Loan Broker Network Reviews: Can You Trust This “Shark Tank” Company? (2024 Update)

![Loan Broker Network Reviews: Can You Trust This “Shark Tank” Company? ([year] Update)](/_next/image/?url=https%3A%2F%2Fcolorful-action-2ff8f86b45.media.strapiapp.com%2FLoan_Broker_Network_Review_jpg_805e5bd6c1.webp&w=1920&q=80)

Introduction To Loan Broker Network Reviews

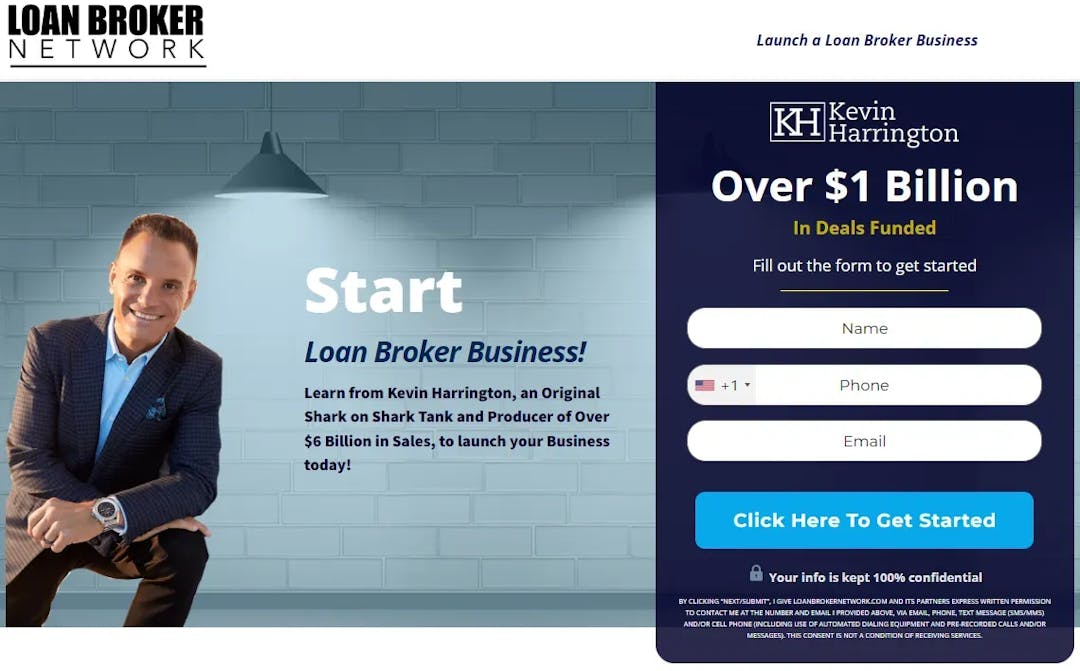

Loan Broker Network is kind of a weird company that combines the loan brokerage business model with lead generation tactics. It was founded by Philip F. Smith and Kevin Harrington - you may have heard of Kevin from his days on the hit show, Shark Tank.

It's an interesting idea, and you might have seen it advertised to you in some YouTube video, or while scrolling through Facebook. Sometimes it's a matter of you fitting the right demographic, or sometimes it's the algorithm picking up what you've been searching up lately - like how to make money online.

So now you're here, trying to figure out which one of these Loan Broker Network reviews actually makes sense.

Well, I've been writing articles on these kind of programs for years now, covering everything from affiliate marketing to real estate. You might have even read my BAM University review, or the guide to starting a lead generation business I put out there.

So when I say I get where you're coming from - I mean it. I know what these guys promise, and I have the experience to figure out which ones are for real and which ones are scammers.

And it's especially tempting to join up with a team when they have a famous guy attached...not that Kevin Harrington is on the same level as Brad Pitt, but in the finance world, Shark Tank is considered pretty legit.

But is loan brokerage worth your time and money? I'll help you figure out what this job actually involves you doing, we'll go over alternative programs, and see how much this one actually costs!

Now, let's jump into our Loan Broker Network review!

DISCLAIMER:

This Loan Broaker Network review has been thoroughly researched with information and testimonials that are available to anyone in the public. Any conclusions drawn by myself are opinions.

Kevin Harrington is a recognizable name from Shark Tank, which could mean that the course has more legitimacy than some other programs.

Lead generation is great, meaning at least half of the program makes a lot of sense.

Operating a loan brokerage isn't very popular, so that means you may have less competition than something like Amazon FBA or affiliate marketing.

Philip F Smith has an F rating on BBB for this program, which means it is hard to trust Loan Broker Network.

