Fund That Flip Review (Updated 2024)

![Fund That Flip Review (Updated [year])](/_next/image/?url=https%3A%2F%2Fcolorful-action-2ff8f86b45.media.strapiapp.com%2FFund_That_Flip_2fa6a184f2.webp&w=1920&q=80)

Fund That Flip Reviews [year]: Scam Or Legit?

This review will go over Fund That Flip to see if it really is the best real estate investment course out there.

You'll learn whether real estate investment is the right online business for you.

And at the end, you'll find answers to some of the most frequently asked questions regarding Fund That Flip and real estate investment in general.

But most importantly, you'll see the exact system many others have used to build their own internet marketing business to over $40,000 a month in mostly passive income.

This system made them swear off real estate for good because it uses some of the same skills but in a much more powerful and profitable way!

DISCLAIMER:

This Fund That Flip review has been thoroughly researched with information and testimonials that are available to anyone in the public. Any conclusions drawn by myself are opinions.

Why Listen To Us

My name is Josiah, and this is my Dad, Joel.

I built that site in 2020, and it still makes me $1,500 per month. It’s a basic 5 page website I built based on a template the program provides.

The best part to me? My dad and I get to do it all together!

So between the:

Ease of reaching $5-$10K per month in income online

Straightforward-ness of the system to do it

Fact that I get to do it w/ my family

Is why I recommend local lead generation as my #1 business model for making money online.

Sure, it takes some work and dedication – but anyone that tells you that there’s a business out there that requires no work is selling you a lemon.

I’m not saying you need to sign up for the same program I did, but I would definitely recommend giving the business model a peek!

What Is Fund That Flip?

Fund That Flip is a residential-focused real estate crowdfunding website.

What Does Fund That Flip Do?

The business specializes in short-term financing for both single-family houses and multifamily developments for fix-and-flip projects.

Fund That Flip aspires to be the leader in the short-term residential crowdfunding market. The objective is to provide the finest solutions to borrowers while reducing risk for investors.

The company has provided over $450 million in financing to hundreds of real estate developers in over 25 states.

It is free to create an account and explore real estate projects and other material on the platform.

The nature of the investment opportunities is the key difference for Fund That Flip is, instead of enabling investors to engage in large-scale commercial real estate developments, Fund That Flip only allows investors to invest in residential properties.

It's essential to understand that Fund That Flip only invests in debt, not stock.

When you invest in a Fund That Flip project, you become the lender, which means you get paid a set interest rate on the money you lend. You are not purchasing any project's equity and will not be entitled to a portion of the deal's earnings, as you would be with a crowdfunding platform that provides equity investments in real estate projects.

Fund That Flip Company Profile

Matt Rodak, who is still the CEO of Fund That Flip, established the company in 2014. He is a Chartered Property Casualty Underwriter with over $400 million in capital raised in his career. The company's other leaders have much relevant expertise as well.

Is Fund That Flip a Good Real Estate Investing Company?

Fund That Flip may be a suitable investment platform for you if you're seeking a consistent flow of income and aren't concerned about equity growth. The fees are a little on the expensive side. An interest rate spread of up to 3 percentage points may eat away a significant portion of an investor's profits, but the business does a fantastic job of providing high revenue with little risk.

Is Fund That Flip A Legitimate Company?

Fund That Flip is a legitimate business.

It is entirely possible to build a profitable, successful real estate business... But there are better ways to build a business other than with real estate.

