Passive Income Ideas For 2024

![Passive Income Ideas For [year]](/_next/image/?url=https%3A%2F%2Fcolorful-action-2ff8f86b45.media.strapiapp.com%2FPassive_Income_Ideas_optimized_a2a8c93fe0.avif&w=1920&q=80)

Best Streams To Make Passive Income

Passive income is now more valuable than ever as it plays a key role in determining your lifestyle and comfort level. Whether you want to earn more money or just maintain your current lifestyle, passive income is a smart way to achieve them.

With passive income, financial security can be achieved without having to work actively for it. If you find the best passive income approach that suits you, freedom and flexibility are just within your reach.

The past decade, in fact, has seen several lucrative passive income streams and ideas emerge, making it a lot easier for even the newbies to make money.

Towards the end of this article I'll answer some of the most frequently asked questions on how to make passive income...

But most importantly, I'll show you the exact system I used to build my own business to over $40,000 a month in mostly passive income.

DISCLAIMER:

This Passive Income review has been thoroughly researched with information and testimonials that are available to anyone in the public. Any conclusions drawn by myself are opinions.

Why Listen To Us

My name is Josiah, and this is my Dad, Joel.

I built that site in 2020, and it still makes me $1,500 per month. It’s a basic 5 page website I built based on a template the program provides.

The best part to me? My dad and I get to do it all together!

So between the:

Ease of reaching $5-$10K per month in income online

Straightforward-ness of the system to do it

Fact that I get to do it w/ my family

Is why I recommend local lead generation as my #1 business model for making money online.

Sure, it takes some work and dedication – but anyone that tells you that there’s a business out there that requires no work is selling you a lemon.

I’m not saying you need to sign up for the same program I did, but I would definitely recommend giving the business model a peek!

28 Passive Income Ideas & Opportunities

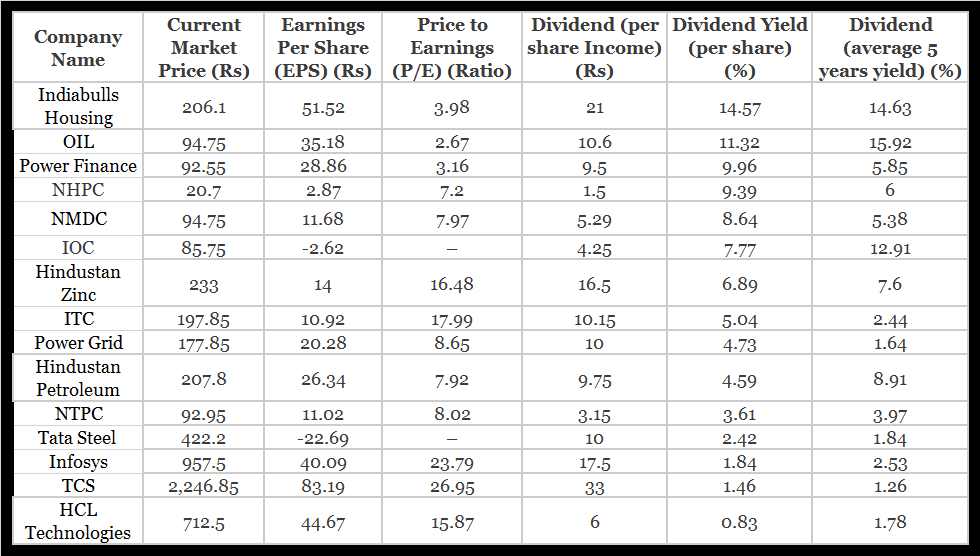

1. Passive Income Through Stock Investment

Many think that owning stocks and bonds isn't the best passive income opportunity. But private retirement accounts are built on this principle.

Buying stocks, bonds, and mutual funds containing both will allow you to live off the passive income during retirement. You just need to find the investing platform that suits your investment preferences.