Loan brokerage is a little complicated, and that means it may be difficult for beginners to jump into.

The expenses can be high, with one student reportedly losing $100,000...meaning this might only be a program for those who can afford huge losses.

Why Listen To Us

My name is Josiah, and this is my Dad, Joel.

I built that site in 2020, and it still makes me $1,500 per month. It’s a basic 5 page website I built based on a template the program provides.

The best part to me? My dad and I get to do it all together!

So between the:

Ease of reaching $5-$10K per month in income online

Straightforward-ness of the system to do it

Fact that I get to do it w/ my family

Is why I recommend local lead generation as my #1 business model for making money online.

Sure, it takes some work and dedication – but anyone that tells you that there’s a business out there that requires no work is selling you a lemon.

I’m not saying you need to sign up for the same program I did, but I would definitely recommend giving the business model a peek!

TLDR - Is Loan Broker Network Worth It?

The Loan Broker Network is a unique kind of program, combining lead generation with loan brokerage. Both of these industries are solid on their own, but do they work well together - and more importantly, does this program actually teach you anything solid?

Well, let's start with the lead generation part.

This one is Philip F Smith's specialty, and the business model makes a lot of sense all in all. It's basically all about using the power of search results to generate leads that can turn into clients for businesses.

Usually in a full-out lead generation agency, you have a ton of freedom and flexibility because you can pick your own niche, and approach any company you want. And once you've got the hang of things, you can branch out into other niches, in other cities, and basically do whatever you want.

The Loan Broker Network is a lot more restrictive than that.

It takes the original skillset, but instead of branching out to other businesses, your turn it back toward your own loan brokerage. This is a good idea for any business, but I need to be clear that this program teaches you how to build a loan brokerage that uses lead generation for marketing...it's not a lead generation program, generally speaking.

If you're looking for something that focuses 100% on lead gen, then I recommend Digital Leasing.

However, if you're interested in the loan side of things, let's take a quick look at what LBN promises to do for you.

If you've ever tried to start a small business before, you might have gone to a bank to get approved for a loan. Sadly, 80% of loan applications are denied these days...and so these fiery entrepreneurs have to look elsewhere for someone to take a chance on their ideas.

I think you're starting to see why Kevin Harrington is a great advertisement tool for this company, since his TV show was all about taking a chance on people's ideas.

Anyway, LBN basically plays matchmaker. They teach you how to build a network of alternative financing solutions, and then find one that'll take on the loan these people are looking for.

Beyond businesses, they also train their students on how to work with individuals on mortgages.

But can you actually make money with these guys?

Maybe.

But loan brokerage is a tricky, complicated business that can be really hard for rookies to get into. This kind of thing is why I typically point people of all experience levels toward that Digital Leasing program I mentioned earlier.

Their students seem extremely passionate about what they're doing - not just getting by, but creating their own future.

Now, if you'd like to hear Loan Broker Network review, then let's get back to it.

Who Benefits From Loan Broker Network...And Who Is It Wrong For?

| Area | Score | Description |

|---|---|---|

| Time Investment | 2/5 | It will take a lot of time to figure out the ins and outs of loan brokerage, not to mention building the right contacts. |

| Level of Control | 1/5 | You use lead generation, but are limited to only putting it toward one business. Very limiting. |

| Ease of Implementation | 2/5 | Super tricky for some rookies to learn about loan brokerage, although lead generation can be fairly easy. |

| Profit Potential | 4/5 | I actually think there's a lot of money to be made with both lead generation as well as loan brokerage...it's just a matter of the trade-offs you have to make everywhere else. |

There are tons of programs hyping themselves up as the best out there, but choosing the wrong one could change your life for all the wrong reasons.

Loan Broker Network might be for you if...

- You're interested in making money from other people's business deals

- You're not afraid of a lot of investment

- You have some experience with marketing (like with Iman Gadzhi)

On the other hand, it probably doesn't make sense to join it if...

- You're looking for a program with a better track record

- You're scared that Kevin Harrington has been sued for fraud in the past

- You'd prefer to focus on lead generation instead of loan brokerage

Loan Broker Network At A 1,000 FT View

As mentioned, this program uses elements of lead generation, but primarily focuses on operating a loan brokerage.

The biggest issue with this business model is that it can be kind of complicated, and even a little boring when it comes to new terms you're gonna have to know. Let's break 'em all down:

What Is A Broker Loan?

A broker loan is a loan that must be paid to a lender, by a borrower, with a deadline that the two of them agree to in a contract.

Someone people call these call loans or demand loans, when a broker needs some capital (investment money) for his client's portfolios.

The risk with these kinda things is something called interest, where the lender takes a percentage of the loan from the borrower, sometimes on a monthly basis.

