One Stock Retirement - 6 Things You Need To Know!

One (Single) Stock Retirement

“Is the Single Stock Retirement Plan a Fraud?”

You must be curious and have that question going through your head – it could driving you crazy, and you need an answer!

I’m pretty sure you’ve read about The Oxford Club and The Oxford Communique somewhere. Thanks to their website, social media, and those emails they send!

It’s no surprise you’ve landed on this page because you’re looking for the truth.

Before I continue with this Oxford Communique review, I’d like to welcome you to my platform and commend you for seeking out independent third-party reviews.

But before we get too deep…

DISCLAIMER:

This One Single Stock Retirement review has been thoroughly researched with information and testimonials that are available to anyone in the public. Any conclusions drawn by myself are opinions.

If you want to stop your membership, the Oxford Club offers a money-back guarantee.

When trading over a long period, a buy-and-hold approach like the one used here does better than market timing.

In the world of investing, throwing all of the eggs in one basket with a single-stock approach is not a smart option.

If the business underperforms, your retirement would be jeopardized.

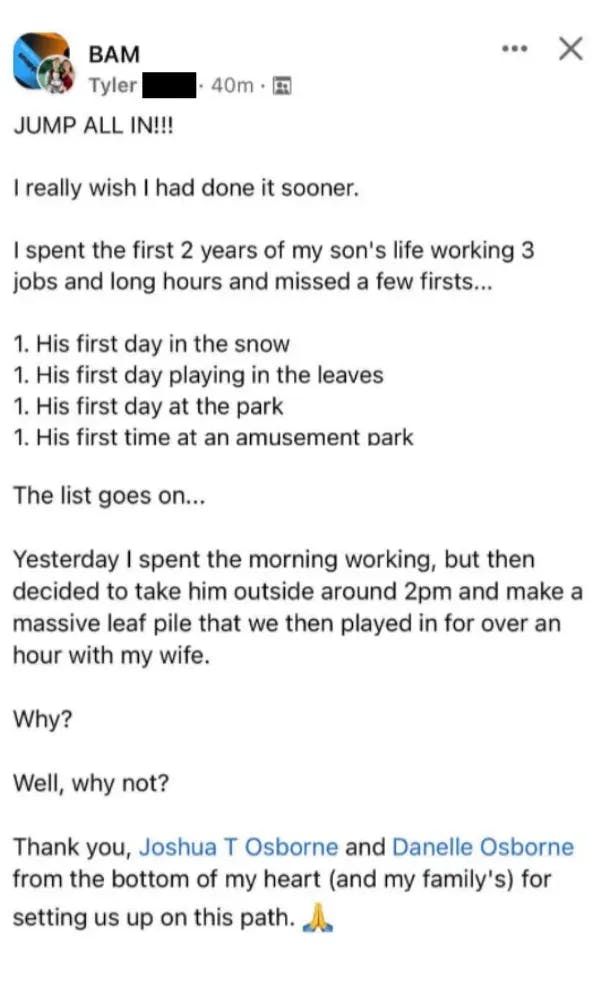

Why Listen To Us

My name is Josiah, and this is my Dad, Joel.

I built that site in 2020, and it still makes me $1,500 per month. It’s a basic 5 page website I built based on a template the program provides.

The best part to me? My dad and I get to do it all together!

So between the:

Ease of reaching $5-$10K per month in income online

Straightforward-ness of the system to do it

Fact that I get to do it w/ my family

Is why I recommend local lead generation as my #1 business model for making money online.

Sure, it takes some work and dedication – but anyone that tells you that there’s a business out there that requires no work is selling you a lemon.

I’m not saying you need to sign up for the same program I did, but I would definitely recommend giving the business model a peek!

You probably discovered One Single Stock for the same reason you might have come across any other financial newsletter, stock trading service, or investment program:

Because you want more money in less time.

And chances are, you want to quickly multiply the money you do have (as opposed to waiting months or even years to see a decent ROI).

This is a really exciting promise, and it’s probably why the financial publishing and training industry is worth billions of dollars.

The problem is, because the idea of doubling, tripling, or 10X-ing your money in a few minutes to a few days is so enticing, there are a ton of shady characters in this space.

But, putting that aside, let’s say every investing guru and “trading expert” on the internet had the best of intentions.

