Credit Associates Reviews (2024 Update): Another Credit Help Scam?

![Credit Associates Reviews ([year] Update): Another Credit Help Scam?](/_next/image/?url=https%3A%2F%2Fcolorful-action-2ff8f86b45.media.strapiapp.com%2FCredit_Associates_Reviews_1_jpg_3248ffdf49.webp&w=1920&q=80)

Credit Associates Reviews

Well, ya blew it!

All that debt has finally come to a head, and you've gotta file from bankruptcy...game over, right?

According to Credit Associates, there may be hope after all.

While bankruptcy can set your credit back for over a decade, and debt consolidation is a hassle, these guys say that they'll do their best to "rip the band-aid" as efficiently as possible.

When all is said and done, I’ll answer some of the most frequently asked questions regarding Credit Associates and Debt Relief in general.

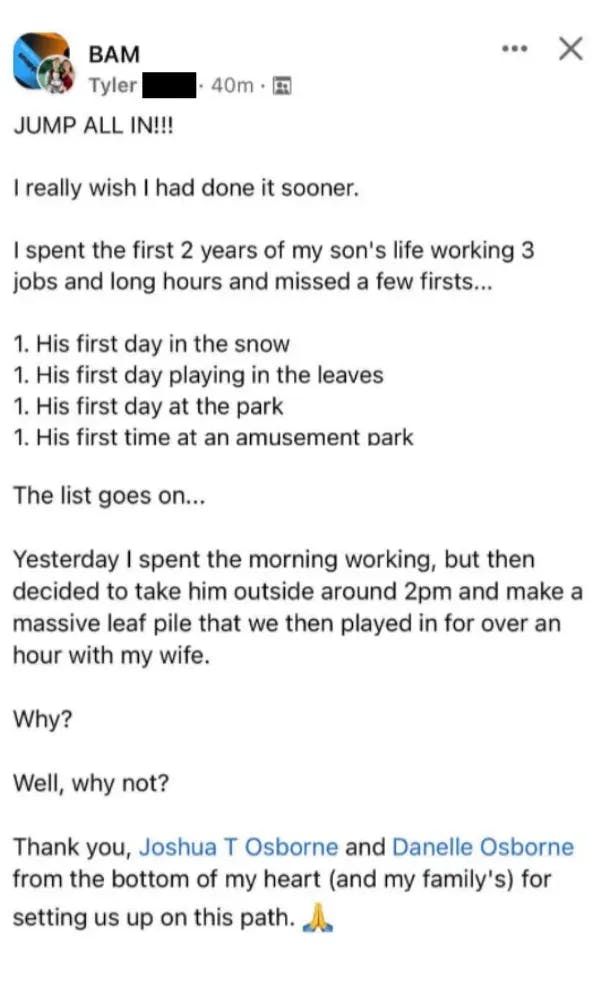

And most important, I’ll show you the exact system I used to build my own internet marketing business to over $40,000 a month in mostly passive income.

What's the best recipe for staying out of debt? Income. What's the best kind of income? Passive income, where you have more free time in addition to your newfound financial freedom.

But first, let's dig more into this company and their debt relief services.

DISCLAIMER:

This Credit Associates review has been thoroughly researched with information and testimonials that are available to anyone in the public. Any conclusions drawn by myself are opinions.

Appears to help many people reduce or clear their debt

Avoids bankruptcy

Seem to do what they claim to do

People often complain about their customer service responsiveness

Your credit will still suffer tremendously

May be similar in credit damage to bankruptcy, but more costly

Why Listen To Us

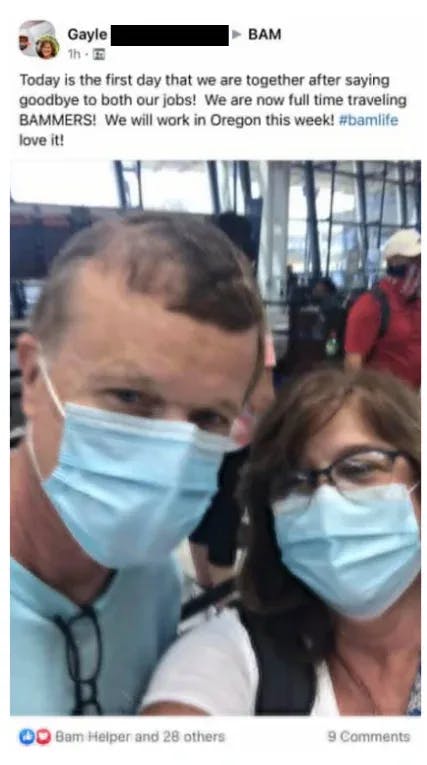

My name is Josiah, and this is my Dad, Joel.

