Top 5 Reasons Why Real Estate Investors Fail

So it looks like you’re interested in getting started in real estate investing…but something just keeps holding you back and you have a few questions…

In fact, you’re probably here because you’re ready to start investing into some passive income assets and think that real estate is your only option.

I get it… and I don’t blame you a bit.

Who wouldn’t want to get invested into 10 different homes and have $10,000 a month rolling in like clockwork?

The thing is, it’s just not that simple.

I mean, I don’t want to sound like an A-hole, but I do want to give a little dose of reality…

You really need to take a hard look at yourself and at this type of business model before you decide to jump into real estate with both feet.

So, we’re going to go over a few things about real estate that you may not know about and then touch on a business model that absolutely kills it when it comes to income potential and longevity.

With that said…

Here are the TOP 5 REASONS WHY REAL ESTATE INVESTORS FAIL!

DISCLAIMER:

This Top 5 Reasons Why Real Estate Investors Fail review has been thoroughly researched with information and testimonials that are available to anyone in the public. Any conclusions drawn by myself are opinions.

Why Listen To Us

My name is Josiah, and this is my Dad, Joel.

I built that site in 2020, and it still makes me $1,500 per month. It’s a basic 5 page website I built based on a template the program provides.

The best part to me? My dad and I get to do it all together!

So between the:

Ease of reaching $5-$10K per month in income online

Straightforward-ness of the system to do it

Fact that I get to do it w/ my family

Is why I recommend local lead generation as my #1 business model for making money online.

Sure, it takes some work and dedication – but anyone that tells you that there’s a business out there that requires no work is selling you a lemon.

I’m not saying you need to sign up for the same program I did, but I would definitely recommend giving the business model a peek!

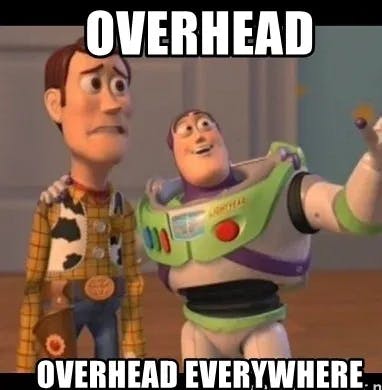

Lots of Overhead

Lots of Overhead

One of the biggest reasons why real estate investors fail is because they don’t understand just how much overhead there is.

It’s not just as simple as collecting a $1000 check every month...in fact, it’s never that easy.

For sake of the argument, here’s a short list of overhead costs in real estate investing:

- Property Taxes

- Property Insurance

- Property Management Costs

- Utilities

- Garbage

- HOA Fees

- Vacancy

Kinda a shocker huh?

You just normally don’t think about all those things…

That $1,000 check you get each month quickly dwindles down after you factor in all those costs.

When a lot of newbie real estate investors realize just how much overhead is involved, they’ll throw their hands up in the air and give up altogether.

Luckily many members of our team have found a way to experience all the advantages of real estate investing, without experiencing the downside.

But more on that later...

Lack of Capital

Another big reason why real estate investors fail is because they just don’t have enough capital to scale out.

Let’s just do some simple math.

On average, you can buy a real estate property by putting $10,000-$20,000 down.

But wait a minute??

What about the guru’s that say you can buy houses with no money down?

Although that’s possible, 99% of homeowners are just going to want some kind of cash out of the home.

Plus, that’s when it starts to turn into you selling the owner on giving you their property for nothing, and if you want passive income...odds sales are the last thing on your mind.

Back to the math…

To generate the kind of income you need to be financially independent with real estate, you need at least 5-10 homes given your region…

That means you would need anywhere from $50,000-$200,000 of cash on hand to get started.

And let’s be real...who has that kind of money on hand at any given time?

Fortunately there’s a business model out there that’s modeled right after real estate and isn’t nearly as cash intensive!

Constant Repairs

You’ve probably seen them, hell, you might have even lived in them...some real estate properties have a lot of things that break.

As the renter, you don’t have to worry about anything...that’s the owners job.

Ahhhh

Now the shoes on the other foot!

Repairs aren’t cheap either. It’s not like every issue is just going to be a leaky faucet or a burnt out light bulb…

Some repairs can be steep!

And when that happens...you can say buh-bye to your income that month.

But what about insurance you ask?

Insurance is pretty much the same all around.

Remember the last time you had a helpful insurance agent? Yeah, don’t worry, we can’t either.

As a real estate investor, you will be out of pocket for a lot of these repairs, and that’s no bueno.

But what if you could rent out a property that never required pricey repairs…?

Rules And Regulations

Yep, this is a massive headache. There are literally so many different rules and regulations regarding real estate, it really does make your head spin.

If you’ve rented a home before you’ll know this too! There are all sorts of rules and stuff that a landlord will have you abide by.

Now you’re probably an A+ renter, you pay on time, follow all the rules, don’t break anything...You’re the ideal tenant!

But there are some pretty bad tenants out there too, and these guys find all sorts of loopholes in the rules and regulations so that they can exploit them.

Often at the real estate investors expense.

If you don’t have 10 or 20 properties that you’re already drawing rent from, you could quickly get buried by all these rules and regulations being used against you.

Luckily, you don’t have to worry about any of that when it comes to Digital Leasing!

Simply Put, 2020

If it’s been one thing that 2020 has taught us, it’s that we’re all in for a whirlwind of change.

As you’ve probably heard or might even be your biggest concern, the moratoriums on rent kept getting extended.

That’s a big deal!

Most real estate investors finance their properties. They’ll pay off the mortgage as the rent payment comes through.

But if that rent doesn’t come through...guess who starts knocking at their door?

Yup, the big bad bank.

And there’s often no one there to protect YOU like the government protects tenants.

Because of this, it has caused many people to wonder if real estate investing is dead…

And although it isn’t dead and will always be relevant, there is now a big emphasis that needs to be made about having cash in the bank to weather a storm like this.

Everything that happened this past year wiped several real estate investors out of the market altogether...

Conclusion

So these are the Top 5 reasons why real estate investors fail.

Now, I don’t want to be a “Debbie Downer”, but then again, I don’t want you get yourself in over your head either.

This doesn’t even touch on the amount of competition that you’ll be running up against, but that’s a totally different conversation.

So what is the best business model when it comes to wanting passive income like real estate?

Digital Leasing

What if you could have 10 homes or rental units that you could charge anywhere from $750-1000 per month?

That’s $7,500-10,000 per month in passive income!

What if you have 100 rental units?

But instead of spending $Millions to build house or apartment complexes… you spend a couple hundred dollars to build websites.

You then get those websites ranked in the search engines for specific home-based services that customers are searching for.

Next, you find local business owners who are looking for customers and are willing to pay you for their information.

And Then…

BAM!

You’ve just created Digital Leasing that is potentially earning you 4-5 figures in PASSIVE INCOME on a monthly basis without spending a single dime on ads.

With Real Estate, you have to compete with thousands, if not millions of others who have much bigger bank accounts to start with.

With Digital Leasing, the competition is virtually nothing and your profit margins are 85-90%.

Now, I could go on and on, but I’m sure you have tons of questions about how to create Digital Leasing assets and start building YOUR digital empire!

#1 Business Recommendation

We each make around $10,000 per month with the help of this system.

yes, show me more