Even with proprietary algorithms, a room full of supercomputers, and a team of rocket scientists, most of these experts would be lucky to get it right 20% of the time.

Now sure, we’re talking about asymmetric bets here, so theoretically the winners should more than make up for the losers.

But in order to make that happen, you can NEVER miss a trade. With a 20% success rate (speaking optimistically), one missed winner could turn a profitable month into a loser.

That’s a lot of pressure and a lot of stress (not to mention a lot of losing) with not much certainty.

But what if there was a way you could build a passive income stream that’s actually passive?

An income stream that doesn’t require:

- Constantly monitoring your phone for buy/sell alerts

- Obsessively watching charts and movement

- The emotional roller coaster and angst of hoping one winner can cover the last 8 losses

- Gambler’s odds (20% chance of success is worse than the odds of winning at Blackjack)

An income stream that brings in consistent revenues every single month (from a couple thousand dollars to well over $10,000)?

An income stream you could actually build in your spare time, and grow as large or as small as you want to, without having to spend hours a day monitoring charts, trades, and alerts?

If that sounds like something you’d be interested in, check out Digital Leasing.

However, if you’d still like to know more about One Single Stock, keep reading.

The Oxford Communique Overview

Product Name: The Oxford Communique

Founder(s): Alexander Green, published by The Oxford Club.

Product Type: Financial Advisory research service

Price: US$99

Best For No one in particular

Summary: Forget about how great their investment advice is or how much they may be able to help you. The financial advice that these guys give is just too good to be true.

When it comes to trusting them with investment advice, the high degree of distrust and manipulative ads just gives me the "heebee jibbies."

Continue reading to find out what the US$3 Secret stock is - I figured it out quickly!

Rating: 20/100

Recommended: No.

What Is The Single Stock Retirement Plan?

Alexander Green's Single Stock Retirement Portfolio is all about a "$3- stock" that he claims will finance a multimillion-dollar retirement plan, which is also a sales tactic for his investment publication called Oxford Communique.

Alex makes the bold claim that you can make money and retire on only one stock.

He says that what you have to do is look for a small-cap and relatively unknown stock that has solid fundamentals, purchase it at a low-entry price, hold it for two years, and watch it grow over time.

To that end, he has described a single stock - a business that was trading at $3 at the time of the pitch.

The company meets the following conditions surrounding a single-stock retirement plan:

- It is fairly cheap and largely unknown.

- It has deals with Apple, Intel, IBM, Hewlett Packard, Sony, Cisco, Microsoft, Sharp, and Nokia. These are worth more than $34.5 billion.

- It has 29,187 patents in the United States and 49,599 worldwide.

- It pays 116 percent more dividends than the typical S&P stock.

- Annual revenues are forecast to hit $164 billion.

And if that isn't enough, there will be some announcement soon that could lead share prices to surge.

Who Is Alexander Green?

Alexander Green is the chief investment officer at The Oxford Club.

He was a Wall Street insider for over 25 years before joining the publication. He worked as a financial writer, fund manager, investment adviser, and research analyst, among other things.

He has been on Fox News, CNBC, and C-Span and "The O'Reilly Factor" and "Oprah & Friends."

Also, he has published three best-selling books: "Beyond Wealth: The Road Map to a Rich Life," "The Gone Fishin' Portfolio," and "The Secret of Shelter Island."

How Does The Single Stock Retirement Plan Work?

It operates similarly to any other stock investment. Green advises you to move fast and buy undisclosed stocks in an unknown firm that is poised to outperform the S&P 500!

Pay $3.00 now and watch your wealth rise exponentially for the next decade. That's the pitch, and this is how the system operates.

At least, that's what we're told.

But is this true? Let's dig deeper.

What’s The Truth About The $3 Stock?

We wanted to connect the dots and follow the stock that was being pitched to us. Who doesn't expect their investment returns to skyrocket for the next ten years? Guess what I'm about to say? I've figured what the "secret" giant is behind the Single Stock Retirement Plan!

It's no rocket science, really. But you're gonna be surprised - or annoyed - or both.

Foxconn is the company in question - Taiwanese technology maker! Yes, this East Asian software mark collaborates with IBM, Apple, and others. The firm is also known as Hon Hai and has the ticker symbol HNHPO!