Whether through borrowing or issuing shares through an initial public offering (IPO), companies need money to finance their business. This process of offering new stock from a private company to the public is called an initial public offering (IPO).

Through investing in stock, you become part of a company's ownership and the best time to buy stocks is when the market is down.

A robust passive income can be achieved before the typical retirement age if you start saving aggressively and invest in good-value dividend stocks. You can reduce the risk of losing all your investments in case a company craters by diversifying your holdings.

This is separate from bonds investing because of the relative nature of the two. Previously, this had been mentioned as a portion of ownership in a company.

Investors often earn money without doing anything because some companies pay them quarterly. However, investing in a company should be done with caution.

2. Passive Income Through Cash Back Websites

Passive income from cashback websites is as good as any other passive income. Simply go about your life as usual, but pay a little more attention to the things you buy.

By using cashback websites, you can earn money while you spend. This may be viewed as something that won't give you an opportunity to retire early.

There's still a way for you to make money without putting much effort into it. Moreover, it's absolutely free. Just enroll in cashback programs on shopping websites. In exchange for their qualifying purchases, these shopping portals give a percentage back to members.

As an example, Swagbucks can be used to earn cashback. If you browse the web, you'll get your Swagbucks points automatically when you use its shopping portal or add the Swagbucks browser plug-in.

In total, over $400,000,000 has been paid out to its members, according to the company. Swagbucks has rewarded dozens of members with up to $12,000 in earnings. Teens can even earn a little pocket money with it.

The MyPoints system, which lets you earn points in several ways, is another example. The shopping portal allows you to earn points by purchasing items from their partner stores and get cash back. Points can also be earned by completing surveys, playing games, watching videos, and reading emails.

In contrast, TopCashback gives the full commission back to the customer and generates their money somewhere else.

You can consistently earn 3% across all sites, which is a high percentage to earn. You can also find coupons and special offers that provide you with higher cashback.

3. Selling Stock Photos Online

If you love taking pictures, stock photos can be a good source of passive income. Online stock photography websites like Shutterstock allow you to sell your photos for a fee.

You can take pictures in any niche, from travel, food, to sports. You can sell your stock photography images as an independent photographer on various stock photography sites.

If you take thousands of great photos, it will take a while to build up but if you are passionate about taking pictures then you will enjoy the whole process. In the end, financial independence is about earning wealth that doesn't take up all your time so you can enjoy your life and do the things you love. Selling stock photos is an excellent passive income idea because you get paid to do something you love to do.

Check out these best stock photography sites below where you can sell pictures for passive income. Start earning this passive income stream by opening an account today.

- Depositphotos

- SmugMug Pro

- Shutterstock

- Pixabay

- iStock Photo

- Etsy

- Getty Images

- Stocksy

- Adobe Stock

- Twenty20

4. Amazon FBA

Selling on Amazon is a great way to earn extra income. For many people, this has become a great passive income source. Using Amazon as a selling platform is a good option if you have a product to sell online. We all know how big Amazon is. It is the third-largest website in the United States. A few other fulfillment options are available from Amazon, such as the Fulfillment by Amazon or FBA.

Like eBay, its FBA program requires you to find buyers in order to sell your product. FBA gives you the benefit of not having to worry about anything. All picking, packing, and shipping is handled by Amazon in their massive warehouses. In total, Amazon has over 175 fulfillment centers with a total storage area of more than 150 million square feet around the globe.

Amazon FBA lets you use their shelves to store your stuff. In addition to terrific customer service and returns, you can take advantage of Amazon's other benefits (such as Prime eligibility and Free Super Saver Shipping) to help your business scale fast. Sellers can also fulfill their orders themselves by choosing this option. There are pros and cons to each method.

Here are the steps to making passive income with Amazon FBA.

- Find an interesting/ profitable product to sell.

- A product with good demand but not readily available in offline retail markets.

- Find out who the suppliers are for those products.

- Remember that to make a profit, you have to buy low and sell high.