I built that site in 2020, and it still makes me $1,500 per month. It’s a basic 5 page website I built based on a template the program provides.

The best part to me? My dad and I get to do it all together!

So between the:

Ease of reaching $5-$10K per month in income online

Straightforward-ness of the system to do it

Fact that I get to do it w/ my family

Is why I recommend local lead generation as my #1 business model for making money online.

Sure, it takes some work and dedication – but anyone that tells you that there’s a business out there that requires no work is selling you a lemon.

I’m not saying you need to sign up for the same program I did, but I would definitely recommend giving the business model a peek!

This economy already has people worried for their wallet – whether it’s the price of groceries, used cars skyrocketing in value, or being priced out of homes (with a potential impending collapse), financial uncertainty is aplenty.

This goes double for people trapped in debt.

So what’s the answer?

Everyone knows you can't turn a life of debt around in one day.…but we also have to build a life for ourselves. Luckily, I did stumble onto something the other day that I’m going to let you in on when we’re done talking about Credit Associates.

Credit Associates Review 2024

Credit Associates is a reputable and established debt relief company. It works a debt settlement program in forty-two states and has been in business since 2007.

The debt settlement company a part of the American Fair Credit Council, whose members promise to follow a code of conduct in the industry. They negotiate unsecured debts, including credit card debt, medical debt, and personal loans.

Credit Associates: Key features

-

- Plenty of experience and tested debt negotiation group.

- Good Customer Reviews

- Can track progress with an online bank account.

- Lack of transparency on their site: Unclear info regarding actual fees and minimum debt.

Program Length: 24 – 36 months

Customer-Care Hours: Monday – Friday: 8:00am – 8:00pm Saturday: 9:30 AM – 3:00 PM

Coverage: 41 states. Not in New Jersey, Vermont, Ohio, Maryland, Minnesota, Georgia, Connecticut, Colorado, and Wyoming.

Accreditation: American Fair Credit Council Accredited Member

Credit Associates: other Features

Established company: Credit Associates runs a debt settlement program in forty-one states and has been in business since 2007.

Short program: Credit Associates’ debt settlement program is built around a 24 to 36 monthly payment plan. This is an intense system and demands you create a monthly cash flow to negotiate your debt quickly.

A wide selection of unsecured debt: Apparently, Credit Associates has a minimum enrollment of approximately $10,000. They are experts in credit card debt, business debt, and medical/hospital bills. But, like some other debt settlement businesses, they don’t negotiate secured debt like mortgages, car loans.

Several business accreditations: Credit Associates is an accredited person in the business team, The American Fair Credit Council (AFCC) accredits Credit Associates. They include the International Association of Professional Debt Arbitrators (IAPDA) logo; however, the IAPDA doesn’t have Credit Associates being a service member.

Free consultation: They provide a totally free debt consultation plan to discuss your financial situation and discover if you’re a great fit for their program.

Zero upfront fees: Like other reputable debt settlement companies, Credit Associates doesn’t have any upfront costs.

Competitive fees and results: Credit Associates doesn’t provide disclaimers or info relating to their savings and fees. Their savings estimate calculator exhibits a sample effect with savings of approximately 35% of the original debt. However, they are aware that this is a standard example, as well as the outcomes may not relate to your unique situation or circumstances.

Essential Considerations: While not exclusive to Credit Associates, these are critical things to keep in mind when searching for a debt settlement company. Let me share several of the most often asked questions folks ask Credit Associates:

Does the program lower my credit score?

The Credit Associates debt settlement program isn’t based upon your credit score. Instead, they remember the quantity of harm “depends on your debt assessment if you enrolled in debt relief program.” Nevertheless, since you do not make payments to your creditors, expect a drop in your credit score.