An ADR allows you to buy two shares of Hon Hai. Since it is a real business, the stocks are also real. That is one question asked, but will Foxconn be able to deal with Microsoft? It's still not even near!

The Single Stock Retirement Plan, to be completely honest, will not change your life because, as far as I can tell, Foxconn's stock will not rise tenfold over the next decade....to even consider it is, in my opinion, a pipe dream.

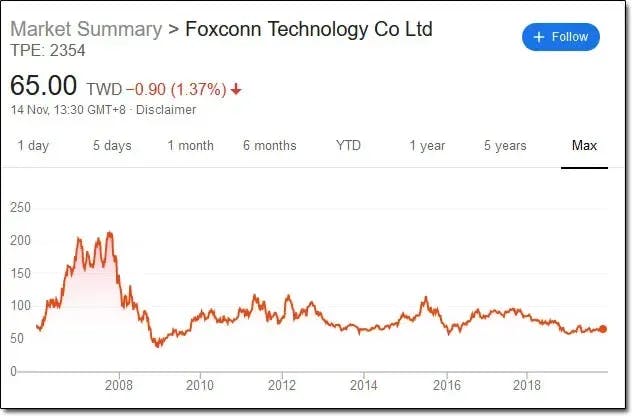

Truth is, at the time of writing this analysis, the price of their stocks is dropping as seen below:

What’s The Turnover Deal?

A bit of research for writing this review of the Single Stock Retirement Plan provided me with a wealth of knowledge about the stock.

Foxconn is not the first organization to outperform the S&P 500.

The fact is that it has been poorly performing and unprofitable since 2008, as seen in the graph below:

We have tested investor sentiment on a well-known market review website. The majority agree that this pattern will continue and that Foxconn will continue to underperform the S&P 500.

Farm closures in the United States have also been a buzzkill.

So it's not looking good for Foxconn, and it's not looking good for your savings either if you follow the recommendations of the Single Stock Retirement Plan.

The Oxford Club seems to be the only ones who are really making money.

How To Join The Single Stock Retirement Plan

Alex created a report titled "The Single-Stock Retirement Plan: How to Retire on This Obscure $3 Stock" to promote his single-stock retirement concept.

It includes all of the details you need to invest in the stock that will fund your retirement.

Everything there is to know is included in the paper, such as the company's hidden name and where you can buy the stock using your regular brokerage account.

Note that it is not exchanged on traditional US markets, but Alex will tell you of a workaround.

To access a copy of the paper, you must become a member of the Oxford Communique.

Each month, you will get a new edition of the newsletter featuring another unique investment opportunity as well as a thorough review of it.

It should provide instructions as to how to purchase it as well as the starting price.

Every week, Alex will give you a Portfolio summary with information on any critical events that could have an immediate effect on your portfolio.

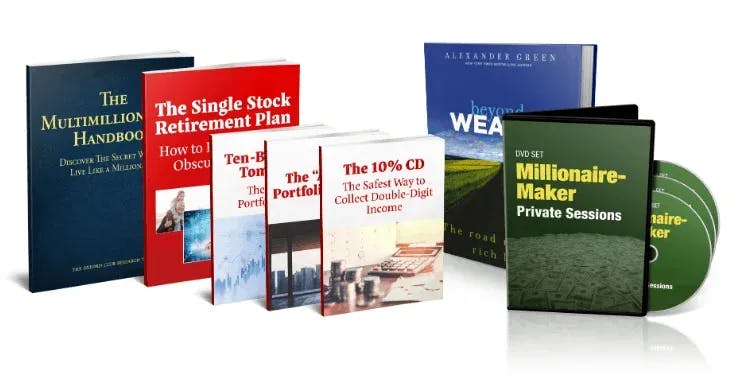

Furthermore, as soon as you become a member, you can get the following things for free:

- "The Multimillionaire's Handbook": This book is jam-packed with retirement secrets and advice, such as how to increase your social security contributions and maximize your tax schedule, to name a few.

- "The 10% CD: The Safest Way to Collect Double-Digit Income": A study on a recent investment that offers significant returns while posing a little risk.

- "Beyond Wealth: The Road Map to a Wealthy Life" is yours for free.

- "The Millionaire-Maker Private Sessions": A collection of high-definition online guides about how to become a successful investor.

