How To Day Trade (In 2023): Best Tips For Trading Stocks? #4 Really Got Me Thinking!

The current market volatility is attracting an increasing number of people to engage in day trading.

Naturally, people desire to earn money quickly by buying and selling stocks everyday.

Is this form of speculative investment really worth it?

Is there any resemblance to the dot-com boom of the 1990s, or is it completely safe to start day trading as a newbie right now?

How do you day trade safely?

How do you day trade profitably?

Now, before we answer these questions, I want to be totally up front here, so...

DISCLAIMER:

This review has been thoroughly researched with information and testimonials that are available to anyone in the public. Any conclusions drawn by myself are opinions.

How to day trade is quick, and you'll notice results right away.

You do not face an overnight risk.

It's a rush of adrenaline.

It might cost $25,000.

It has the potential to be very addicting.

You don't have time to think.

Why Listen To Us

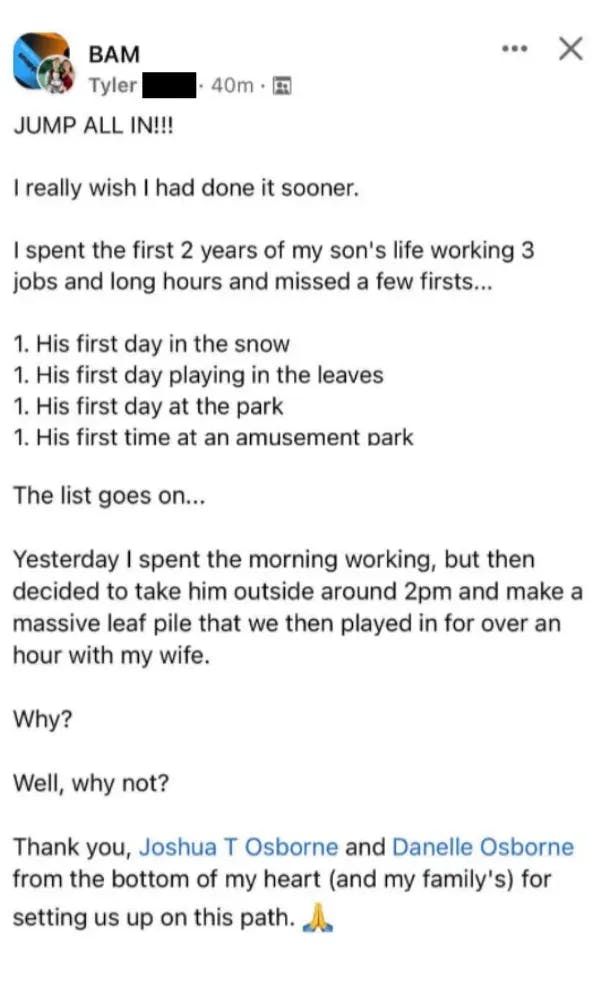

My name is Josiah, and this is my Dad, Joel.

I built that site in 2020, and it still makes me $1,500 per month. It’s a basic 5 page website I built based on a template the program provides.

The best part to me? My dad and I get to do it all together!

So between the:

Ease of reaching $5-$10K per month in income online

Straightforward-ness of the system to do it

Fact that I get to do it w/ my family

Is why I recommend local lead generation as my #1 business model for making money online.

Sure, it takes some work and dedication – but anyone that tells you that there’s a business out there that requires no work is selling you a lemon.

I’m not saying you need to sign up for the same program I did, but I would definitely recommend giving the business model a peek!

You probably discovered day trading for the same reason you might have come across any other financial newsletter, trading service, or investment program: Because you want more money in less time.

And chances are, you want to quickly multiply the money you do have (as opposed to waiting months or even years to see a decent ROI).

This is a really exciting promise, and it’s probably why the financial publishing and training industry is worth billions of dollars.

The problem is, because the idea of doubling, tripling, or 10X-ing your money in a few minutes to a few days is so enticing, there are a ton of shady characters in this space.

But, putting that aside, let’s say every investing guru and “trading expert” on the internet had the best of intentions.

Even with proprietary algorithms, a room full of supercomputers, and a team of rocket scientists, most of these experts would be lucky to get it right 20% of the time.

