How To Become A Real Estate Investor In 2024

![How To Become A Real Estate Investor In [year]](/_next/image/?url=https%3A%2F%2Fcolorful-action-2ff8f86b45.media.strapiapp.com%2FHow_To_Become_A_Real_Estate_Investor_jpg_a43db6a138.webp&w=1920&q=80)

How To Become A Real Estate Investor

You’ve probably found yourself wondering about this because you, just like others before you, thought that if you grew up, got good grades, and went to college…that you’d be set for life.

But once you got that job, you found out that 9-5’s are stressful, lack real freedom, and don’t pay you nearly enough…

So what other options do you have?

Even if you get a better job with higher pay…you’ll still run into the same issue of income scalability. Whether you like or not, your income is capped with a job.

And now that you know real estate investing is virtually limitless along with the income potential…you’re wondering if you really can get financially independent as a real estate investor.

So in this article, we’ll talk about whether real estate investing is the right online business for you.

At the end, I’ll answer some of the most frequently asked questions regarding real estate investing and the model in general.

And most important, I’ll show you the exact system I used to build my own internet marketing business to over $40,000 a month in mostly passive income.

This system made me swear off real estate investing for good, because it uses some of the same skills in a much more powerful and profitable way!

DISCLAIMER:

This How To Become A Real Estate Investor review has been thoroughly researched with information and testimonials that are available to anyone in the public. Any conclusions drawn by myself are opinions.

Why Listen To Us

My name is Josiah, and this is my Dad, Joel.

I built that site in 2020, and it still makes me $1,500 per month. It’s a basic 5 page website I built based on a template the program provides.

The best part to me? My dad and I get to do it all together!

So between the:

Ease of reaching $5-$10K per month in income online

Straightforward-ness of the system to do it

Fact that I get to do it w/ my family

Is why I recommend local lead generation as my #1 business model for making money online.

Sure, it takes some work and dedication – but anyone that tells you that there’s a business out there that requires no work is selling you a lemon.

I’m not saying you need to sign up for the same program I did, but I would definitely recommend giving the business model a peek!

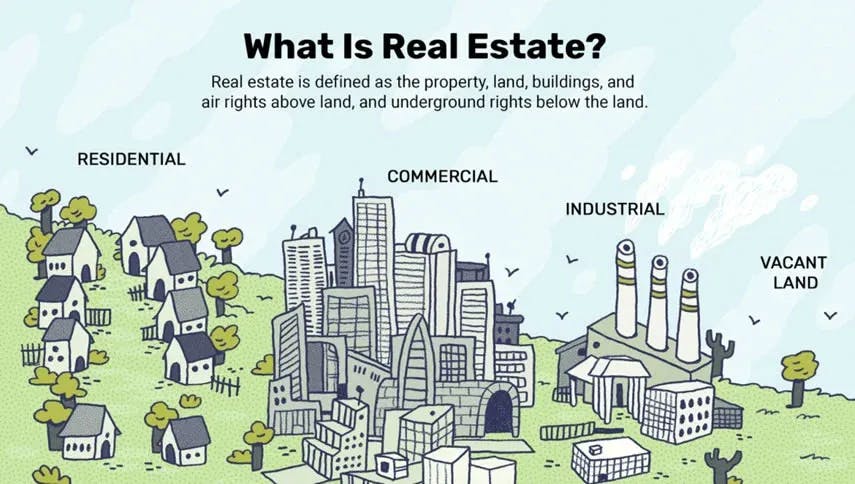

What Is Real Estate Investing?

Not to be confused with a real estate agent, Real Estate investing is one of the oldest independent wealth builders of all time. All it is, is simply buying an investment property for cash flow purposes.

Real Estate is actually one of the 5 basic classes for assets. In fact, investment advisors typically recommend having a portfolio with some part of it in real estate to make it balanced.

