Credit Strong Review (2024 Update): 7 Secrets You Should Know About Credit Builder Loans!

![Credit Strong Review ([year] Update): 7 Secrets You Should Know About Credit Builder Loans!](/_next/image/?url=https%3A%2F%2Fcolorful-action-2ff8f86b45.media.strapiapp.com%2FCredit_Strong_Review_jpg_97e0583a7e.webp&w=1920&q=80)

If you're looking for credit builder loans you should check out Credit Strong! They offer a quick sign up and penalty free cancellation!

They have allowed many different people to sleep easier at night with their approach to credit builder loans. Credit Strong lends a helping hand to anyone that needs it whether you have bad credit or no credit at all!

The chief aim of Credit Strong is to give people an affordable and clear solution to improving their credit scores and growing their savings account.

Now, I do want to be totally up front in this review, so...

The mission of Credit Strong is great and the opportunities they provide for individuals to build their credit are some of the best in the market.

In this full review we'll tackle anything and everything related to Credit Strong and their credit builder loans...the good, the bad, and the ugly!

DISCLAIMER:

This Credit Strong review has been thoroughly researched with information and testimonials that are available to anyone in the public. Any conclusions drawn by myself are opinions.

Helps build credit

Returns cash at the end of the term

Decent interest rate

The loan you get back in cash does not include interest

Hurts your score if you make a late payment

Has a net expense

Why Listen To Us

My name is Josiah, and this is my Dad, Joel.

I built that site in 2020, and it still makes me $1,500 per month. It’s a basic 5 page website I built based on a template the program provides.

The best part to me? My dad and I get to do it all together!

So between the:

Ease of reaching $5-$10K per month in income online

Straightforward-ness of the system to do it

Fact that I get to do it w/ my family

Is why I recommend local lead generation as my #1 business model for making money online.

Sure, it takes some work and dedication – but anyone that tells you that there’s a business out there that requires no work is selling you a lemon.

I’m not saying you need to sign up for the same program I did, but I would definitely recommend giving the business model a peek!

What Is Credit Strong?

This is a short description from the company itself:

"A Credit Strong account is the first fusion of credit building and an FDIC insured savings account available nationwide. Credit Strong allows you to grow your savings as you build credit, instead of spending on purchases with a credit card or making a large upfront deposit for a credit builder loan."

On the surface it appears the company will be helpful to many different people, we shall see if that's the case later on...

Who Owns Credit Strong? Austin Capital Bank

Founded in 2006, Credit Strong is a division of Austin Capital Bank. Austin Capital Bank is located in Austin, Texas and have a 5-star rating with the FDIC insured Texas State Savings Bank.

Full In-Depth Credit Strong Review

In the deep dive we are going to cover the many different facets of Credit Strong and when the three credit bureaus get involved. We are going to look this division of Austin Capital up and down, giving you a full unbias, unaffiliated review!

Where Is The Credit Strong Service Available?

Credit Strong is available in 47 states. It is not available in Wisconsin, North Carolina, and Vermont. Wisconsin requires you to have spousal support which cannot be authenticated in their online process. In North Carolina there is a legal struggle excluding the military so they decided to not offer to everyone altogether until the military issue can be solved. In Vermont, deposit secured consumer lending is illegal.

Credit Strong Features

Loan Amounts: $1,000 to $18,000

APR: 5.83% to 14.89%

Terms: 12 Months to 10 Years

Administration Fees: $8.95 to $25

Early Termination Fee: None

Prepayment Penalty: None

Credit Check Required: No

Availability: Available in all states except:

North Carolina

Wisconsin

Vermont

Minimum Income Requirement: None

Reports to Credit Bureaus: Yes, Experian, Equifax, and TransUnion

Customer Service Number: 1-833-850-0850

Customer Service Hours: Mon–Fri 8 AM to 5 PM (CST)

Mobile App Availability: None

FDIC Certificate: 58082

Promotions: None

Is Credit Strong Legitimate?

Credit Strong is a good solution for anyone who wants to build credit. Their approval process for a credit line without a credit check is easy and the lions share of your "loan" payments eventually become cash in your pocket.

Don't just hop into this because they seem to be doing ok...always do your research and look at what other competitors may have to offer.

Don't expect to make money though...even though your savings account may look like its gaining interest...the overall loan fees will turn that into a net expense.

Does Credit Strong Do A Hard Pull?

Nope! No worries here!

When you apply for a Credit Strong account, a hard credit inquiry isn't made which means your credit score is safe!

Are There Any Fees?

Yes, Credit Strong currently has seven plans. The fees and interest rates for each are detailed in the table below:

Unfortunately there are fees. According to the list below you will notice Credit Strong has 7 different plans. You can see all their plans, fees, interest rates and terms associated below.