Now sure, we’re talking about asymmetric bets here, so theoretically the winners should more than make up for the losers.

But in order to make that happen, you can NEVER miss a trade. With a 20% success rate (speaking optimistically), one missed winner could turn a profitable month into a loser.

That’s a lot of pressure and a lot of stress (not to mention a lot of losing) with not much certainty.

But what if there was a way you could build a passive income stream that’s actually passive?

An income stream that doesn’t require:

- Constantly monitoring your phone for buy/sell alerts

- Obsessively watching charts and movement

- The emotional roller coaster and angst of hoping one winner can cover the last 8 losses

- Gambler’s odds (20% chance of success is worse than the odds of winning at Blackjack)

An income stream that brings in consistent revenues every single month (from a couple thousand dollars to well over $10,000)?

An income stream you could actually build in your spare time, and grow as large or as small as you want to, without having to spend hours a day monitoring charts, trades, and alerts?

If that sounds like something you’d be interested in, check out Digital Leasing.

However, if you’d still like to know more about how to day trade, keep reading.

However, if you’d still like to know more about how to day trade, keep reading.

What To Expect From This Day Trading Review

This review will go over how to day trade.

You'll learn whether day trading is the right online business for you.

And at the end, you'll find answers to some of the most frequently asked questions regarding day trading in general.

But most importantly, you'll see the exact system many others have used to build their own internet marketing business to over $40,000 a month in mostly passive income.

What Is Day Trading?

Day trading is the activity of buying and selling securities inside a single trading day. It may happen in any market, but it is most prevalent in the FX and stock market.

A day trader is often well-educated and financially secure.

Swing traders use high levels of leverage and short-term trading tactics to profit from small price swings in highly liquid stocks or currencies.

A day trader is acutely aware of factors that drive short-term market movements. Trading on the basis of news is a common strategy. Economic data, company profits, and interest rates are all susceptible to market expectations and market psychology.

When such expectations are not fulfilled or surpassed, markets respond with fast, large swings, which may tremendously benefit a day trader.

Can I Really Make Money Day Trading?

Yes, You can!

But...

There's a lot that comes along with day trading that many people struggle with.

Now, don't get the wrong idea...

It's not impossible to make money with day trading, but if you're gonna put in the amount of grueling work to do this business (which, trust us, isn't easy), you might as well bring in some REAL money while you're learning the ropes.

Is Day Trading Legit Or A Scam?

Day trading is completely legit. There are several restrictions in place to safeguard investors. Certain asset classes are restricted in certain countries. All common assets, including stocks, options, and futures, are completely legal in the United States.

Traders run the danger of losing money in a short period of time. If the buying and selling were done on margin, this might result in a margin call.

The majority of day traders trade stocks for no commissions, although other markets such as foreign exchange are also popular.

So, is day trading a scam?

Not technically. You can make money with it, but it’s definitely not as easy as it sounds.

Again, with any kind of financial product (especially trading), you’re taking on a lot of risk.

Sure, you could hit it big and retire in Italy, but chances are you need the stomach and financial cushion to weather tons of losses before you get there...and it may never happen.

Most of the big gains numbers these companies use in their marketing (“xyz grew by 4,112% in 3 months” or “this option made 324% in just 2 days”) are cherry-picked.

They don’t tell you about the 10 100% losers that came before.

In other words, if you invested $100 into 11 recommendations, you’d lose $1,000, and make back $324...so you’d still be out almost $700.

Most people don’t have the fortitude to stick it out through 3 straight months of losers in the hopes of landing one big winner.

What if, instead, you took those same 3 months, invested just a couple hours a day (in your spare time), and your reward was a $500 to $2,000 payment that came in every single month?

And what if you actually didn’t need to wait 3 months? What if you could get started today and have your first payment in a week?

And what if you could double it next week?

Well, that’s the power of Digital Leasing.

It’s a true lifestyle business.

Your laptop and an internet connection is all you need.

Some of the most successful students in this program run their entire 6-figure businesses from:

- A camper in the middle of the woods

- A beach chair on the water in Mexico

- A small villa in Greece

They’re able to travel around, living their lives first, and focusing on their income second.