- Set the prices for these products through your Amazon seller account.

- For your business to compete with other sellers on Amazon, you need a competitive pricing strategy.

- Your listing page should include the right title and description of the products.

- Consider how best to help customers discover information about your products, make decisions about purchasing them, and answer their questions.

- You can ship all the items at once to Amazon.

- Through Fulfillment by Amazon (FBA), Amazon takes care of packaging, labeling, and shipping products.

- You get money twice a month from Amazon after the company collects payment and deducts their fees.

You can take advantage of Amazon's tools once you have launched your business. Advertising on Amazon offers new ways for you reach out and engage shoppers at various stages of the buying process, whether they are just comparing products or ready to purchase. Advertisements appear right where the customer is likely to see them (such as on search result pages or product detail pages).

It should be noted that the sales are passive, but the work is not. The following are a few things you might try within your first 90 days as an Amazon seller.

- Using Seller Central, monitor the health of your account.

- Make use of Amazon Fulfilled Prime or Fulfillment by Amazon.

- Put deals and coupons on your listings and advertise.

- Create enhanced brand content by enrolling in Brand Registry.

- Add more products to your selection.

- Use Seller Central's Automated Pricing Tool.

5. Lending Money To Others For Interest-Based Income

Loaning money to others and getting paid in interest is one of the best passive income ideas. This is not to suggest to lend money to a broke friend who won't pay it back. When you lend privately, you can lend to whoever is in your social circle. In order to fund the initial purchase of their properties, a lot of fix and flip investors require quick access to a capital.

Your capital can be used by them for a short period in return for an interest rate that you and they agree upon. Furthermore, you can also lend money to others by using peer-to-peer lending websites. Payments are collected through the lending site, which provides more leverage when payments are late. By diversifying, you can lower your lender risk.

Rather than putting all of your eggs in one basket, lend your money out to a variety of people. When the goal is to beat stock market returns with higher yields, this strategy makes sense.

The high risk in this passive income idea probably is one of the few of its kind. It is, however, quite profitable.

Those who cannot access conventional financing can secure money from you. You could charge a 6 to 10% interest rate for lending money.

The best way to minimize financial risk is to invest in a company that is able to act as a mediator. It is their responsibility to make sure you are paid back.

The peer to peer lending concept is another easy way to earn passive income from lending, since you can lend money out to other people who may not qualify for conventional financing.

On a crowd lending website, you lend money out and receive interest payments. You're getting interest now as if you were a bank.

The feeling of being the lender rather than the borrower is awesome. Your investment is part of a loan. When you invest with a company like Lending Club, you can earn 6-10% passive income, which is typically much higher than normal investment funds or interest from banks.

6. Earning Passive Income As Silent Business Partner

A perfect passive income idea many people don't know about is becoming a silent partner in a company.

As opposed to lending the business money, you invest in it. Then, you get paid a percentage of profit, which is guaranteed by a percentage of the company assets' value. On some websites, you can find businesses looking to partner with silent partners.

A 10% stake in a friend's restaurant will cost you thousands of dollars, but you can choose from thousands of small businesses or startups to find one that appeals to you. Additionally, investing in several startups can help you reduce your risk.

Those who want to start their own business but aren't interested in the work can turn to this passive income idea as a great alternative.

You should know that passive income ideas like this require you to conduct due diligence, verify the value of the business, and secure your investor rights.

You can also lend money to friends or family members who want to start businesses. You can then let them run the business on your behalf.

Before you make a financial commitment to an ongoing operation, you need to review and assess their financial statements and other aspects of their businesses.

When investing in a new business, you must find out if the business partner is reliable.

While this does not automatically make you less susceptible to financial loss, you can rest easy knowing your money is in capable hands.

7. Starting A Blog & Monetizing It

Many bloggers have been able to stop exchanging time for money thanks to passive income through blogging.