Real Estate investors typically have many unique benefits compared to other asset based classes. Just to name a few, you'll get tax advantages, dependable cash flow, and the potential for appreciation on the property. It's worth noting that if you hate taxes as much as we do, this is probably the one wealth building model that grants you so many tax advantages it might as well be a middle finger to uncle Sam.

Different Real Estate Investments

Generally speaking, most people don't get into real estate because it's cash intensive and requires a decent credit score. And while it most definitely is, there is a small chance you don't have to buy the house outright and put 20% down on the investment properties.

Others assume that by owning an investment property, that automatically makes them a land lord...Most people hate that idea and the sentiment that comes with it.

However, there are lots of other ways you can get invested into real estate if you're dead set on it! Throughout this article, we'll take a look at the 4 most common ways average joes like yourself become a real estate investor: real estate investment trusts (REIT's), house flipper, buying investment properties directly, and real estate development.

You can certainly make money with real estate investing, but if you're gonna put in the amount of grueling work to become a real estate investor (which, trust me, isn't easy), you might as well bring in some REAL money.

The program that helped skyrocket my online business to $40,000+ per month teaches some of the same real estate skills, but shows you how to monetize them in a much, MUCH more profitable way.

REITs

The first common way of real estate investing we'll talk about is an real estate investment trust. It's kind of similar to a mutual fund. Basically all you do with this one is buy a stock inside a real estate portfolio that is managed by real estate pros. Thanks to federal regulations, every REIT is required to give investors 90% of the profits.

You're also able to buy and sell these "stocks" whenever you want, which is great if you prefer to have the ability to liquify on a moments notice. However, the drawbacks are that returns are lower than a direct investment and you don't get the tax benefits like the other options.

Buy Rental Properties

Now this might be tough if you've still got student loans to pay off, but you can invest in real estate by directly buying rental properties. If you are bootstrapped for cash, the way most first time investors do it is by buying a small multi family home and renting out the basement or the other side.

It's a great option because it shows you on a smaller scale what being a land lord is like, while also getting some really good financing.

To put it in perspective, most real estate gurus teach you a that allows you to basically live there mortgage free!

But, this doesn't mean that you're limited to only residential property, in fact as a real estate investor, you can buy pretty much anything. Industrial space, warehouses, office space, retail, and anything else you can rent out for a cash flow profit.

Regardless of the type of real estate you purchase, buying rental property can be done either actively or passively. Owning and managing rental properties can be time intensive (active), but many investors outsource the day-to-day responsibilities to a third-party property manager (passive) to be freed of obligations like showing properties, running credit checks on prospective tenants, collecting rent checks, overseeing repairs and maintenance, etc.

No matter which real estate your purchase, you can choose an active or passive role. Managing all the properties can get time intensive and most people just outsource all the day to day responsibilities to management companies. Some of these responsibilities include:

- showing properties

- running credit score checks on prospective tenants

- collecting rent

- maintenance

Now that might sound great and all, but those services cost a pretty penny and can quickly cut into your profits for the month!

Our team at scam risk recommends a real estate model that doesn't require nearly as much OVERHEAD as this model does. CHECK IT OUT!

Flip Homes

Remember those shows your mom used to watch on TV throughout the day? Odds are it was a house flipping show! In fact, some argue that house flipping isn't really investing and more so a business.

All you have to do is buy the home cheap, fix it up, and sell it for a profit. Of course that's an oversimplification, but that's gist.

The turnover rate for house flipping is pretty fast in this market, typically 6-12 months, which means that free time is going to be few and far between.

Beginners typically do all the work themselves, and after they've saved a pretty penny from the first few properties, then they invest into a general contracting company to perform the work and free up their time.

It's a double edged sword because outsourcing can cut into your profits so it's something to be conscious of.

But why just continuously buy and flip homes when you could just build one for a few hundred bucks and get thousands out of it each month?

Sound crazy?

Check out Scam Risk's #1 Recommended Business Model Here!

Invest in Real Estate Development

Another common way to invest in real estate is through real estate development. Although there are many different options, the most common is when an investor buys up a vacant piece of land with plans to make it income producing.