Example: you borrow $1 million to start a business, and there's an interest rate of 5%. That would be 50,000, paid yearly, divided into monthly payments of a little over $4,000 every month.

Usually the interest rates will change depending on the level of risk the lender is taking. For example, with a mortgage, someone who puts down a higher down payment and has a good credit can likely get a lower interest rate than someone who has declared bankruptcy and barely meets the minimum down payment.

If you're no stranger to loans, then this is all old news to you...but if you're new, this may be a little overwhelming. Like I said earlier, you may just wanna skip to my top recommendation for getting some money online...because it only gets deeper from here!

What Is A Loan Broker?

To keep it as simple as I can, a broker is person (or a company) who helps bridge the gap between someone giving a loan and the person taking the loan.

And then they get paid for helping make the deal happen. Sounds like they're only person not taking a risk - a cool gig, in theory!

A business loan (also called a commercial loan) is usually for stuff like equipment and inventory, while a mortgage is for real estate like a house or land. A person loan is, you guessed it, for personal projects.

What Are Mortgage Brokers?

When it comes to brokering a mortgage, you're the middleman (or middle-woman) between people who wanna buy some real estate, and people who give out real estate loans.

- You don't have to use your own funds or resources to get this done, which you may have to do when negotiating other loans.

- With mortgage brokerage, you'll have to run around picking up all kinds of documents, getting them approved and doing all the nitty gritty work.

- At least you get a commission after all the running around, if all goes well.

What Is A Personal Loan Broker?

Just like the other kinds of brokerage, this one plays the "bridge".

- This time the borrower will be looking for things like a dream wedding or big home renovation job

- These are usually not as costly as starting a business or buying a home, so the commission will be less

- That said, there's less hassle to get this done. It's more of a sure thing

Why Work With A Business Loan Broker?

As we briefly touched on above, this kind of loan helps out startup businesses, or businesses in cash flow trouble. Here are some examples:

- Businesses who don't have much credit built up, or bad credit

- Companies who are refused by banks

- Small businesses who need more intimate help figuring all their financial needs out

- Startups that may need some things that big banks can't provide

Lead Generation

The lead gen aspect of this does make it more interesting, as it's a great way to boost any business, including loan brokers.

But if you get the wrong guy to teach and guide you, it won't matter how good the industry is.

Philip F Smith's awful BBB page is enough to recommend you check out my recommendation instead. A great mentor, someone you can trust.

Who Are The Founders Of Loan Broker Network?

Who Is Philip F. Smith?

While you probably haven't heard of Philip F. Smith, he's been doing alright for himself behind the scenes for the last couple decades.

His specialty appears to be digital marketing, as well as pushing the idea of getting yourself on TV with local cable news channels whenever possible.

He claims to have consulted for more than 40 companies, and built 4 digital marketing businesses dating all the way back to 1998. So at least you're not dealing with some kid with no experience.

Phil Smith was probably most well known for his agency, PJP Marketing, and its work within the lead generation world. However, he seems to mostly advertise his website philipfsmith.com, and his marketing program is called All In One Marketing.

You might be wondering where Loan Broker Network comes into all this...well, eventually he started getting into providing leads for business loans (and a little bit of credit repair), and saw that America has really become a debt-driven economy.

And he wanted a slice of that pie.

But the problem he kept running into was that it wasn't his expertise, and people still didn't really recognize his name. So he made a smart move, and gave Kevin Harrington a cut of Loan Broker Network in order to use the big "Shark Tank" name as part of his program's marketing material.

Unfortunately, it doesn't seem like Mr. Harrington actually does a lot for LBN other than let them post his face everywhere.

Who Is Kevin Harrington?

Some people call Kevin Harrington the "Godfather of Infomercials" since he is responsible for filling the airtime after TV stations would stop playing shows for the day, all the way back in 1985.

Yup, if you're too young to remember, TV stations would play the national anthem at the end of the day (or "Dixie" if you lived in the American South) and then you would have to wait until the next morning to watch anything else.

Well, Kevin Harrington helped kill all that, and ended up building a $400 million net worth for himself in the process. And by '94, over 90% of TV stations were playing informercial the way he was doing it.

While I give credit to Phil Smith for using Kevin Harrington's fame as marketing, it might have backfired a little when a big lawsuit was filed against Harrington for allegedly committing fraud.

How Much Does Loan Broke Network Cost?

I've heard a bunch of prices for this course at this point, so there must be several unlisted upsells that Smith and Harrington send their students' way.

It seems their base charge will set you back $997, with a common upsell that'll add on another $2,997...