Subscribe 1,000

$15 per month

13.50%

10 years

Subscribe 2,500

$15 per month

7.75%

10 years

Build & Save 1,000

$8.95 per month

14.04%

12 months

Build & Save 1,000

$8.95 per month

14.89%

24 months

Build & Save 2,000

$8.95 per month

14.43%

24 months

MAGNUM® 4,500

$25 per month

5.92%

10 years

MAGNUM® 9,000

$25 per month

5.86%

10 years

MAGNUM® 18,000

$25 per month

5.83%

10 years

How Do I Open An Account?

You can visit their website to open an account. It will take roughly 5 minutes to complete the application and you can rest assured your credit won't be affected since Credit Strong does not pull on your credit. To qualify however you need a checking account, debit card, or even a prepaid card that is in good standing for you to actually qualify.

Can I Cancel Credit Strong?

Yes! You can cancel at anytime without worry of prepayment or a termination fee!

When Does Credit Strong Report To Credit Bureaus?

Your credit report will appear on your account somewhere in-between 30-60 days after your first payment. Although they provide the credit bureaus your payment history...it can still take time for them to process that info and apply it to your credit history report.

With this process of monthly payments and the three credit bureaus consistently updating your info, you'll find that it was easy to build your credit.

How To Get Started With Credit Strong

Interested in seeing what Credit Strong can do for you? Here's how to start!

What Are The Eligibility Requirements?

The first thing you need to do is make sure you're eligible for a Credit Strong account.

Here’s what you’ll need:

- Be a US citizen

- At least 18 years old or older

- Valid Social Security Number or ITIN (Individual Taxpayer Identification Number)

- Phone number and email

- Bank account or prepaid / debit card

Credit Strong shines when it comes to requirements...they don't require a minimum income as well!

Credit Strong Application Process

The Credit Strong application is quick and straightforward, needing only 5 minutes of your time to complete.

- To apply, go to the Credit Strong website and click the apply now tab.

- It will walk you through their product selector to help find the best option for you based on your financial goals.

Upon completion of filling out the application, Credit Strong will use a database of past bank records to determine whether or not you should be accepted.

To be clear...they do not run a credit check for that process.

When you are approved...you can start making the credit building payments ASAP!

Does Credit Strong Care About Your Credit Score?

They don't care about your credit score in the slightest. Whether you have little credit, bad credit, or no credit it doesn't matter. Your credit score is not one of the deciding factors for this.

Not A Credit Repair Service

It is worth noting that Credit Strong isn't a credit repair service. A credit repair service helps remove negative marks on someone's credit report. Credit Strong doesn't do credit repair...all they do is provide the payment history of the customer to the three credit bureaus.

If you have good credit management, reporting can help your score increase...but if you miss payments on your credit installment loans with your credit builder accounts...it can work against you.

Credit Strong will report these missed payments to the bureaus and posts will be made on the report about it. Not making timely payments can decrease your credit score. You should treat Credit Strong like you do with other creditors, even though they aren't a credit card issuer.

Credit Strong: Is It A Good Option For Credit Builder Loans?

A high credit score can get you in almost anywhere...but a low credit score...not so much. When you want to build your credit, it can seem as though there aren't many options...

That's where Credit Strong makes an introduction...

If you are looking to build credit, then Credit Strong offers the ability to improve your credit profile with 7 different plan. You are also able to cancel at any time without payment penalties.

Take action today in order to see results as soon as possible.

See how they can help you today!

Customer Reviews

Many customers have given Credit Strong 5 star reviews, explaining their progress with loans and how it increased the credit score by many points in just 30 days.

FAQ'S

What Is The Fastest Way To Build Credit?

Here are a few of the tips we recommend for building credit fast:

- Pay your bills on time

- Make frequent payments

- Ask for higher credit limits

- Dispute credit report errors

- Become an authorized user

- Use a secured credit card

- Keep credit cards open

- Mix it up.

Which Card Builds Credit Faster?

The Discover It card is always a favorite among the people along with the Capital One Mastercard.

What Credit Card Is Best For Bad Credit?

There are few different cards that are very popular among people today, they are:

- Discover It

- Credit One

- Capital One

- Citi

What Are The Three Major Credit Bureaus?

The three major credit bureaus are Equifax, Experian, and TransUnion.

How Can I Make My Credit Score Increase?

One of the best ways to make your credit score increase is to make sure and keep your balance low on your cards, make the monthly payment on time.