You can, for example, set up a WordPress blog as a travel blogger and share your experiences with others. You can document whatever you see and do whenever you visit a new place.

You can earn money in several ways. Your site can be monetized with programs like Google Adsense.

Your advertising partner, like Google, will pay a small fee if anyone clicks through. In addition, there are affiliate programs that you can join as well.

Among the number of ways to earn cash online is affiliate marketing. Affiliate marketing allows you to promote products or websites to earn a commission as a reward.

8. Affiliate Marketing

It's common to see bloggers earn passive income almost exclusively from their blogs. Your blog can have ads on it if you get decent traffic, and you will be paid for each click or view on the ads.

This can add up to a fair amount of money if you get a lot of traffic. Essentially, affiliate marketing is all about promoting products and receiving a commission from sales.

All you need to do to start earning money is to link a product on your blog, social media account, or website.

The ad revenue on the blog isn't completely passive; you need to create content that attracts enough viewers for it to be profitable.

While you have to create content, you can also hire others to do so.

9. Money Making Websites

Google ads are a common source of revenue for blogs. Affiliate income may be earned as described above. A lot of people don't know this, but you can buy blogs from their owners and take over.

Ideally, evergreen content should generate passive income for many years. Increase your traffic and monthly revenues by adding fresh content.

This also paves the way for making money from site flipping.

Another option is to build a niche blog that caters to a small subset of the blog's audience and thus increases its value to readers and advertisers.

In fact, cross-linking to each of your blogs can boost traffic to them all.

For those who also wish to do something other than writing a blog every day with the same topic, this is one of the best passive income ideas.

10. Renting Your Car

It is possible to earn passive income by renting your secondary car through popular car rental apps.

These apps connect car owners with renters. By providing a slight discount and setting a minimum amount of rental days, you'll be sure you get the most money for your time.

If you have a car that you can rent for cash, this is one of the easiest passive ways to earn an extra income online.

11. Writing Books

In the form of royalties, book sales can be an exceptionally good way to earn passive income. As soon as your book becomes accessible on a site like Amazon, you could get a check every month without ever doing a thing. As you spend more time promoting your book, you're more likely to make money online and offline.

12. Drop-Shipping

In the age of eCommerce, dropshipping has become increasingly popular. It works like this: you set up an online store that sells items from different manufacturers, then your system sends an order request to the manufacturer of a product when a customer visits your site, orders a product, and pays for that item.

As a result, your maker fulfills the order by sending it directly to the person who ordered on your site. You don't need to keep inventory of the products you are selling in this kind of business because no stock is required on your part.

Customers pay for the item, you get the commission, and the item's manufacturer or seller does the storing and shipping to the customers.

13. Create An Online Course.

Selling courses or guides to an audience that needs their content is one of the best passive income ideas. You can make passive income from this if you have expertise on any topic.

Even if it is a lot of work and effort initially, once you have created and marketed your e-book or online course, it can generate for you passive income for many years.

There are varying versions of it since the "Four Hour Workweek." This passive income building has changed over time, however.

The money you make goes directly to you, and you can use it in order to market your blog through the online learning platform.

Online courses could also help you market your current business, whether you're a house decorator, realtor, lawyer, or contractor.

In addition, you could benefit from the course by using it to promote your own content, such as your blog or book. You can also invite them to subscribe to your newsletter.

You can generate passive income with content creation by connecting with services that can create quality content on-demand that you can add to your newsletter at any time.

The marketing and distribution part of the business can be handled with a variety of tools.

Newsletters, for instance, can be set up to send content automatically to your list. You'll have people paying you for your content once you have identified a need and created a decent online course that fills it.

People will refer it to their friends if it's good, which will generate more revenue. The content only needs to be created once, then posted on a site where visitors pay for it.

The students of your online course can purchase a companion guide or ebook as part of the course. It is possible to create audiobooks or courses based on your online guide and provide additional value if that guide is doing well.

Additionally, you can use online courses as a means of promoting your expertise and your published books.