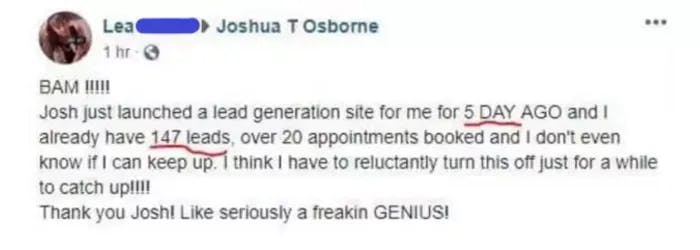

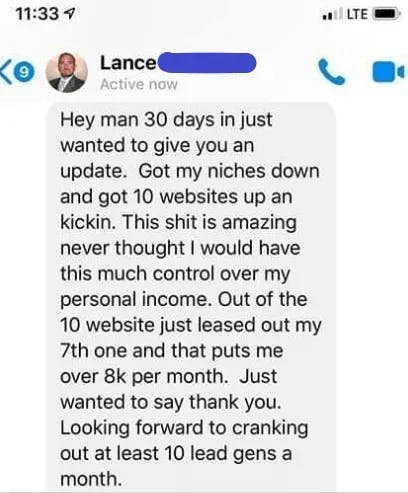

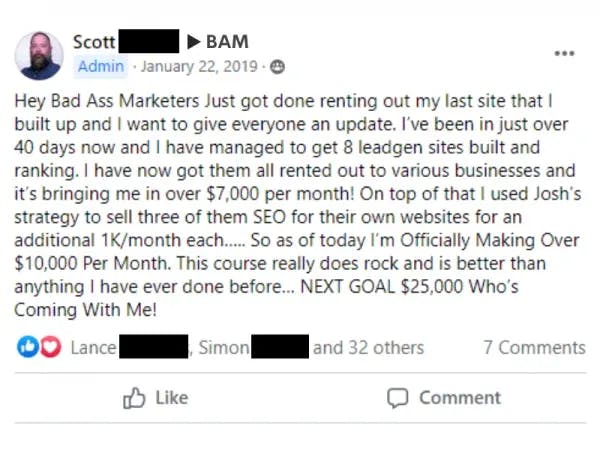

My #1 pick proves this. Because unlike Fund That Flip, it actually provides real proof of real success from real people as recently as a few days ago.

How Does Fund That Flip Work?

Here's how Fund That Flip works for investors:

Invests in Borrower Dependent Note (BDN)

When a real estate investor participates in a Fund That Flip offering, they are investing in a Borrower Dependent Note (BDN). The success of the Borrower Dependent Note (BDN) is closely related to the performance of the note that Fund That Flip invests in with the selected project's redeveloper.

Two Offerings

Fund That Flip has two products:

Offerings of Series Notes

- for investment in a portfolio of potential projects. Residential bridge note funds and pre-funded note funds are two subtypes of this.

Individual bridge note offerings

- for investing in particular projects (investors may finance the project wholly or partly).

Short-term Offerings

Fund That Flip mainly provides short-term loans (flip loans) with maturities of one year or less, but durations may vary from 3-18 months. Borrowers are generally able to extend their loans for a few months.

Interest Payments

During the loan's duration, investors benefit from monthly interest payments that are proportionate to the amount invested. When the loan is repaid, the full principal is refunded in one single payment.

Fund That Flip Loans: Duration, Sizes, And Interest Rates

Loan Duration

The majority of the loans available for investment mature in a year or less, with durations ranging from 3 to 18 months.

Borrowers can opt to extend the loan for a few months (for a fee).

Loan Size and Interest Rates

Loan sizes vary from $100,000 to $5 million (with an average loan size of about $300,000), and borrowers pay interest rates ranging from 8.49 % to 12 %.

Minimum Investment

The minimum investment in a single transaction or fund via Fund That Flip is $5,000.

The loans are interest-only, as is common in the rehab loan business, meaning, you will get interest payments on the amount of money you contribute throughout the loan's duration and your full principal investment will be refunded in a lump sum when the loan is repaid.

On each transaction, the interest rate spread earned by Fund That Flip is revealed to borrowers.

Are Fund That Flip Investments Risky?

Although debt investments are generally considered to be less risky than equity investments, Fund That Flip investments are not.

There is no investment that pays 10% or more in interest that is low risk.

While the platform takes precautions to ensure the success of its investors by only approving 6% to 8% of real estate projects submitted on its platform and requiring borrowers to put 15% to 20% of their equity into each flip, it’s still possible that a borrower will be unable to repay their loan.

Fund That Flip Transparency

Fund That Flip is extremely transparent in publishing monthly performance data. Although the numbers fluctuate monthly, the proportion of loans in default or foreclosure is not zero.

Because the loans are secured by the underlying real estate, at least some money is likely to be recovered if a loan fails, although there is still a substantial risk of loss.