Do I have to pay fees on unforgiven debt?

You have to report any forgiven debt of more than $600. In insolvency or bankruptcy, the IRS has specific rules that might exempt you from having to pay taxes. Always talk to an authorized tax preparer or perhaps a CPA about fees.

Will creditors sue me?

Credit Associates promises that “There is minimal possibility that any creditor can sue you.” Nevertheless, they do remember that there’s a good possibility that your creditors could continue collection endeavors on delinquent profiles.

Their actions can include telephone calls, collection letters, driving users to collection agencies, or filing a lawsuit. Don’t forget that Credit Associates doesn’t give legal representation in the event you’re sued.

Can I keep my credit cards?

You will have to stop using credit cards when you are enrolled in the debt settlement services program. At any rate, since you just stop making payments, creditors often shut off your accounts. Speak to your debt consultant about holding open at least one credit card for emergency consumption.

Credit Associates a debt relief company: Qualifying for a debt relief program

National Debt Relief features a debt settlement program to assist people with a hard time with their bills. Much like other debt relief companies, below are their essential requirements:

Financial hardship: Credit Associates depends on your certification that you’re in financial problems. They work together with you before and also during the system to substantiate the economic hardship of yours.

Behind in payments: To get a debt settlement program, you have to be a minimum of several months or more behind in your payments.

Ability to generate a payment amount: You have to make a monthly payment on the program. Credit Associates notes that this is a cost savings-oriented program. Rather than making payments to your creditors, you have to make monthly payments to a designated bank account in your title utilized to pay off your debts.

Sufficient debt to justify the program: Although they do not post a minimum obligation, it appears like Credit Associates calls for you to enroll a minimum of $10,000 in debt.

Credit Associates Debt Settlement Cost

Credit Associates doesn’t charge advance charges to use you. Instead, you spend the company just in case you recognize a debt settlement negotiated on your behalf. The price for services and your settlement fee is withdrawn from your Special Purpose Savings Account.

Credit Associates recommend talking to an economic advisor about taxes you might owe on the quantity of debt forgiven. Your circumstances might allow you to be qualified for exclusion or maybe exemption from fees on passive income.

Credit Associates Complaints

Credit Associates is a Consumer Affairs accredited brand & scores 4.5 out of five stars from clients. Many customers claim they received a complete explanation of the debt settlement plan and respectful treatment from its case workers.

However, several complained about getting unsolicited phone calls and mailers from Credit Associates. Meanwhile, others claim they cannot get a hold of their Credit Associates agent.

Would You Recommend Credit Associates?

Debt companies raise a lot of red flags, in my opinion.

Because of these red flags, I can’t fully recommend these guys to anyone.

That said, it’s worth mentioning that Credit Associates has already demonstrated some legitimacy, with numerous credentials. They're no con artist.

However, the first reason I do not recommend this company, of course, is the cost.

It seems bankruptcy may have similar credit damage, but with less of your income going toward the existing debt.

It is entirely possible to kill off your debt and rebound through a company like Credit Associates - but the most effective way will always be to increase your income substantially.

Is Credit Associates a scam?

So, is Credit Associates a scam?

Not technically – even if people online are saying otherwise.

You can rebuild your life with this program, but gaining good credit back is is definitely not as easy as they make it sound.

Now, there’s nothing wrong with front-loading the work and making the money later.

But if you're planning on your big financial comeback happening 10 years from now…that’s not a great deal, is it?

Reminds me of those God-forsaken MLMs many of us have experienced…all hype and no substance.

What if, instead, you could do that same work (in your spare time), and your reward was a $500 to $2,000 payment that came in every single month?

And what if you actually didn’t need to wait months or years? What if you could get started today and have your first payment in a week?

And what if you could double it next week?

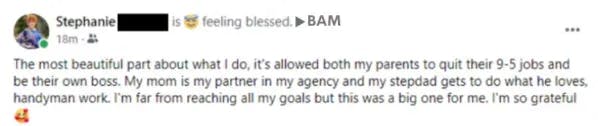

Well, that’s the power of Digital Leasing.

And you can legitimately do this from anywhere. It’s a true lifestyle business.

Your laptop and an internet connection are all you need.