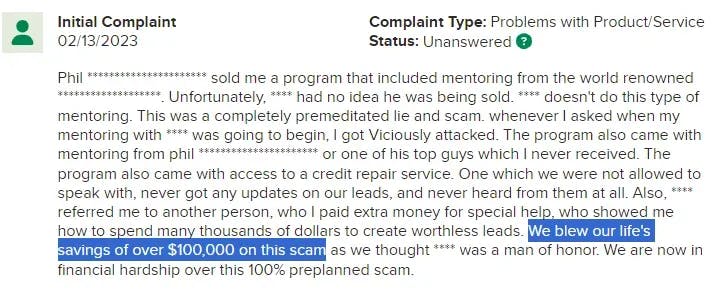

...but the biggest number we saw is illustrated in the image above - over $100,000!!

It's one thing to invest big in something that offers even bigger returns...but it's another to waste all that money and get nothing out of it from an absent guru.

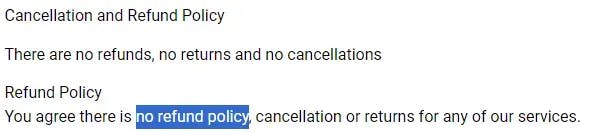

Loan Broker Network Refund Policy

If you give your money to Phil or Kevin, just prepare yourself to never see it again.

They are very upfront with their no-refund policy...at least if you check out their terms and conditions page.

Hopefully their students read that part.

What's Up With The "loanbrokernetwork.com reviews" Search Results?

Sometimes you just get weird search results! Personally, I'd just look up "Loan Broker Network reviews", but apparently enough people try "loanbrokernetwork.com reviews", so I figured we could briefly address that before moving on.

Is Loan Broker Network Legit Or Not?

| Source | Quote | Link |

|---|---|---|

| "We blew our life's savings of over $100,000 on this scam" | Source |

| "I think this sounds illegal under Dodd-Frank / RESPA" | Source |

| "unless you’re interested in taking years out of your life to experiment with an unproven business model, I would look elsewhere" | Source |

Honestly, I expected pretty solid reviews based on the decent business model and experience of the gurus...but judging from the table above, it doesn't look like Loan Broker Network is impressing their students.

...so, is Loan Broker Network legit?

I think the program is probably still legit, in spite of the legal problems facing Kevin Harrington in recent years. And like I said, both lead generation and loan brokerage have high upside, where you can find ways to make some big money.

I'm guessing the big problem comes down to Philip F. Smith not being able to get the job done as a coach. If everything else lines up, but the students still aren't happy and the program isn't doing that well, then something isn't being executed right.

I have Phil mention how he runs a 1-man company, and while that may save him some expenses, it also likely limits the mentorship and support he's able to provide for his students.

My recommendation is still that you should focus 100% on lead generation, instead of just using it within this loan brokerage idea.

Digital Leasing seems to be working pretty well for their students.

Personal Opinion On Loan Broker Network

Phil Smith seems like a great marketer, and even says he will close deals for you...but the students still aren't happy.

Like I said earlier, I've been examining industries like lead generation, social media marketing agencies, and loan brokerages for years now, so I've got a pretty good idea of what makes up a great program.

So...how do we find the right course for you?

- Make sure the guru has a proven track record of mentorship

- See if you can get an idea about their training, to see if it's the right fit

- If they have a well-known community and support system, that's great

While this program has some work to do, I do think Phil Smith is a quality businessman overall.

Here's a quick 3 things I like about Loan Broker Network:

- Philip F Smith knows how to advertise a course well

- Using lead gen is a good start

- Everyone is going to need loans with the way the economy is going

...and, in all fairness, here are 3 things I don't really like:

- Legal issues (fraud) facing the team

- Loan brokerage has been described as "boring" and "dry" for beginners

- It seems there are some very expensive upsells that don't pay off

What's Inside Loan Broker Network?

“Tap into our existing infrastructure… We will also do the heavy lifting and CLOSE YOUR DEALS FOR YOU, so you can make MASSIVE COMMISSIONS. All we ask you to do is generate a lead, and we will teach you how to do that via free and paid marketing.”

This quote is from the LBN website, and it's kind of a weird pitch...they say that they'll do all the loan brokerage work for you, but they also say elsewhere that they'll train you how to become a successful loan broker.

I'd guess the "done for you" closing they mention will cost you a significant upcharge, which would make sense if they're doing the heavy lifting for you. But if it were me, and I'm diving headfirst into a program called "LOAN BROKER Network", and I'm spending a lot of time learning the industry...I'd probably just save my money and learn to work the whole operation myself.

