AmOne Reviews (2024): Is AmOne Legit?

![AmOne Reviews ([year]): Is AmOne Legit?](/_next/image/?url=https%3A%2F%2Fcolorful-action-2ff8f86b45.media.strapiapp.com%2FAm_One_Reviews_jpg_d1d0574340.webp&w=1920&q=80)

Even if you're great at budgeting, you can still find yourself needing a loan at some point...whether it's an emergency or funding a startup small business. Regardless, it's always reassuring to know you have options.

The tough part is knowing who to trust in the world of online loans. There are several fake loan scams out there, how can you know the personal loan you're applying for is legit?

Thankfully, people like the ones at AmOne exist to help you weed through all the BS.

AmOne is a trustworthy and convenient lending service that can help you find the right loan for your specific financial situation. Using this platform, you’ll get access to several personal loan options without doing damage to your credit score.

AmOne is a lending service that can help you find the loan options you're looking for in a convenient manner.

Their platform simple and user friendly, giving you access to many different personal loan options given your financial situation without hurting anyone's credit scores.

Now for all the details in our AmOne review going through everything you could possibly want to know about the company!

DISCLAIMER:

This AmOne review has been thoroughly researched with information and testimonials that are available to anyone in the public. Any conclusions drawn by myself are opinions.

Quick lending process

Many different loan options

no hidden costs

Lack of transparency

Mixed consumers reviews

Some lender companies seem shady

Why Listen To Us

My name is Josiah, and this is my Dad, Joel.

I built that site in 2020, and it still makes me $1,500 per month. It’s a basic 5 page website I built based on a template the program provides.

The best part to me? My dad and I get to do it all together!

So between the:

Ease of reaching $5-$10K per month in income online

Straightforward-ness of the system to do it

Fact that I get to do it w/ my family

Is why I recommend local lead generation as my #1 business model for making money online.

Sure, it takes some work and dedication – but anyone that tells you that there’s a business out there that requires no work is selling you a lemon.

I’m not saying you need to sign up for the same program I did, but I would definitely recommend giving the business model a peek!

Even if you're great at budgeting, you can still find yourself needing a loan at some point...whether it's an emergency or funding a startup small business. Regardless, it's always reassuring to know you have options.

The tough part is knowing who to trust in the world of online loans. There are several fake loan scams out there, how can you know the personal loan you're applying for is legit?

Thankfully, people like the ones at AmOne exist to help you weed through all the BS.

AmOne is a trustworthy and convenient lending service that can help you find the right loan for your specific financial situation. Using this platform, you’ll get access to several personal loan options without doing damage to your credit score.

AmOne is a lending service that can help you find the loan options you're looking for in a convenient manner.

Their platform simple and user friendly, giving you access to many different personal loan options given your financial situation without hurting anyone's credit scores.

Now for all the details in our AmOne review going through everything you could possibly want to know about the company!

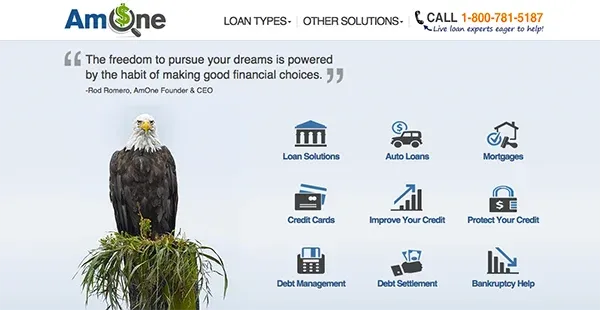

Overview: What Is AmOne?

AmOne and their employees are not loan providers, but instead connect you with their lending partners if you make it through the approval process.

Whether you are a small business owner or a consumer...

They give you different loan options from their lending partners, ranging between $100 and $10k. Normally you can't start a business off with less than $10k...but more on that later...

If you need a personal loan AmOne will walk you through their lenders different loan offers, loan provider, loan application process, pros cons, and loan term.

AmOne has a high level search process that helps you find the best loans offers and they even employ loan matching specialists with years of experience to help you make the best decision for a personal loan or small business loan.

Who Started AmOne Financial?

Rod Romero is the CEO of AmOne Financial and has been since January of 2000. He graduated from Florida State University with a BA in Finance and Marketing.

As the CEO of AmOne, Rod is responsible for the overall strategic direction of the company.

Always being a visionary, Rod used AmOne as a pioneer in the unsecured loan consulting industry. With his direction they were able to manage $15 Billion in unsecured loan approvals.