It provides a great way for writers to generate passive income through their existing content because you can monetize it in a new way, which can even increase your profile.

Your ebook can either be sold directly on your website, or it can be offered via affiliate deals by websites providing relevant content to the ebook.

14. Buying Bonds

The fact that you can basically sit back, watch money roll in, makes this one of the most popular passive income ideas.

A bond is a substantially safer investment than stocks, because a bond is viewed as a liability by the issuing company. A bond is a loan offered by a corporation, city, or government.

A written and signed promise of payment is exchanged for a specific sum of money on a specific date and under certain conditions.

Stocks, however, are a type of equity. In the event the company files for bankruptcy, it must make sure its debts are settled first.

Bonds can also be issued by governments, but not stocks. Investing in tax-free municipal bonds, government treasury bonds, or corporate bonds will provide you with a large passive-income stream.

15. Vending Machine Business

Passive income ideas like this are often underestimated. Even so, this is an excellent way to earn money if you find the right place to put your vending machine.

You will stand a good chance of making a large profit if the machine is placed in a strategic location considering the number of people going in and out of that location.

A vending machine at the right place could generate more than $100 per week or even hundreds of dollars a day.

As an example, one vending machine in a good location might bring in $50 to $100 per month. When you purchase 100 vending machines in prime locations, you could earn about $1000 per day.

Vendor route operators are required to obtain the right licenses and permits as dictated by their local ordinances, like any other business. You need to be aware of them when starting a vending machine business.

16. Time Deposit

Investing in fixed deposit accounts can earn you passive income which is one of the low-risk passive income ideas. Time deposits are different from other savings accounts in that they have a specific maturity date.

A high-yield savings account like this cannot be withdrawn before their maturity date. A savings account of this type typically earns higher interest than other accounts, but it varies based on the account's terms and balance.

To withdraw savings, you are required to notify the bank at least 30 days prior to the withdrawal date. Your interest rates will increase the longer and higher you park your money.

17. Podcasting

You can make money through podcasts even if they are small, through advertising for instance. Users can download podcasts to their personal devices so that they can listen to them on the go.

You can only make money from podcasting if people watch it.

Until listeners understand your worth, it will take some time for them to appreciate you. For this reason, if you're thinking to launch a podcast just to earn money this week, it would be wise to look into other options.

Your podcasts can be monetized, however, if you have thousands of subscribers. By selling products and services through your blog or affiliate program, you can earn passive income.

It is possible, for example, to obtain sponsorships and to include advertisements throughout each episode. In addition, you can opt to choose affiliate programs like Audible, which many podcasters and YouTubers use.

They provide you with an affiliate link to promote the product. Whenever someone uses your link, you will earn $15 from that sale. Consider investing in the best podcasting headsets in your budget before starting a podcast.

It is important to make sure that both your audio and content are of high quality.

18. Starting A YouTube Channel

You can earn money through YouTube if you join the YouTube Partner Program. If you are under 18 years old, you must have a legal guardian who can deal with your AdSense payments. Their guidelines on advertiser-friendly content must be followed.

Your channel will be reviewed by Google before the YouTube Partner Program accepts you. You will also be constantly reviewed for compliance with all their policies and guidelines.

It is possible to monetize YouTube channels even without millions of subscribers.

Earning potential is determined by more than just the number of subscribers and views you get, but also by the niche you serve, your level of engagement, as well as the revenue channels you use. The majority of YouTubers build millions of subscribers and then sell their own merchandise.

Partnering with different brands seeking to target specific audiences is also something they do. Influencers who already have a loyal following are now being targeted by brands with large advertising budgets. Depending on how well you negotiate, you as a creator could profit from this.

YouTube has the following features that can be used to generate passive income:

- Advertising revenue

- Channel memberships

- Merchandise shelf

- Super Chat & Super Stickers

- YouTube Premium Revenue

19. Becoming A Social Media Manager (WFM Job)

Working from home and managing several social media accounts of different businesses is possible. Due to lack of time, many small business owners hire freelancers who can work from home to handle social media.