- “The ‘All-Star Portfolio’ Strategy”

- "Ten-Baggers of Tomorrow: The Official Portfolio Guide"

How Does The Oxford Communique Work?

The Oxford Communique aims to be a financial advisory consulting service targeted at seniors or those about to retire.

I'd say this newsletter's audience is those who are 45+ years old and looking to raise their retirement fund—the sort of person who wants a high return on investment.

The Oxford Communique contains the following:

- Monthly Bulletin: This is what you're signing up for Alexander Green's advice and suggestions from his newsletter about what he believes are the right businesses to invest in for the most significant possible profits.

- Updates per week: A month can be a long time in the market and investment world due to the fast-paced climate. Weekly reports will hold you up to date with any investments you may have made based on The Oxford Communique's advice.

- Access To The Oxford Club's Members-Only Area: Access to a confidential area that is kept up to date regularly, which is said to have the most up-to-date financial details on the internet.

- Their Model Portfolio: If you apply to the Oxford Communique, you will have access to their model portfolio, which you can imitate and model if you wish.

- Membership in the Oxford Club: It grants you access to additional exclusive publications, unique rewards, and invitations to investing conferences and retreats.

- Alexander Greens' investment book: The Gone Fishing Portfolio.

- 2x Special Reports: "401(k) Secrets" and "The Best Investments of All Time."

Subscription Fee

There are three payment options available:

- Premium membership ($99): Includes a digital and print subscription as well as four bonus reports, namely "How to Create a Million-Dollar Portfolio From Scratch," "The Gone Fishin' Portfolio," "The Oxford Club Guide to Gold: The Owner's Manual," and "The Secrets of the 401(k): 18 Ways to Increase Your Retirement Cash."

- Standard membership ($129): Provides multimedia and print access.

- Basic membership ($49): Includes a digital subscription.

Money-Back Guarantee

There is a one-year money-back guarantee with Oxford Communique. Within one year after signing up for the email, you can request a full refund.

Performance Guarantee

If you do not add at least $100,000 to your investments by meeting all of Alex's advice, you will be given another full year of the Oxford Communique - all for free!

Is The Oxford Communique Accredited By The BBB?

No, the Oxford Communique is not BBB-accredited.

The Better Business Bureau does not recognize goods, whether tangible or digital, to be companies and thus does not accredit or rank them.

We should, however, look at the publisher, The Oxford Club, to see if they are ranked by the BBB.

The Better Business Bureau is currently updating its profile, so no information is currently available.

Why He Claims This Is Such An Amazing Opportunity

The share price is something Alex is really concerned with. He informs you that this stock is available for less than $3, but why is this significant?

No, it isn't. Although lower prices seem more enticing, share prices aren't all that significant.

What he emphasizes even more, is that this stock is "undiscovered." He says that only one out of every 50,000 investors is aware of this and that this is because it exists under a "secret name."

This is clearly a much bigger deal. Of course, if you can get in on good investing prospects before they become well-known, you can make a lot of money. This kind of stuff is very common.

The rich people are usually the ones who can spot winning stocks before they take off.

Great Investment Opportunity Or Not?

Okay, so it's certainly not as good as it's made out to be, which, I'm sure, is not something you would risk investing in.

With a market cap of close to $50 billion, these securities are unlikely to skyrocket in valuation-as most would have expected.

The chance of a tenfold rise in ten years is slim to none.

While there is much speculation about the share price being under $3, as I briefly mentioned above, this doesn't really mean much.

You'd also be surprised to learn that this stock has, by a long shot, poorly performed the S&P 500 since 2008 - accounting for just around half of the returns.

There aren't many people who agree with Alex on this, though.

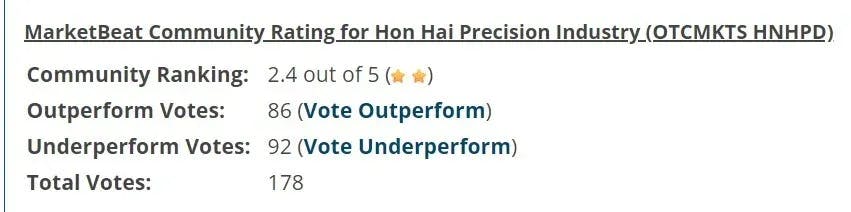

On the MarketBeat.com website, I was able to find a survey in which they asked investors about Hon Hai's long-term outlook - precisely, whether they expect it would outperform or underperform the S&P 500.