In 2008 Rod began to focus more on financial marketing which had the result of AmOne becoming one of the most trusted financial service providers in America today.

Each year his company helps over 1 million small business owners get matched with the best loan offers and credit solutions.

As of 2018 AmOne was acquired by Quinstreet Inc.

What Credit Bureau Does AmOne Use?

In the US, there are three different credit reporting agencies or credit bureaus that are considered the best. Instead of just using one over the others, AmOne uses all three.

The three credit bureaus that AmOne uses are Experian, Equifax, and TransUnion.

They all compile information a little differently, but they all focus on your personal financial information, develop a report and a credit score, that shows you loan and credit history and your rating as a borrower.

Creditors, stores, and lenders you work with will share this information to these credit bureaus. The personal information of yours that is shared to these different agencies are your name, address, employer info, amount of credit cards in your name, and more.

So in the case that you apply for a credit card for example, depending on the size of the creditor or merchant...your personal information may be reported to all three. There scoring models are all a little different so your credit report and ratings may higher or lower than each other.

Is Debt Consolidation A Good Idea?

At the end of the day debt consolidation is not a good idea. It is basically the combination of payday loans, credit cards, medical bills, etc (unsecured) that give the illusion of lower interest rates and monthly payments.

It promises one thing and delivers another...there's a reason that these programs are at the top of the FTC's complaint list!

Let's say best case scenario you do end up qualifying for a loan with a low interest rate, there is still no guarantee that the interest rates will stay low.

But come on, let's be real here...loans with rates like these aren't the problem...

Your spending habits are.

What Should I Do Instead Of Loans?

Instead of taking out more loans and seeking business loans at a rate that could really put you under...

What about starting a business that you'll never need loans for ever again?

But how is that possible?

Skip to the end of the review to find out!

What Do You Need To Know About AmOne Personal Loan?

Amone is a free service to any United States citizen that uses cutting edge tech to instantly match the requirements of the loan you want with the highest rating lenders all over the country.

The list of lenders is based on what they're willing to approve. This is not a lending site, but a network of peer to peer lenders.

Here Is A Summary Of What AmOne Offers:

Expected Loan Amount— The minimum is $100, and the maximum is $50,000

- Annual Percentage Rate — The minimum is 4.99 %, and the maximum is 35.99%

- Monthly Payment— Variable

- Loan Term— 24 to 84 months

- Types of interests— AmOne interest rates vary according to several factors on your side. It includes factors like your credit standing, annual income, loan amount, and outstanding loans

- Unsecured or Secured loan— unsecured

- Typical approval time— Varies based on lender

- Typical funding time— Can get funds just one day after approval

- Fees and Penalties:

Origination Fee— Depends on lender

Prepayment Penalty— Depends on lender

Late Payment Penalty— Depends on the lender

Returned Payment Fee— Not available

What Is AmOne Personal Loan Eligibility Criteria?

To be eligible for a loan with AmOne, you must fit within these requirements:

- 18 years or older.

- Must be a citizen or permanent resident of United States.

- No income threshold, however you must have a steady source of income.

AmOne Loan Requirements

If you do not meet even one of these requirements it will be nearly impossible for you to succeed in the approval process.

Although AmOne wants to offer solutions to all borrowers a lender won't give options for borrowers with a rating and credit report that is subpar.

If you want that new credit card, you're going to have deal with these requirements.

Does Your Credit Score Matter To AmOne?

Your credit score doesn't matter to AmOne per se...but it matters to the lenders that AmOne is partnered with.

How To Apply For A Personal Loan With AmOne?

How Much Does AmOne Cost?

Amone is a free service to borrowers that are looking for a loan from a trusted lender.

What Can I Use AmOne Loans For?

You can use a loan for personal or business use. The pros/cons for this definitely balances towards the pros...

It is always nice when borrowers aren't forced to use their money in a specific way by a different lending company.

What Makes AmOne Different From Other Lending Sites?

Through AmOne, you can apply for up to $10,000 in personal loans! However, you can also take a look at credit cards you might qualify for.

On top of that, they have a hotline in the US that will automatically connect you with a financial expert that can help determine the best loan provider for you!

Even further, AmOne personal loan service helps more the 1.5 million people every month.