There is always a high demand for social media managers as companies compete for online presence and recognition.

In exchange for a contracted monthly fee, you can run basic social media pages for local businesses.

In order to produce quality content for social media, you need the ability to write well and to understand how content works. It is possible to learn these skills online, even without a college degree.

20. Passive Income From Airbnb Business Model

In exchange for renting your room, you can earn passive income by partnering with Airbnb. Those with spare bedrooms can find roommates or list them on AirBnB.

AirBnB is a system that generates passive income by monetizing living space. Renting a room, an apartment, or a whole house through Airbnb is a great way to earn passive income.

Bookings and payments are handled by their systems, while the hosts handle everything else.

21. Investing In Mortgage Notes

A mortgage note is also called a real estate lien note or a borrower's note. The past few years have seen them grow in popularity.

There are many advantages to investing in mortgage notes including: higher rates of return than traditional bank bonds; higher dividends than most stock investments.

Real estate mortgage notes are promissory notes backed by mortgage loans.

If you are looking for steady and substantial passive income, this is one of the best passive income ideas.

You can acquire real estate mortgage notes to generate passive income without being a landlord, or you can purchase notes and sell them down the road.

Loans or "notes" can be purchased from others. Payments are then made to you. A note like this is provided to every person who offered financial assistance to the homeowner.

Some may also agree to a discount on the note if they can get the most cash back.

To ensure your investment is protected, you should do your due diligence and draft the appropriate documents.

Unless you have a lot of experience handling tax liens, you should avoid them when seeking passive income ideas.

In contrast to renting or buying real estate, mortgage notes require relatively little work other than the initial search and purchase.

22. Invest In Real Estate.

In the real estate industry, passive income can be generated in many ways. Renting out properties is one way to do this.

A rental property involves renting out either a room or the entire house to earn extra income.

Real estate investments are always at least partly active, so they would probably fall into the category of semi-passive income.

The biggest challenge, however, comes once you have a fully rented property - you need to manage it well in order to keep it performing well.

For future landlords, the standard approach is to buy a property and renovate it, then find tenants to rent it out. By purchasing a turnkey property, the middle two steps can be skipped.

The property you are buying already has tenants. The real estate investment approach may not be one of the newest passive income ideas for 2022, but it is catching on again.

Passive income seekers are finding it increasingly attractive because of several factors. To purchase properties like this, you can borrow money from banks and other institutions at low rates. You can create passive income almost instantly.

Aside from inheriting the tenants, you can possibly inherit the property management company too.

Unless you want to, you don't have to make any repairs to the property. In any case, you should be informed regarding major problems and potential repairs by the seller.

If the house needs a new roof, air conditioner, foundation, or repairs, you can choose not to buy it. You are less likely to be blindsided with unexpected costs after purchasing a property.

Likewise, you're likely to see a growing number of properties coming up for sale from retiring Baby Boomers wanting to sell their assets and just enjoy retirement, while others are being sold as part of an estate.

There is no doubt that owning and holding rental properties is among the best passive income ideas.

23. Owning Rental Properties Indirectly For Cash Flow

Rental properties can be owned indirectly in a variety of ways. You can own part of a rental house and let someone else manage the maintenance and collect the rent.

This is truly a passive income. However, having a business partner can turn out to be problematic too if he or she makes a mistake and you get lower returns as opposed to outrightly owning the property.

Investments in REITs can be made in many ways, including buying publicly traded stocks, mutual funds, and ETFs. An REIT generally owns and/or manages income-producing commercial property, whether that's the property itself or the mortgage on that property.

Among the various types of REITs you can invest in are Retail REITs, Residential REITs, Healthcare REITs, Office REITs, and Mortgage REITs.

A REIT will provide you with high dividend yields as well as moderate capital growth over time. One of the best passive income strategies for investors is to invest in REITs.