Some of the most successful students in this program run their entire 6-figure businesses from:

- A camper in the middle of the woods

- A beach chair laid out on gorgeous white sands

- A small villa in the Mediterranean

These people are able to travel around, living their lives first, and focusing on their income second.

Because even if they stop working for an extended period of time, the money keeps coming in - so adventure, memories, and experience are the top priority.

And they never have to worry about how to pay for the next trip, or consider asking for time off.

If this sounds more like the type of life you want to lead, just click here to find out more about Digital Leasing.

Are There Alternatives To Debt Relief Services?

Yes, there are plenty of other business models to choose from if you want to find ways to escape debt. Here are just a few:

Credit Associates appears to be a decent debt services company. After all, the apparent purpose of removing debt is to increase your financial status.

However, something like this may not be necessary.

Suppose you’re an entrepreneur looking to make some passive income. In that case, there are already a plethora of online courses available that will teach you a new business model for working from home.

Furthermore, this program’s debt services are widely available elsewhere. And the best part is that some of them are either completely free or significantly less expensive than this system.

For the price of their service, it is far better to invest it in something that will allow you to actually make money. Something that teaches you a valuable skill.

Can I Make Money With Credit Associates?

Sure, I guess. Maybe one day.

But…

…there’s a lot that comes along with debt relief that many people struggle with.

Now, don’t get the wrong idea…

…it’s not impossible to rebuild via Credit Associates’ system, but if you’re gonna put in the amount of grueling work to do this (which, trust us, isn’t easy), you might as well bring in some REAL money while you’re learning the ropes.

The program that helped skyrocket many online businesses to over $40,000+ per month is so simple that making money really does become second nature.

What Is Our Top Recommendation For Making Money From Home In 2024?

Our review team has spent months researching, reviewing, and vetting dozens of business models and thousands of programs.

While there may be no “perfect business”, the research IS conclusive:

Digital Leasing is the #1 online business model for entrepreneurs.

Whether you’ve never made a dollar online, or you’ve been in this space for a while but never really “made it,” Digital Leasing is probably your best bet.

Why?

Frankly, I don’t think you can afford to make the wrong choice when it comes to your career in this day and age.

Have you seen inflation lately? You know, that thing where your money is worth less but your costs of living keep rising? You must find a way to overcome this strain on your financial life, and you can’t rely on others to do it for you.

“Relying on others to do it for you”…where have I heard that before?

Oh yeah, it’s Credit Associates' entire business model. Not good.

Whether you’re a man sick of living an average life, or a single mom seeking a new stream of income in order to stop the cycle of barely getting by…it seems clear to me that Digital Leasing is a great option to take control in today’s economy.

Let’s dig into the details:

1) It’s Flexible:

Got an hour a day? You can do this. Ready to drop everything else and dive in full time? You can do this.

Yes, the more time you put in, the faster you see results. But even with a little time each day, you can move the needle in a Digital Leasing business.

And because this system is so flexible, you don’t have to constantly be working to make more money. It’s called PASSIVE INCOME because if you stop working, the money doesn’t.

Imagine taking 3 months off to just tour around Europe, rent a cabin in the woods to write a book, hike the Appalachian Trail, or live on the beach and surf all day.

This is only possible if you have an income stream that’s not tied to your time.

2) You Own & Control EVERYTHING:

With debt, you don’t own anything. With Credit Associates you REALLY don’t own anything.

You don’t own the sales platform, you don’t own a brand, and you don’t own the customers.

So…are you comfortable trusting debt relief with your livelihood?

With Digital Leasing, you own the assets, which means you have all the power and all the control.

3) Little To No Startup Costs:

It’s possible to get into Digital Leasing with zero dollars upfront. Because, using the strategies outlined in this program, you can get a client to pay you BEFORE spending a penny out of your own pocket…even before you do any work.

That said, I’m not going to lie to you and say you’ll never have to put any work in. That’s a red flag. You don’t get anything for free in this life…however, you can absolutely put work in up front that frees up your time and lifestyle as you stack success.

That’s the life-hack to sitting back and watching money roll in.

Even without getting paid in advance, you can have your first Digital Rental Property up, running, and generating profits for a much more efficient investment than debt services – or even worse, taking out student loans.