As seen below, over 178 votes are in as of this writing, and most people feel it would underperform.

It's no joke that they believe this. You would, too, if you knew its history. As I previously said, the S&P 500 has delivered roughly twice the earnings of HNHPD since 2008.

Final Verdict: Is The Single Stock Retirement Plan A Scam?

So, is One Single Stock a scam? Not technically. You can make money with it, but it’s definitely not as easy as Oxford Communique makes it sound.

Again, with any kind of financial product (especially trading), you’re taking on a lot of risk.

Sure, you could hit it big and retire in Italy, but chances are you need the stomach and financial cushion to weather tons of losses before you get there...and it may never happen.

Most of the big gains numbers these companies use in their marketing (“xyz grew by 4,112% in 3 months” or “this option made 324% in just 2 days”) are cherry-picked.

They don’t tell you about the 10 100% losers that came before.

In other words, if you invested $100 into 11 recommendations, you’d lose $1,000, and make back $324...so you’d still be out almost $700.

Most people don’t have the fortitude to stick it out through 3 straight months of losers in the hopes of landing one big winner.

What if, instead, you took those same 3 months, invested just a couple hours a day (in your spare time), and your reward was a $500 to $2,000 payment that came in every single month?

And what if you actually didn’t need to wait 3 months? What if you could get started today and have your first payment in a week?

And what if you could double it next week?

Well, that’s the power of Digital Leasing.

It’s a true lifestyle business.

Your laptop and an internet connection is all you need.

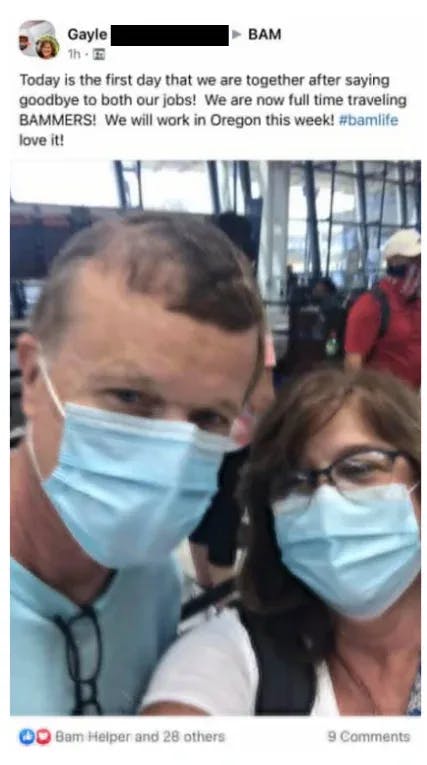

Some of the most successful students in this program run their entire 6-figure businesses from:

- A camper in the middle of the woods

- A beach chair on the water in Mexico

- A small villa in Greece

They’re able to travel around, living their lives first, and focusing on their income second.

Because even if they stop working for an extended period of time, the money keeps coming in.

So adventure, memories, and experience are the top priority.

And they never have to worry about how to pay for the next trip, or consider asking for time off.

If this sounds more like the type of life you want to lead, just click here to find out more about Digital Leasing.

What Is Our #1 Recommended Way To Make Money Online In 2024?

Our Review team has spent months researching, reviewing, and vetting dozens of business models and thousands of programs.

While there may be no “perfect business”, the research IS conclusive:

Digital Leasing is the #1 online business model for those just starting out.

Whether you’ve never made a dollar online, or you’ve been in this space for a while but never really “made it,” Digital Leasing is for you.

Why?

It’s Flexible: got an hour a day? You can do this. Ready to drop everything else and dive in full time? You can do this. Yes, the more time you put in, the faster you see results. But even with a little time each day, you can move the needle in a Digital Leasing business.

And because this system is so flexible, you don’t have to constantly be working to make more money. It’s called PASSIVE INCOME because if you stop working, the money doesn’t.

Imagine taking 3 months off to just tour around Europe, rent a cabin in the woods to write a book, hike the Appalachian Trail, or live on the beach and surf all day.

This is only possible if you have an income stream that’s not tied to your time.