24. Fixing & Renting Property

Real estate can provide many passive income opportunities. Flipping houses seems simple and straightforward, so many people get into it to make more money.

Purchase a run-down house, upgrade it, and resell for a profit.

With this approach, you can earn between 50,000-150,000 dollars a year if you handle several properties, earn a profit of 15,000 to 30,000 on each deal, and everything goes according to plan.

How Does "Fix And Rent" Make Sense As One Of The Best Passive Income Ideas?

People who have fixed up a house but don't believe they can sell it for a profit are most likely to benefit from this solution.

Renters are easy to find because real estate remains an essential activity and people still require housing. Your rental income allows you to pay your mortgage, insurance, and other bills.

Using this approach may also have the side benefit of reducing your capital gains tax bill if you hold the property for a long period of time.

As an alternative, you could rent out houses owned by fix-and-flip professionals struggling financially. The longer the housing market stays in the doldrums, the greater the chances you'll get a bargain.

Fix and flipping is an option for people who do not wish to deal with tenants or maintenance. You can address this issue by outsourcing your property management work to a good company.

If Your End Goal Is To Sell The Property, What Should You Do?

While the housing market is still recovering, you can generate passive income by taking on a tenant. In addition, it increases your property's value if you decide to sell it. An property investor/ developer who is looking for turnkey deals will love an affordable property with a tenant in it already.

25. Real Estate Crowdfunding

Another passive income idea that is relatively new is crowdfunding rental properties. The purpose of crowdfunding is not to replace mortgage applications.

You can instead lend to real estate investors via crowdfunding sites.

How can this passive income method benefit you?

You won't work with individual investors personally; you merely vet each investor's project individually.

By doing this, you can avoid high-pressure sales by investment groups, and you eliminate the personal appeal of helping a friend buy a house.

Several hundred or a few thousand dollars can be loaned to each potential investor to diversify your holdings. The interest rate is higher than you would get in a money market account.

You can also diversify through crowdfunding sites if you're on the lookout for new passive income ideas.

Although you may invest a large portion of your money in real estate, you could also invest in a restaurant or a debt consolidation loan of someone else.

26. Becoming A Social Media Influencer

Passive income streams can be generated by using popular social media marketplaces like Instagram.

Did you know that Kylie Jenner, a makeup business owner and social media mogul, is the highest-paid social media influencer to date?

Each sponsored post she shares with her 185 million followers on Instagram can earn her more than $1 million.

With the spread of social media as well as the ability to monetize their followings, social media influencers are now becoming a new breed of celebrities.

Unlike most forms of brands partnering with social media platforms like Instagram, Facebook, or YouTube, affiliate links tend to be more passive.

27. Mortgage Refinancing

This may be an option for you if you are paying far more for your mortgage than you should. If you refinance your mortgage, you are guaranteed a lower interest rate and a lower monthly mortgage payment.

Also, refinancing helps the borrower obtain new money at a lower interest rate so that the homeowner's monthly payment will be reduced. People typically take out loans to fund their studies, homes, vehicles, etc., and in addition, they accumulate credit card debt.

28. Transcription

The transcription job is ideal for someone looking for flexibility to work at home with little or no experience required. You can earn money online by learning this skill.

It gives you the flexibility in setting your own work hours and allows you to work as much or as little as you decide to every week.

Pay is typically based on the number of audio hours. This means you are paid for one hour of work if that audio file is an hour long. Moreover, transcription jobs usually fall into 3 categories: general, medical, and legal.

29. Opening A CD

A certificate of deposit is a deposit with a particular term, which may be a few months to twenty years; when the term is over, the principal plus interest are redeemed and you may invest them.

With CDs, the risks are virtually eliminated, but they usually come with higher interest rates, so they are a good option for making passive income.

However, there is a penalty for withdrawing your money before the end of the term, so only use this service if you believe you will not need the funds anytime soon.