Who Is Eligible To Invest In Fund That Flip?

Fund That Flip is currently only available to accredited investors.

What Are Accredited Investors?

Accredited investors are persons or companies that are permitted to trade securities that are not registered with financial authorities.

What Are Examples Of Accredited Investors?

High-net-worth individuals (HNWIs), banks, insurance firms, brokers, and trusts

At least one of the following criteria needs to apply to become Accredited Investors:

- You have a net worth of at least $1 million, excluding the value of your main residence.

- You earned at least $200,000 in the previous two years ($300,000 if you're married filing jointly) and anticipate earning the same this year.

- You're making an investment on behalf of a recognized entity, such as a venture capital fund.

Non-accredited investors may be able to invest in Fund That Flip in the future. According to the company:

"The SEC has set the criteria under which unaccredited investors may participate in the future. Currently, these regulations prohibit Fund That Flip from commercially investing in non-accredited investors. We will keep an eye on the new law." - Matt Rodak

Investors may self-accredit to see offers, but Fund That Flip will verify their credentials before making the initial investment.

It's also worth noting that Fund That Flip accepts investments from self-directed IRAs and other tax-deferred accounts. If you don't have an account that will enable you to accomplish this, Fund That Flip can recommend a financial advisor on hand to assist you through the procedure. This financial advisor may be a registered broker-dealer or investment advisor.

How Do I Get Funding For Real Estate?

It’s simple. Just go to the Fund That Flip official website and fill up an application form.

Can I Make Money In A Fund That Flip Investment?

Yes, You can!

But...

There's a lot that comes along with real estate that many people struggle with.

Now, don't get the wrong idea...

It's not impossible to make money with real estate, but if you're gonna put in the amount of grueling work to do this business (which, trust us, isn't easy), you might as well bring in some REAL money while you're learning the ropes.

The program that helped skyrocket many online businesses to over $40,000+ per month is so simple that making money really does become second nature.

Conclusion

In a word, Fund That Flip is a good option for those who want to generate income rather than capital gain. The platform is a legitimate marketplace for short-term loans that have been thoroughly vetted by the company.

Just keep in mind that short-term real estate debt investments aren't precisely "low-risk" income investments, and they may not be suitable for investors with a low-risk tolerance.

What Is Our Top Recommendation For Making Money Online In 2024?

Where this Fund That Flip falls short in my opinion, is in scalability.

Because in order to make a good amount of money with real estate, you have to own several different houses.

And who has that kind of capital to start?

But what if you went local?

With Local Lead Generation, you will be getting service requests from multiple sites at every minute of the day from people who are willing to pay a lot of money for what you can provide them.

I was watching a YouTube video once where the host made a comment that it isn’t about making a lot of money from one website… it’s about making a little bit of money from lots of different websites.

So, think of it this way….

What if you could have streams of investment income where you operated 10 rental units that you could charge anywhere from $750-1,000 per month?

That’s $7,500-10,000 per month in passive income!

What If You Invested Into 100 Rental Units?

But instead of spending $Millions to build houses or apartment complexes… you spend a couple hundred dollars to build websites.

You then get those websites ranked in the search engines for specific home-based services that customers are searching for.

Next, you offer your lead generation system to local business owners who are looking for customers and are willing to pay you for their information.

And Then…

BAM!

You’ve just created a Digital Leasing Investment Empire that is potentially earning you 4-5 figures in PASSIVE INCOME on a monthly basis without spending a single dime on ads.

With conventional Digital Leasing, you have to compete with thousands, if not millions of others who are selling the SAME product to the SAME customers.

Once the training program is completed you will also have access to a Facebook group much better than the Fund That Flip in our opinion. This group is much more active.

Unlike what I've seen with Fund That Flip, where you’re profiting maybe $250 per property, you could be getting 5-10X THAT.

With Local Lead Generation, the competition is virtually nothing and your profit margins are 85-90%.

Now, I could go on and on, but I’m sure you have tons of questions about how to create Digital Leasing assets and start building YOUR digital empire!

#1 Business Recommendation

We each make around $10,000 per month with the help of this system.

yes, show me more