4) No Wasted Time:

As mentioned above, spending tons of hours every day calling in to check on your accounts is a huge time commitment.

You'll need to spend years building yourself back up to some semblance of financial stability.

With Digital Leasing, a 100% online business, you're on the fast-track.

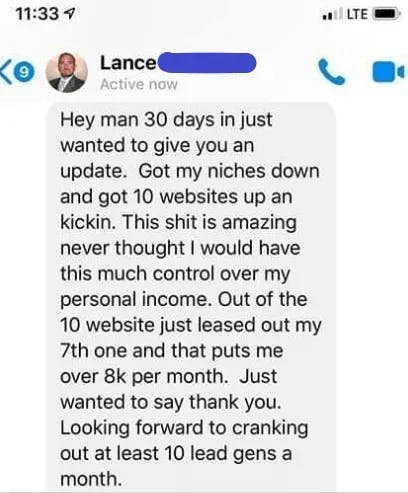

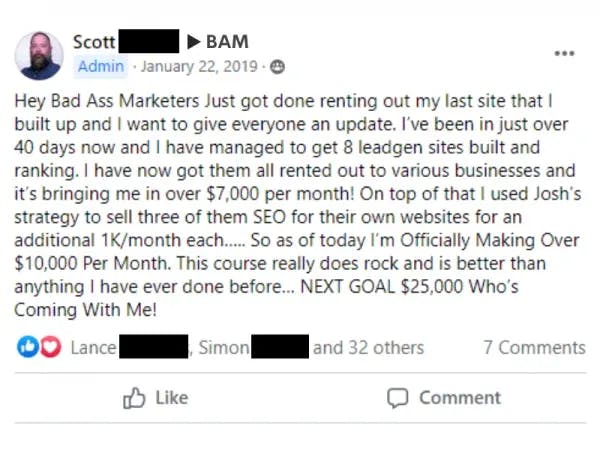

5) Easy To Duplicate:

Ok, here’s the best part: once you have your first Digital Rental Property up and running, you can literally DOUBLE your income with a few clicks, a couple keystrokes, and a single phone call.

Remember: each Digital Rental Property is worth $500 to $2,000 a month in semi-passive income (over 95% profit). Every time you decide to create another one and increase your income, it gets easier.

How does it get easier?

Because you have more knowledge, more experience, more results, and more momentum.

If you wanted to double your income while debt services is working with you, you’d have to double your time investment OR your profit margins. And it doesn’t take a rocket scientist to figure out that’s a lot harder than a few clicks and a few minutes of your life.

Is it all worth it. Credit Associates is a decent way to give yourself some temporary relief, but it doesn’t improve anyone else’s lives.

After all, there’s always someone else selling debt services. That might be fine in the short term, but in the long run you may feel like you’re missing a purpose.

Don’t even get me started on MLMs, where your friends and family become the product…I’m sure many of you reading have been through that sort of “bait and switch” nonsense before.

You know the type – they promise a living wage, then you’re only on commission for a sketchy product.

With Digital Leasing though, you’re actually helping people by solving your clients’ biggest problem:

Small, local businesses need more customers, and with Digital Leasing, you are unleashing a flood of happy, paying customers for these businesses.

You make money by helping them make money.

Not some big, faceless corporation either…a small business owner who’s using that money to put food on the table for their family, start a college fund for their kids, or take care of a sick parent.

Once you see how Digital Leasing makes a real impact in the lives of real people, you’ll see what I mean.

Now, the choice is yours. You could continue browsing, looking at desperation plays like Credit Associates which could one day make you money…

…you could continue researching, never making a decision…

OR, you could take a look inside, consider what you really want, and join a program that makes your dreams a reality.

At the same time, you’re joining a community of over 2,000 successful students that are living life on their own terms thanks to Digital Leasing.

A consistent, reliable, semi-passive stream of income that doesn’t depend on you or your time to keep producing profits? It’s as good as it sounds.

All while genuinely helping real people who are grateful and happy to pay for it.

If this sounds more like what you want out of life (or if you just want some nice side income), click here to learn more about Digital Leasing.

#1 Business Recommendation

We each make around $10,000 per month with the help of this system.

yes, show me more