Because even if they stop working for an extended period of time, the money keeps coming in.

So adventure, memories, and experience are the top priority.

And they never have to worry about how to pay for the next trip, or consider asking for time off.

If this sounds more like the type of life you want to lead, just click here to find out more about Digital Leasing.

How To Day Trade: What Is the Average Career Duration of Day Traders?

It all depends. A day trading career might span a lifetime for some people.

However, if you don't analyze or do risk management, your day trading career might end in a single trade. That is why you prepare...

A mentoring program, such as the SteadyTrade Team, might help you in your endeavor. There's a chat room, a community, twice-daily webinars, and much more:

https://stockstotrade.com/steadytrade-team/

How To Day Trade: How Does Day Trading Work?

Trading is defined as the attempt to buy a stock or other financial instrument at a low stock price and sell it at a high stock price. There are several and more intricate trading strategies for doing this, but that is the core idea.

Day trading is done more regularly. Day traders finish their deals entirely in the same day, as opposed to buying a stock and keeping it overnight or longer.

How To Day Trade: Day Trading Tips For Beginners

There are several strategies and tactics for boosting your day trading profits, but these three are the most vital for risk management associated with day trading:

You should only trade with money you can afford to lose.

It is critical to practice good money management by putting aside a certain amount of money for day trading. Don't trade more than that amount, and don't use the money for your mortgage or rent. Why? It's possible that you'll lose it.

Start trading small.

You will make errors and lose money day trading, especially at first. Keep a close eye on your losses until you get some experience.

Don't give up your day job.

You might have a lucky streak, particularly if the market is on a long winning streak. However, before you broaden your efforts, you'll need to examine how your trading technique works when the market is volatile, particularly during a recession. Once you've established a steady profit, determine if you want to spend more time trading.

Start with paper trading.

Every newcomer makes mistakes, particularly when it comes to something as sophisticated as day trading the stock market.

Using real-time data, traders may simulate a real-life trading environment. Paper trading allows you to practice your setups without risking real money.

StocksToTrade is one of the greatest platforms available. It offers a strong paper trading function that allows you to practice your abilities without worrying about depleting your money account.

What You Will Need Before Starting Day Trading

Strong understanding of Day Trading Terminology and Technical Analysis

Day trading is a very tough skill to learn, much alone perfect. Consider day trading to be similar to participating in a professional sport. Your ability to make money is entirely dependent on your ability to perform consistently.

Trying to day trade without any kind of training or knowledge is a formula for catastrophe and financial loss.

Reading books and watching videos is the first step in learning day trading vocabulary and technical analysis! This is the process of acquiring knowledge. But keep in mind that just because you've read a skydiving book doesn't imply you're ready to jump out of an aircraft!

One of the difficulties in learning to trade is the vast quantity of information available. Things you discover will often be paradoxical. The reason for this is that technical analysis or entry and exit requirements that work for one strategy may not work at all for another.

Learning a little bit of 100 different tactics will not benefit you in the long run. It's much better to understand all you can about a single successful method. So, while deciding who you'll learn from, it's always a good idea to ask yourself, "Is this individual genuinely profitable?"

The first step in learning how to day trade is to research.

Developing profitable day trading strategies or adopting proven day trading strategies

As a budding trader, you have two-day trading strategy options. You may either choose a strategy that is currently being used by other traders or develop your own.

If you make your own, expect to spend months, if not years, backtesting and polishing it before you can trade with real money.

Rather than reinventing the wheel, most new traders choose to learn a lucrative approach that has previously been proven. After learning that strategy, traders may choose to put their own spin on it by modifying it somewhat.

Whatever technique you use, it's critical to have a certain setup, trading system, or methodology that you're comfortable with before you begin trading.

It lets you focus on developing a competency in one area rather than attempting to locate opportunities for many setups at once and never truly being proficient in any of them.

If the setup/system you chose isn't great for you, you may always learn more later.

The main thing is to focus on one thing and master it from the start. Whether you attempt to trade five different strategies at the same time, how do you know if one of them is lucrative if one of the others is losing you a lot of money?

Practice in a Day Trading Simulator to Convert Knowledge to Skill

You may have completed a few great trading courses, read a book or two, and been following free online coaches and believe you are ready to trade.