Otherwise, you're basically just being taught how to generate leads for one business, that isn't entirely yours anyway. I'd imagine if you choose the Done for You option, you will also be surrendering a huge chunk of your commission to Phil Smith and Kevin Harrington, as well.

And if you're going to do lead generation for someone else, then you should just focus on that and sell your leads to many companies, instead of just one...and without splitting the profits.

Conclusion: Loan Broker Network Reviews

So, do Philip F Smith and Kevin Harrington deserve your trust with their loan broker business?

I would say no.

The premise is nice, and the big shiny "Shark Tank" branding is gonna draw in a lot of other people...but I'm not sure it's the best idea for you to jump into these waters.

It just seems like the Loan Broker Network's boat has a few leaky holes in it, and I'd rather keep things simple with the tried-and-true lead generation industry.

I think there is at least one opportunity that stands out in comparison...

What's My #1 Way To Make Money In 2024?

I have spent years researching, reviewing, and vetting dozens of business models and thousands of programs.

While there may be no “perfect business”, the research IS conclusive:

Digital Leasing is the #1 online business model for those just starting out.

Whether you’ve never made a dollar online, or you’ve been in this space for a while but never really “made it,” Digital Leasing is for you.

Why?

1) It’s Flexible: got an hour a day? You can do this. Ready to drop everything else and dive in full time? You can do this. Yes, the more time you put in, the faster you see results. But even with a little time each day, you can move the needle in a Digital Leasing business.

And because this system is so flexible, you don’t have to constantly be working to make more money. It’s called PASSIVE INCOME because if you stop working, the money doesn’t.

Imagine taking 3 months off to just tour around Europe, rent a cabin in the woods to write a book, hike the Appalachian Trail, or live on the beach and surf all day.

This is only possible if you have an income stream that’s not tied to your time.

2) You Own & Control EVERYTHING: With Philip F. Smith's program, you don’t really own anything.

You’re a hired gun for borrowers and lenders, totally at their mercy.

Sure, you learn some of the tactics of a full-fledged lead generation professional, but you're not going to be taught how to use it to its maximum potential - and that means less cash in your pocket.

With Digital Leasing (a passive income stream), you own all the assets, which means you have all the power and all the control.

3) Little To No Startup Costs: It’s possible to get into Digital Leasing with zero dollars upfront. Because, using the strategies outlined in this program, you can get a client to pay you BEFORE spending a penny out of your own pocket...even before you do any work.

Even without getting paid in advance, you can have your first Digital Rental Property up, running, and generating profits for less than $100

4) Easy To Duplicate: Ok, here’s the best part: once you have your first Digital Rental Property up and running, you can literally DOUBLE your income with a few clicks, a couple keystrokes, and a single phone call (and you don’t actually need the phone call).

With Loan Broker Network, you'd have to bank on twice as many people needing a loan today than they did yesterday. And while things can heat up in a hurry, it seems that things like the housing market can cool off in an instant - and that actually cuts your mortgage broker opportunities can be cut in half.

And remember: each Digital Rental Property is worth $500 to $2,000 a month in semi-passive income (over 95% profit). Every time you decide to create another one and increase your income, it gets easier.

Because you have more knowledge, more experience, more results, and more momentum.

5) Make Money Helping Real People: This part is what makes it all worth it. With Digital Leasing, you’re actually helping people by solving your clients’ biggest problem:

Small, local businesses need more customers, and with Digital Leasing, you are unleashing a flood of happy, paying customers for these businesses.

Loan Broker Network teases the upside of lead generation, but instead of helping local businesses you're only allowed to help generate leads for your loan brokerage business - and Philip F. Smith will want his cut of all that, of course.

You just have less freedom with LBN.

With Digital Leasing, you make money by helping businesses make money.

Not a big, faceless corporation either...a small business owner who’s using that money to put food on the table for their family, start a college fund for their kids, or take care of a sick parent.

Once you see how Digital Leasing makes a real impact in the lives of real people, you’ll sleep like a baby with a big smile on your face.

Now, the choice is yours. You could continue browsing, looking at opportunities like Loan Broker Network, which could one day make you money.

You could continue researching, never making a decision.

OR, you could take a look inside, consider what you really want, and join a program that makes your dreams a reality. At the same time, joining a community of over 2,000 successful students that are living life on their own terms thanks to Digital Leasing.

A consistent, reliable, semi-passive stream of income that doesn’t depend on you or your time to keep producing profits.

All while genuinely helping real people who are grateful and happy to pay for it.

If this sounds more like what you want out of life (or if you just want some nice side income), click here to learn more about Digital Leasing.

#1 Business Recommendation

We each make around $10,000 per month with the help of this system.

yes, show me more