Neighborhoods are perfect examples of this. A real estate developer will come in and buy a piece of property for say $1,000,000. He / she knows they can build 20 homes on that land for $500,000 each.

Do the math...

The only downside with this business model is that once the homes are all sold, the real estate developer has to move on to the next piece of property...there is no recurring income with this model.

If recurring income investment opportunities are what you're after, check out this business model instead!

Step By Step Guide On How To Become a Real Estate Investor

Step 1: Identify your source of funding

The first thing you'll need to do when investing in real estate is figuring out how you're going to acquire the capital you need to invest.

Most first timers use their savings account and then leverage the equity in that property to buy a second property.

Don't be too upset if you can't buy a house outright though...most investors just put 20-30% down and finance the rest through their rent payments...just like how the initial housing crisis happened in 2008!

Types of Real Estate Funding

Equity Financing

Real Estate development investment opportunities have general partners and limited partners who all together put the equity into the deal. A general partner will be more active in the decision making process while the limited partner typically takes a back seat. The equity of that deal is then paired with debt financing. The more equity, the better the rates.

Step 2: Create an Investment Strategy

As I hinted above, there are two different major investment strategies with real estate investors. You can either be ACTIVE or PASSIVE.

Active Investing

When choosing active real estate investing, you are an investor that is directly involved with every process. It's your time, your capital, and your risk involved. Simply put, you are involved in all the heavy lifting.

Active real estate investing examples would consist of wholesaling, property flipping, and development.

Passive Real Estate Investing

Passive real estate investing is the type of real estate investing most people want. It's mainly passive as the name implies. However, you have to be ok with your income growing a bit slower than the active options. This is also the option that typically has nice tax benefits.

Step 3: Identify your target market

Once you've figured out how you're gonna get the capital you need and what type of investing role you're going to take, it's time to pick you target market.

Investing in bigger cities is generally the safest approach because these markets tend to hold their value and even appreciate over time.

Most investors, especially those who have been beat out of primary markets, choose to invest in secondary and tertiary markets. Real estate in these markets tends to be cheaper, meaning the barriers to entry are lower. Yet real estate in secondary and tertiary markets tends to be more at risk for market swings, making it a bit more scary. With big risk comes the chance for higher profits, so investing in these markets may appeal to those with money to play with.

Step 4: Understand the Risks of Real Estate Investing

Investing in real estate may come with a fair share of benefits, but it's not bulletproof. Here's a short list of the risks you will assume upon entering a market:

- General Market Risk: A soft economy could lead to property values depreciating. Properties with high leverage could go underwater fast or even default on loans!

- Asset Level Risk: This is risk based on class, for example, shopping centers everywhere turn up vacant daily as more consumers have optioned to online shopping. Hotels are also a risk depending on consumer spending and travel patterns. Multifamily properties and industrial properties are usually a safe bet because they aren't prone to risk like that.

- Property Specific Risk: This is the risk one assumes with every property, think of it like it's miscellaneous. Water heater could go out, unusually high vacancy, and so on.

- Liquidity Risk: It's hard to liquify your real estate assets compared to stocks and cryptocurrency.

Is Real Estate Investing Right For You?

So after all that info, are you still wondering if real estate is right for you? Ask yourself some of these questions...

- Do you have a lot of time to invest? Real Estate will eat up a lot of it in one way or another...

- Do you like taking big risks? If you don't mind losing your own house, real estate could prove lucrative for you!

- Are you just looking to diversify your portfolio? If so this might be a good option for you after all!

What Is Our Top Recommendation For Making Money Online In 2024?

Where real estate falls short is in scalability. Because in order to make a good amount of money with real estate, you have to have several different properties.

And who has the capital for that right away?

But what if you went local?

With Local Lead Generation, you will be getting service requests from multiple sites at every minute of the day from people who are willing to pay a lot of money for what you can provide them.

I was watching a YouTube video once where the host made a comment that it isn’t about making a lot of money from one website… it’s about making a little bit of money from lots of different websites.