You Own & Control EVERYTHING: With anything in the financial markets, you own and control NOTHING. You have no say in price fluctuations, demand, or what the market will do.

Trying to beat the market is fighting against the tide. There’s just too much working against you, no matter how many supercomputers or rocket scientists are on your side.

With Digital Leasing, you own the assets, which means you have all the power and all the control.

Little To No Startup Costs: It’s possible to get into Digital Leasing with zero dollars upfront.

Because, using the strategies outlined in this program, you can get a client to pay you BEFORE spending a penny out of your own pocket...even before you do any work.

Even without getting paid in advance, you can have your first Digital Rental Property up, running, and generating profits for less than $100.

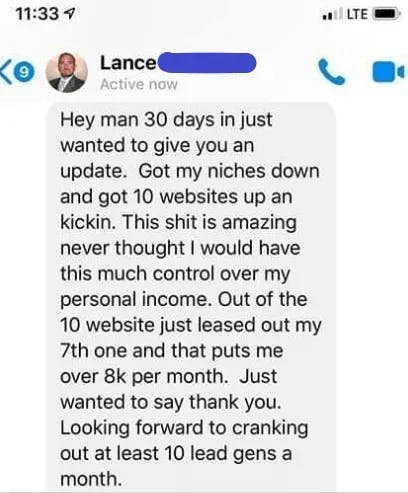

Easy To Duplicate: Ok, here’s the best part: once you have your first Digital Rental Property up and running, you can literally DOUBLE your income with a few clicks, a couple keystrokes, and a single phone call (and you don’t actually need the phone call).

Remember: each Digital Rental Property is worth $500 to $2,000 a month in semi-passive income (over 95% profit). Every time you decide to create another one and increase your income, it gets easier.

Because you have more knowledge, more experience, more results, and more momentum.

If you wanted to double your income with any kind of trading or investing, you’d have to double your initial capital OR double the average order size of your existing trades. And, guaranteed that’s a lot harder than a few clicks and a few minutes of your life.

Make Money Helping Real People: This part is what makes it all worth it. In the financial markets, you might be helping your family, but the impact never goes beyond you and maybe a few others.

But with Digital Leasing, you’re actually helping people by solving your clients’ biggest problem:

Small, local businesses need more customers, and with Digital Leasing, you are unleashing a flood of happy, paying customers for these businesses.

You make money by helping them make money.

Not a big, faceless corporation either...a small business owner who’s using that money to put food on the table for their family, start a college fund for their kids, or take care of a sick parent.

Once you see how Digital Leasing makes a real impact in the lives of real people, you’ll sleep like a baby with a big smile on your face.

Now, the choice is yours. You could continue browsing, looking at opportunities like One Single Stock which could one day make you money.

You could continue researching, never making a decision.

OR, you could take a look inside, consider what you really want, and join a program that makes your dreams a reality. At the same time, joining a community of over 2,000 successful students that are living life on their own terms thanks to Digital Leasing.

A consistent, reliable, semi-passive stream of income that doesn’t depend on you or your time to keep producing profits.

All while genuinely helping real people who are grateful and happy to pay for it.

If this sounds more like what you want out of life (or if you just want some nice side income), click here to learn more about Digital Leasing.

#1 Business Recommendation

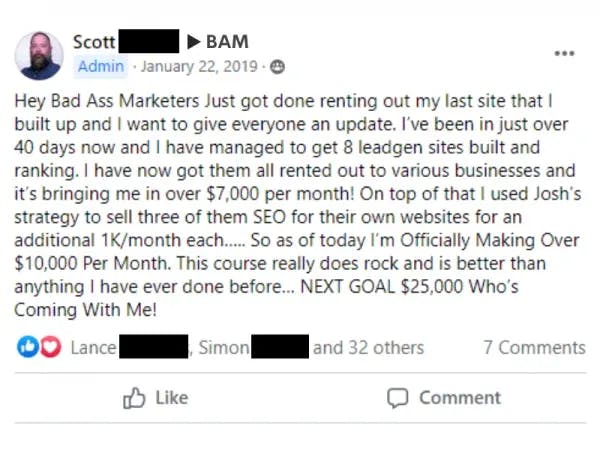

We each make around $10,000 per month with the help of this system.

yes, show me more