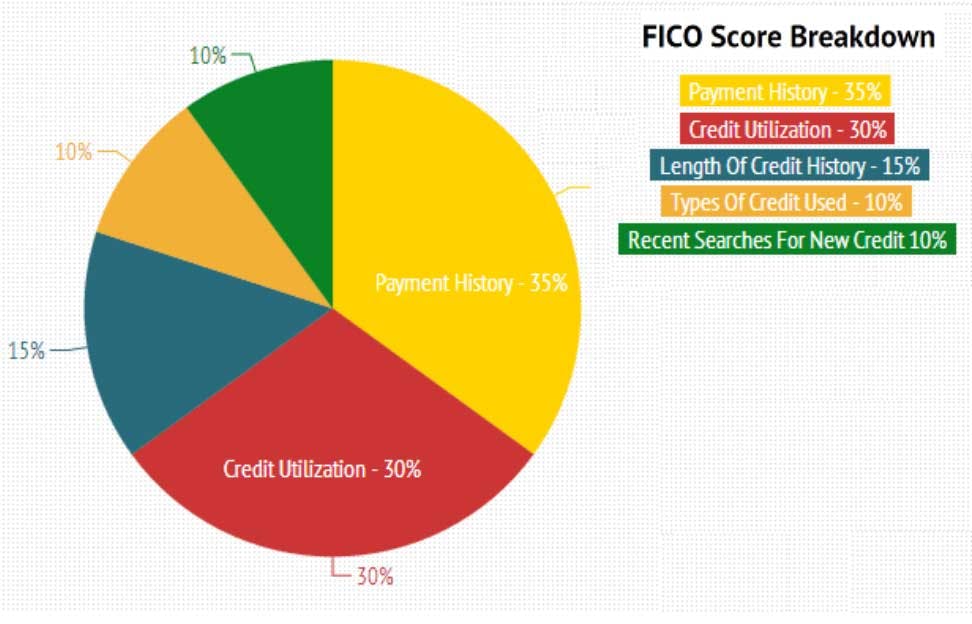

How Are FICO Scores Calculated?

A FICO score is calculated by using many different pieces of your credit data from your report and credit history. It is grouped into 5 categories: payment history, amounts owed, length of credit history, new credit, and credit mix.

By paying back your "loans" with Credit Strong on time, your credit score points will increase.

What Is Scam Risk's #1 Recommended Way To Make Money In 2024?

Wouldn't it be nice to never be pigeon held to a credit card issuer again?

What about having a bank account so big, you never have to worry about a FICO score getting in your way from buying the house you want?

Our team at Scam Risk has come across a program that can help you achieve that.

Digital Leasing

Or Lead Generation as some people like to call it is one of the most scalable ways to build wealth in 2021

The physical real estate market is hard to enter, especially considering the level of difficulty we're seeing in the market exiting this year.

However Digital Leasing is much easier and cheaper to enter.

All you have to do is build a website, rank it on page one, and pass off the calls it generates to a business owner in town.

As you can imagine, when you are the top result on google...you will get the lions share of the calls.

But how do you make money with this you're wondering?

How Can You Make Money?

It's pretty simple actually...

Each of these jobs have a monetary value associated with them...it's actually how home advisor turned into a multi million dollar business.

But businesses hate home advisor right?

Yeah...and we aren't saying you have to be home advisor either...you can be better.

Picture it like becoming exclusive partners with the business owner...you send him the work and he does the job.

Owners all over the service industry could use more work, they're just looking for people they can trust!

By giving them the lead only and not passing it off to anyone else, you can really separate yourself from the likes of home advisor.

So now for some money talk...how much

Let's use roofing for example...

The average roof replacement costs about $10,000 and roofers are known to pay a referral fee of about 10-20%...

If you had a roofing website locally that got 5 jobs coming in per month...you're looking at adding $50,000 to their bottom line!

They'd have no problem throwing 5k your way each month for it.

But did you see what you did there? You just built out an digital asset for super cheap...but are collecting high ticket levels of real estate rent!

But you're worried you cant do it because you don't know how to build a site...let alone rank it...

Don't worry, we got you.

Where To Learn

Our team at Scam Risk searched far and wide for program that teaches this business model exactly and isn't taught by one of those Scammy Gurus, believe us when we say...there's a lot of those out there.

But this course the real deal.

They walk you through the process step by and step from start to finish.

On top of that...they have live calls twice a week where you can hang out and get any questions you may have answered.

Further they even have a Facebook group they give you access to that is active 24/7. This is extremely helpful and it's a great way to connect with those who are likeminded.

They take no man left behind very seriously.

With our review pass, we've seen a student go from struggling to 15k a month in just 90 days!

If Digital Leasing, passive income, and financial freedom sound like something you'd be interested in... check it out here to learn more!

#1 Business Recommendation

We each make around $10,000 per month with the help of this system.

yes, show me more