So, think of it this way….

What if you could have streams of investment income where you operated 10 rental units that you could charge anywhere from $750-1,000 per month?

That’s $7,500-10,000 per month in passive income!

What If You Invested Into 100 Rental Units?

But instead of spending $Millions to build houses or apartment complexes… you spend a couple hundred dollars to build websites.

You then get those websites ranked in the search engines for specific home-based services that customers are searching for.

Next, you offer your lead generation system to local business owners who are looking for customers and are willing to pay you for their information.

And Then…

BAM!

You’ve just created a Digital Leasing Investment Empire that is potentially earning you 4-5 figures in PASSIVE INCOME on a monthly basis without spending a single dime on ads.

With conventional Digital Leasing, you have to compete with thousands, if not millions of others who are selling the SAME product to the SAME customers.

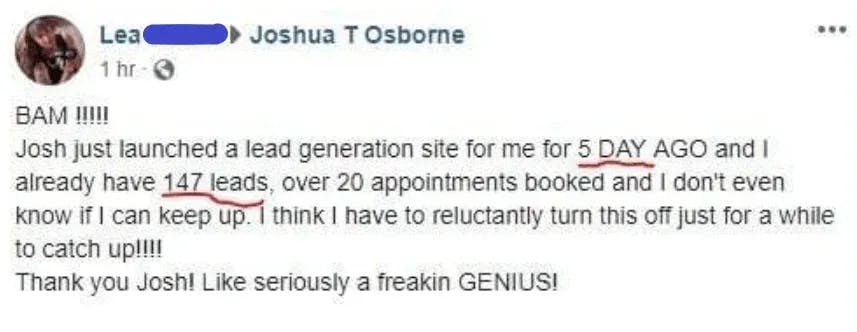

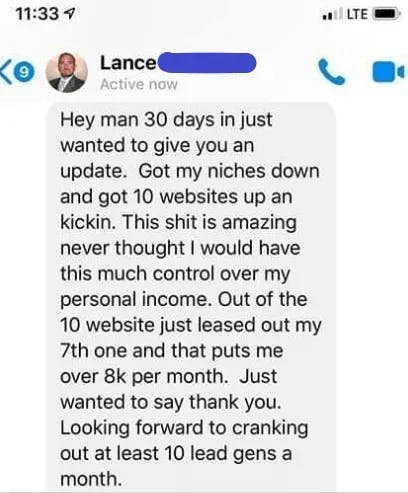

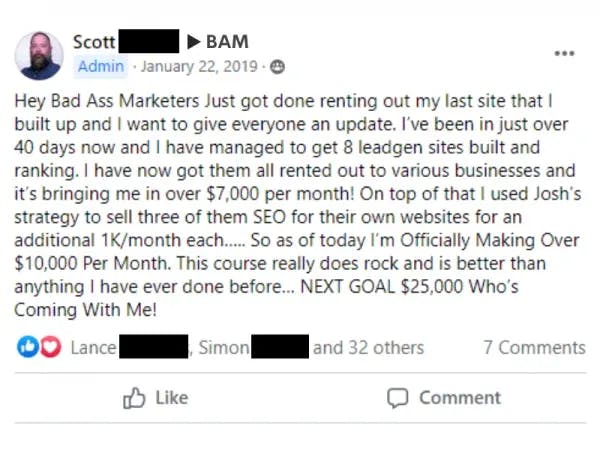

Once the training program is completed you will also have access to a Facebook group much better than any real estate group in our opinion. This group is much more active.

Unlike Real Estate, where you’re profiting maybe $250 per property, you could be getting 5-10X THAT.

With Local Lead Generation, the competition is virtually nothing and your profit margins are 85-90%.

Now, I could go on and on, but I’m sure you have tons of questions about how to create Digital Leasing assets and start building YOUR digital empire!

#1 Business Recommendation

We each make around $10,000 per month with the help of this system.

yes, show me more