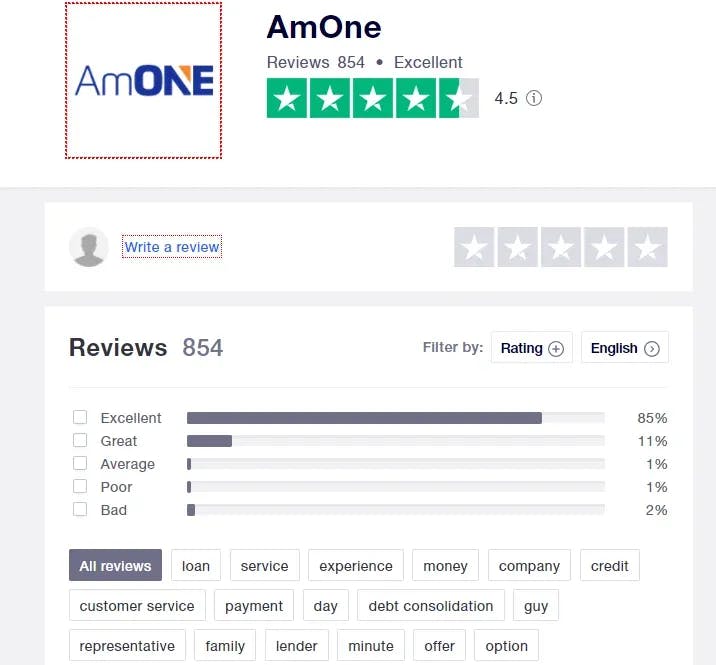

AmOne Customer Reviews

According to trust pilot, the customers give it a 4.5/5 stars. There are a few negative customer reviews that have been sprinkled throughout but they seem to have been taken care of promptly.

AmOne Reviews BBB

Of the 5 customer reviews listed on the BBB, they are all one star. That is a little discouraging to see.

AmOne is rated at a A+ and is not BBB accredited.

Is AmOne A Legitimate Company: Scam Risk Loan Experts?

Yes it is!

AmOne does not store personal info, so you don't have to worry about hackers getting your social security number, date of birth, and landing you in even more credit card debt.

Your details are only shared with a team of lending partners that you want to work with. This makes calls from telemarketers a thing of the past!

The application process provided by all companies involved is safe, secure, and confidential.

Never Worry About Loans Again!

Yep!

You read that right!

With this business model we're about to share, you'll never need a loan again!

And we'll show ya why!

Digital Leasing

Or Local lead generation depending on who you talk to is the ability to build a website, rank it, and send the leads off to service based businesses in town.

You see businesses need leads, especially during this lock down we're all under, if you can bring service based small businesses leads during this time...

It will be incredibly valuable to them.

Enough on that though...all you want to know about is the money right?

How Do I Make Money From This?

The way you make A LOT of money with Digital Leasing is by having many of the local websites ranked and bringing in leads.

But how profitable is it as a beginner?

Very.

A website like this doesn't take much time to build, maybe a few hours, and the cost to build and publish is dirt cheap...

Seriously.

We're talking $12 for a domain name and maybe $8 a month for hosting.

Hard to beat if you ask me...especially when you consider these sites are worth anywhere from...

$500-$1,000 a month!

I'm no math expert but that's got to be well over a 90% margin.

Sound too good to be true?

Let's break it down with some math.

Imagine you decide to build a tree service site...

The average tree service job ranges anywhere from $500-$2,000 and it's not uncommon for contractors to pay a 10-20% referral / finders fee.

And since you're at the top of page one on google, you're getting all the calls.

But let's say you picked a jacked up market and totally messed up, statistically speaking you'll still get at least 10 calls per month...

And if we do the math on that we'll find that you have an asset worth $500-$2,000 a month worst case scenario!

Now imagine if you had 10 of these bad boys!! You truly would be making enough money per month to never need a loan again.

But you're for getting one little thing my guy...I don't know how to rank let alone build a website!!

Don't worry we got you covered.

Where Do I Start?

Our review team at Scam Risk has searched high and low for online courses that teach this exact Digital Leasing model.

We have come across one course in particular that has hit all the marks on our checklist to not qualify as a scam!

This course walks you through how to do everything from building the site, ranking it, and even talking to the business owner who's life you're about to change.

On top of that, they have live group calls twice a week going over anything and everything you want to talk about.

They even have a Facebook group that's active 24/7 incase you have any questions that occur when they aren't live.

This has been the most active group of people we have come across and the results we saw from people were great!

One guy even made scaled up to $40k recurring in just 90 days!

For more info on this course and how you can get started and never need a loan again...

#1 Business Recommendation

We each make around $10,000 per month with the help of this system.

yes, show me more