However, the fact is that you are most likely not prepared. Beginner-day traders are renowned for overestimating their skills, trading with real money, and losing.

Understanding day trading intellectually is not the same as being able to respond to opportunities and effectively execute them in real-time.

Here's when practice comes in handy.

You'll need a trading simulator to practice your strategies in real-time until you're comfortable with order entry and trade management.

If you can't earn money in a trading simulator, odds are you won't be able to make money in a real account either!

One of the greatest mistakes a newbie trader can do is to enter a genuine trading account cold turkey.

What Are The Risks Of Day Trading?

The Securities and Exchange Commission (SEC) of the United States highlights some of the risks associated with day trading, which are described below:

Be prepared to lose money - a lot of money:

Because day traders generally lose a lot of money in their first few months of trading, and many of them never make a profit, good risk management is to risk losing money that they can afford to lose.

Day trading is a high-stress, high-cost full-time job:

Day trading is highly challenging and requires a high level of focus to monitor hundreds of ticker quotes and price movements in order to recognize market trends. Day traders have high expenses as well, generally paying big sums to their businesses for commissions, training, and computers.

Day traders rely heavily on borrowed funds:

Day-trading tactics employ borrowed money as leverage to create gains, which is why many day traders not only lose all of their money but also wind up in debt.

What Are The Day Trader's Margin Requirements?

The minimum equity requirement for a client of a broker-dealer who is designated as a pattern day trader is $25,000, which must be put into the client's account prior to any day-trading activity and maintained at all times, according to Financial Industry Regulatory Authority (FINRA)2 rules.

What Is A Pattern Day Trader?

A pattern day trader (PDT) is a regulatory classification for traders or investors that execute four or more day transactions utilizing a margin account over the course of five working days. The number of day transactions must amount to more than 6% of overall trading activity in the margin account during that five-day period.

If this happens, the trader's account will be marked by their broker as a PDT. The PDT classification restricts future trading. This designation was meant to dissuade investors from trading excessively.

Should You Get Involved in Day Trading?

Day trading is only one strategy for the stock market, and it's not for most investors. Here are some resources to help you balance less-intensive and easier methods of expanding your money management:

NerdWallet’s guide on how to invest money.

https://www.nerdwallet.com/article/investing/how-to-invest-money

Why Don't Day Traders Keep Their Positions Overnight?

Day traders typically do not hold positions overnight for a variety of reasons, including most brokers have higher margin requirements for overnight trades, necessitating additional capital; a stock can gap down or up on overnight news, resulting in a large trading loss; and holding a loss-making position overnight in the hope that part or all of the losses can be recouped may violate the trader's core day-trading philosophy.

Day Trading's Best Securities

To begin, you must pick what types of securities you will buy and sell. Bonds, options, futures, commodities, and currencies may all be day traded, but stocks are among the most popular for a successful day trader since the market is large and busy, and fees are minimal or nonexistent.

The greatest day trading stocks often have the following characteristics:

Good volume

Stocks are popular among day traders because they are liquid, which means they can be traded often and in large volumes. Liquidity enables a trader to buy and sell without significantly impacting the price. Currency markets are likewise very liquid.

Day Trading Tools You Need

What you'll need to get started with day trading:

- Online Broker

- Scanners

- Charting Platform

When Looking For A Broker, There Are A Few Factors To Consider:

Trade Execution

Some successful traders have certain requirements for their brokers. The most critical factor is execution speed. A matter of seconds may be the difference between catching and missing a breakaway. As a result, professional day traders want a broker that offers direct market access (DMA).

You may be wondering, 'Don't all brokers provide direct market access?' No. Most online brokers serve as a go-between for the market and your order. When they sell your order flow, they route it to the market on your behalf, often merging your order with other customers' requests and giving precedence to some routes over others.

To eliminate through the middlemen, you'll need a broker who offers DMA. This way, if there is a bid or ask that you want to trade with, you can just grab that liquidity immediately rather than hope the stock trades at your price long enough for your broker to complete the order.

Lightspeed Trading is one example of a broker that provides direct market access.

Commissions

Because day traders trade so often, fees might be the difference between a lucrative and a losing month.