A 70-month CD can be had at 0.24% as an average nationally, but some have much higher rates.

30. Create An App.

While some apps can be purchased, others can be downloaded for free - the catch is that they will usually be accompanied by ads.

You can make passive income from selling your own app or by giving away the app for free and selling ad space for it. Even if you don't come from a technical background, you can still create professional apps thanks to sites like Bubble.

According to Appinventiv, over 25% of iOS developers receive $5,000 or more from their apps, but only 16% of Android developers do the same.

Do These Ideas & Sources Really Work?

The passive income ideas mentioned here are all viable and can supplement your income. It would be even better if you turned some of these into your main source of income.

Unlike traditional jobs, you don't have to put in much effort to earn money. It's just a matter of finding the right one.

As soon as you've locked down a passive income deal, you'll receive decent returns with a minimum amount of effort.

You won't have to worry about the financial market or how to run a small business. Ultimately, when it comes to passive income, you don't have to search for the next deal; that's what's great about it.

Ideally, it's best to settle any debt obligations in your credit cards before jumping into any of these passive income investments.

What Is Our Top Recommendation For Making Money Online In 2024?

Our review team has come across a program in the real estate industry that is next level!

Although it’s not real estate in the traditional sense, it’s all digital.

With this Digital Leasing program, you can have the ability to completely walk away from manual labor!

Sound too good to be true?

Of course it does!

But it isn’t…in fact, business owners wish they had this skill!

All you have to do is build and rank a website and forward the jobs off to a business owner in town, you could even email it to them!

This works for literally any service based business, tree service, plumbing, towing, etc.

How do you get paid and how much?

Simple, after you forward the jobs off to a business owner and he makes some money off of them, you simply ask to make the deal beneficial for each other.

A fair price to charge per lead, depending on the industry is 10-20%…let’s just use the tree service industry for example and go by worst case scenario.

Let’s say you build and rank the site and only 20 jobs a month come in. The average tree service job is anywhere from $500-$2000!

That means at bare minimum you have an asset worth $1000 a month!

See why they call it Digital Leasing now?

That’s a rent payment.

The great thing is how easy it is to scale. You don’t have to answer the phone…all you have to do is get the phone to ring.

Unlike the passive income ideas I mentioned earlier...

This one actually allows you to collect that without working in a brick and mortar business all day.

Truly passive income!

The training program takes making money online to a whole other level. The owner of the program walks you through how to build and rank a site hand in hand, with the occasional voice over when he is sharing his screen.

You will learn the importance of keywords, website name, how to send call notifications via email, backlinking, etc.

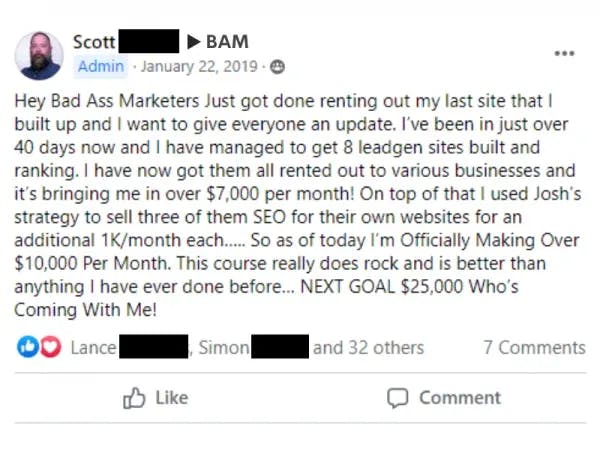

Once the training program is completed you will also have access to a Facebook group where you can ask questions and be in a community with others on the same journey as you.

Digital Leasing allows you to have passive income with most of your day being spent OUT of the brick and mortar landscape.

Now, I know you probably have tons of questions… So, check this out to learn more.

#1 Business Recommendation

We each make around $10,000 per month with the help of this system.

yes, show me more