local?

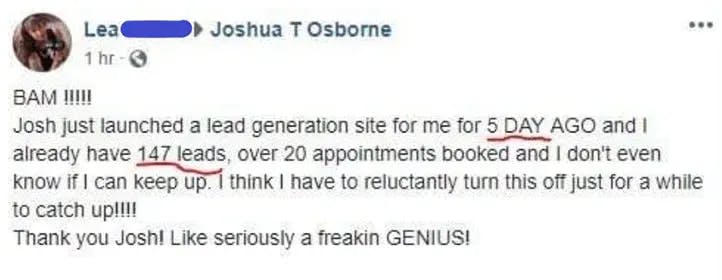

With Local Digital Leasing, you will be getting service requests from multiple sites at every minute of the day from people who are willing to pay a lot of money for what you can provide them.

There was a YouTube video once where the host made a comment that it isn’t about making a lot of money from one website… it’s about making a little bit of money from lots of different websites.

So, think of it this way….

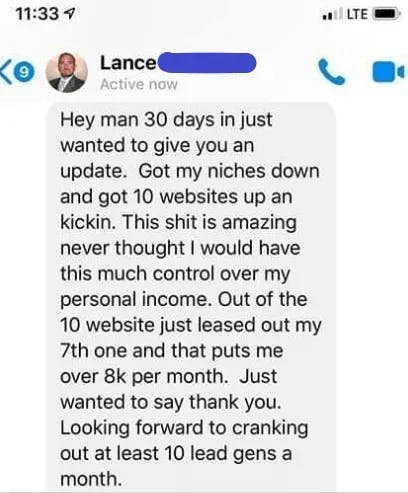

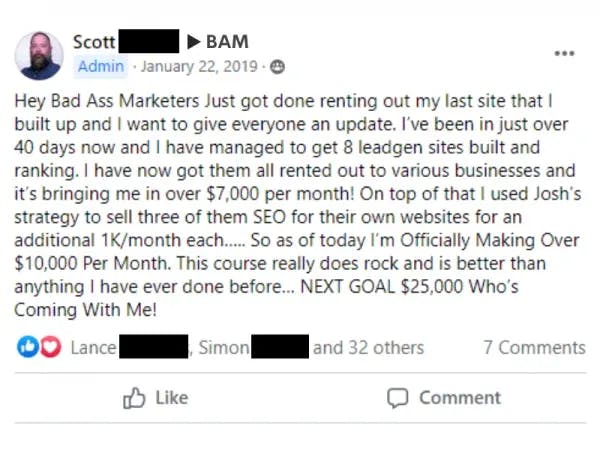

What if you could have streams of investment income where you operated 10 rental units that you could charge anywhere from $750-1,000 per month?

That’s $7,500-10,000 per month in passive income!

What If You Invested Into 100 Rental Units?

But instead of spending $Millions to build houses or apartment complexes… you spend a couple hundred dollars to build websites.

You then get those websites ranked in the search engines for specific home-based services that customers are searching for.

Next, you offer your lead generation system to local business owners who are looking for customers and are willing to pay you for their information.

And Then…

BAM!

You’ve just created a Digital Leasing Investment Empire that is potentially earning you 4-5 figures in PASSIVE INCOME on a monthly basis without spending a single dime on ads.

With conventional Digital Leasing, you have to compete with thousands, if not millions of others who are selling the SAME product to the SAME customers.

Once the training program is completed you will also have access to a Facebook group where you can all of your questions answered.

Unlike traditional real estate, where you’re profiting maybe $9,000 per property/per year (before expenses), you could be getting 5-10X THAT.

With Digital Leasing, the competition is virtually nothing and your profit margins are 85-90%… and it’s RESIDUAL!!!

That means you’re making money month after month whether you go into the office or not…

Whether you show a house or not…

Now, I’m sure you have tons of questions, so check out how to create Digital Leasing assets and start building YOUR Digital Leasing empire!

#1 Business Recommendation

We each make around $10,000 per month with the help of this system.

yes, show me more