When it comes to day trading brokers, there are two price systems to choose from: per-share and per-trade. The option you choose is determined on the size of your position. The smaller the company, the more sense a per-share structure makes, and vice versa.

Per-Share:

Day trading brokers and proprietary trading businesses like the per-share structure. The typical per-share rate paid to the least capitalized retail traders is $0.005 per traded share.

Some businesses have a $5.00 minimum, which contradicts the point of the structure for a trader with less funds.

Per-Trade:

This is the industry's most prevalent commission structure. You just pay a fee (usually approximately $5.00) for each trade you make. A $5 fee each transaction becomes essentially nothing after you reach a certain average position size.

Quick Note: It's important to recognize that just because a broker has lower commissions doesn't mean they're a superior alternative. Some brokers are compensated for steering their order flow to certain market makers, which may result in longer wait times and lower fill costs. That is why, as previously said, it is critical that they have direct market access.

Stock Scanner

There is a significant distinction between a stock scanner and a stock screener:

Stock scanners continuously scan the market and transmit real-time data.

Stock screeners essentially scan the market for criteria and provide a static list of stocks, generally with data from the previous day.

Most day traders, particularly those who trade on extremely short time periods, need a decent stock scanner. Most scanners can scan on timeframes as short as ticks and as long as weeks, all while updating data in real time.

What is the purpose of a stock scanner? Because you need to trade the appropriate stocks, scanners are essential. Stocks that are moving on high relative volume as a result of some form of catalyst. We refer to them as 'stocks in play.'

In-play stocks are more likely to follow through on breakouts and trend in a definite direction throughout the day.

This raises their predictability and boosts your chances of making winning deals. There are other scanner programs available, but Trade-Ideas is a favorite. Their scanners are completely configurable and quite dependable.

Charting Platform

Having a solid and dependable charting platform is beneficial for seeing price activity and making trading choices. Unfortunately, many brokers' charting tools do not match the needs of active traders, thus they rely on third-party charting software.

eSignal is a sophisticated and complete day trading charting software on the market that is a good option.

How To Start Day Trading

Once you've mastered a strategy and are successfully trading it on a simulator, you may start trading in a real account.

Here are the steps you must take:

Open a brokerage account and deposit funds.

Have a written trading strategy that you can go through every morning.

Make your watchlist first thing in the morning.

Make a plan and stick to it.

At the end of the day, go through your trades.

Taking it slow is one of the most important pieces of advice we can provide novice traders in a real account.

Don't go in headfirst and trade for maximum size. Take it slowly at first until you feel at ease.

Trade on a real account adds a lot more emotion and pressure to your trading, which will diminish as you acquire expertise.

After all, you don't want to blow up your account and lose all your money on the first day!

How Much Capital Is Needed In Day Trading?

The amount of money you need is determined by whether you intend to make day trading your full-time income or simply a side business to generate a few extra bucks here and there.

Someone opened a modest account with $500 and grew it to over a million dollars in only two years.

That is an extreme case, and most traders, even experienced ones, would struggle to replicate such a return.

My argument is that you don't need a lot of money to begin day trading.

However, while determining how much money you need, you must ask yourself two questions:

How much do you hope to earn every day?

How much money do you have to begin day trading with?

We just need to complete some simple mathematics once we get the answers to those questions.

Assume you want to earn $100 every day but only have $1,000 to invest in your day trading account.

That implies that if you trade stock for $2.00 a share, you can buy 500 shares, which means the price must rise 20 cents in your favor to meet your $100 objective.

This is an extremely simplistic example since we didn't account for margin, which would give you greater purchasing power.

How Much Do Day Traders Get Paid?

This is a wide topic since many various factors come into play, such as the amount of funds you trade with, your skill level, market circumstances, and so on.

Highly expert traders may earn seven figures per year, while novice profitable traders can earn $200-$500 per day.

The markets are open around 253 days per year, which equates to $50,600 per year if you average $200 every day. That's not awful!

If you make $500 every day, you'll make $126,500 in a year!

Conclusion

Despite the fact that day trading has become somewhat controversial, it may be a profitable way to earn a living. Day traders, both institutional day traders and retail day traders, play a vital role in the market by keeping it efficient and liquid. While the day trading journey is still popular among newcomers, it should be reserved largely for individuals with the necessary expertise, resources, and trading platform.

But, when it comes to building a business, you have plenty of options. And even if you're dead set on becoming a day trader, you've got way better options than day trading.

Keep in mind, we don't get paid to promote any of the programs we review. We personally think day trading is a great business model, but you could end up leaving way too much money on the table.

Are There Alternatives To Day Trading

Yes, there are plenty of other business models to choose from if you want to pursue this making money online. Here are just a few:

What Is My Top Recommendation For Making Money Online In 2024?

Our review team has spent months researching, reviewing, and vetting dozens of business models and thousands of programs.

While there may be no “perfect business”, the research IS conclusive:

Digital Leasing is the #1 online business model for those just starting out.

Whether you’ve never made a dollar online, or you’ve been in this space for a while but never really “made it,” Digital Leasing is for you.

Why?

1. It’s Flexible: got an hour a day? You can do this. Ready to drop everything else and dive in full time? You can do this. Yes, the more time you put in, the faster you see results. But even with a little time each day, you can move the needle in a Digital Leasing business.

And because this system is so flexible, you don’t have to constantly be working to make more money. It’s called PASSIVE INCOME because if you stop working, the money doesn’t.

Imagine taking 3 months off to just tour around Europe, rent a cabin in the woods to write a book, hike the Appalachian Trail, or live on the beach and surf all day.

This is only possible if you have an income stream that’s not tied to your time.

2. You Own & Control EVERYTHING: With anything in the financial markets, you own and control NOTHING. You have no say in price fluctuations, demand, or what the market will do.

Trying to beat the market is fighting against the tide. There’s just too much working against you, no matter how many supercomputers or rocket scientists are on your side.

With Digital Leasing, you own the assets, which means you have all the power and all the control.

3. Little To No Startup Costs: It’s possible to get into Digital Leasing with zero dollars upfront.

Because, using the strategies outlined in this program, you can get a client to pay you BEFORE spending a penny out of your own pocket...even before you do any work.

Even without getting paid in advance, you can have your first Digital Rental Property up, running, and generating profits for less than $100.

4. Easy To Duplicate: Ok, here’s the best part: once you have your first Digital Rental Property up and running, you can literally DOUBLE your income with a few clicks, a couple keystrokes, and a single phone call (and you don’t actually need the phone call).

Remember: each Digital Rental Property is worth $500 to $2,000 a month in semi-passive income (over 95% profit). Every time you decide to create another one and increase your income, it gets easier.

Because you have more knowledge, more experience, more results, and more momentum.

If you wanted to double your income with any kind of trading or investing, you’d have to double your initial capital OR double the average order size of your existing trades. And, guaranteed that’s a lot harder than a few clicks and a few minutes of your life.

5. Make Money Helping Real People: This part is what makes it all worth it. In the financial markets, you might be helping your family, but the impact never goes beyond you and maybe a few others.

But with Digital Leasing, you’re actually helping people by solving your clients’ biggest problem:

Small, local businesses need more customers, and with Digital Leasing, you are unleashing a flood of happy, paying customers for these businesses.

You make money by helping them make money.

Not a big, faceless corporation either...a small business owner who’s using that money to put food on the table for their family, start a college fund for their kids, or take care of a sick parent.

Once you see how Digital Leasing makes a real impact in the lives of real people, you’ll sleep like a baby with a big smile on your face.

Now, the choice is yours. You could continue browsing, looking at opportunities like day trading which could one day make you money.

You could continue researching, never making a decision.

OR, you could take a look inside, consider what you really want, and join a program that makes your dreams a reality. At the same time, joining a community of over 2,000 successful students that are living life on their own terms thanks to Digital Leasing.

A consistent, reliable, semi-passive stream of income that doesn’t depend on you or your time to keep producing profits.

All while genuinely helping real people who are grateful and happy to pay for it.

If this sounds more like what you want out of life (or if you just want some nice side income), click here to learn more about Digital Leasing.

#1 Business Recommendation

We each make around $10,000 per month with the help of this system.

yes, show me more