AcreTrader Review (2024): Best Land Investment Platform?

![AcreTrader Review ([year]): Best Land Investment Platform?](/_next/image/?url=https%3A%2F%2Fcolorful-action-2ff8f86b45.media.strapiapp.com%2FAcre_Trader_Review_jpg_fdea7c6f6e.webp&w=1920&q=80)

Investing in real estate has always been a strong strategy to grow your money if you have the understanding.

There are numerous ways to get involved in investing in real estate, and a lot of individuals are drawn to one of these options in particular: farmland investing.

An investment like this can offer a really unique opportunity to diversify your portfolio, and also includes a lot of outstanding attributes. But one issue stands in our way: Assessing good farmland is a rare ability that most of us lack, and it's really expensive.

Until recently, there was no option for people to invest in agricultural real estate without any knowledge or at a reduced price, but AcreTrader offers a platform that does both.

AcreTrader is a real estate investment platform that's quite unique, but it's not suited for everyone. In this evaluation, you will be guided in figuring out whether you should AcreTrader or not.

This article will go over investing in farmland to see if it really is the best fit for you.

And at the end, you'll find answers some of the most frequently asked questions regarding farmland investing in general

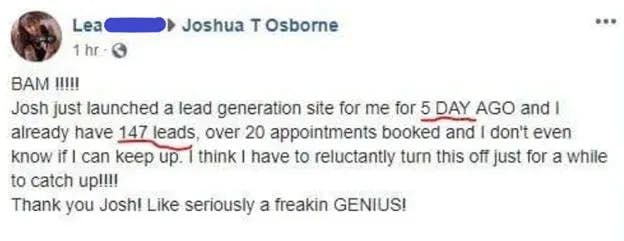

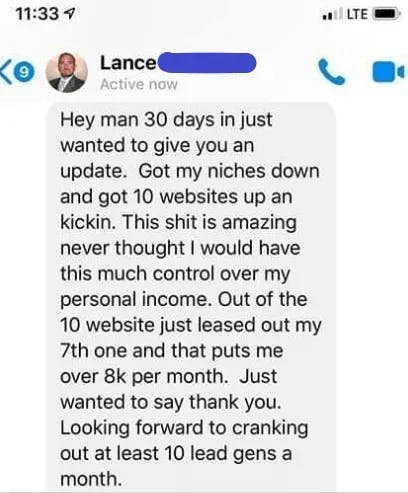

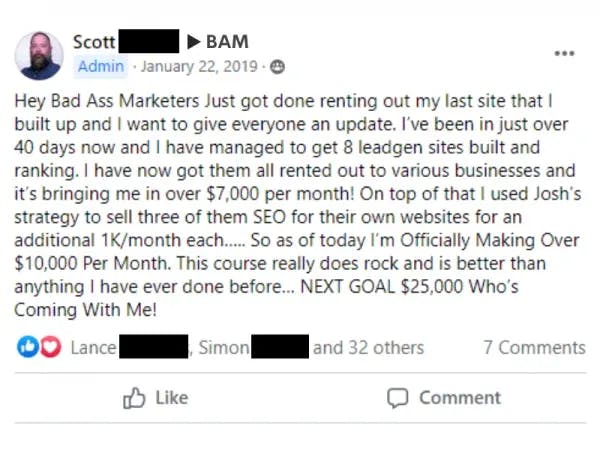

But most importantly, you'll see the exact system many others have used to build their own internet marketing business to over $40,000 a month in mostly passive income.

DISCLAIMER:

This AcreTrader review has been thoroughly researched with information and testimonials that are available to anyone in the public. Any conclusions drawn by myself are opinions.

Why Listen To Us

My name is Josiah, and this is my Dad, Joel.

I built that site in 2020, and it still makes me $1,500 per month. It’s a basic 5 page website I built based on a template the program provides.

The best part to me? My dad and I get to do it all together!

So between the:

Ease of reaching $5-$10K per month in income online

Straightforward-ness of the system to do it

Fact that I get to do it w/ my family

Is why I recommend local lead generation as my #1 business model for making money online.

Sure, it takes some work and dedication – but anyone that tells you that there’s a business out there that requires no work is selling you a lemon.

I’m not saying you need to sign up for the same program I did, but I would definitely recommend giving the business model a peek!

What Is AcreTrader?

AcreTrader is a farmland-focused crowdfunded real estate investing platform. While it is only open to accredited investors, many of the deals on its platform have lower investment minimums than another commercial real estate (CRE) investing platforms.

Furthermore, the nature of the asset class on which it concentrates makes it particularly interesting. Farmland has outperformed every other major asset class since 1990, according to AcreTrader, with not a single negative year.

That's not to suggest that individual transactions don't lose money; low-risk doesn't mean risk-free.

However, it remains a very interesting asset class, and AcreTrader is one of the first platforms to provide it to individual investors.

AcreTrader conducts rigorous due diligence, including in-person interviews with sponsors and operators, in-person tours to the properties, the expected financial analysis, and comparisons to similar farm transactions in the area, as applicable.

AcreTrader makes money in a slightly different way than many other real estate investing platforms, in addition to focusing on farmland.

While it does charge asset management fees ranging from 0.75 percent to 1 percent per year, it also operates as a real estate broker, earning a commission on each property purchased and later sold.

Real estate listing fees and commissions are a common and typical expense in any property sale, and AcreTrader claims that by acting as a real estate broker, it can earn from this fee while keeping other fees lower for investors.

AcreTrader Company Profile: Who Is Carter Malloy?

Carter Malloy, the company's founder and CEO, comes from a farming family and spent much of his career before launching AcreTrader investing in real estate for large private equity and investment banks.

Malloy is AcreTrader's largest shareholder, giving him a lot of personal stake in the company.

Malloy explained the benefits of farmland investing and how AcreTrader analyses this unique asset class in a 2020 interview. (To listen to this interview, go to https://share.transistor.fm/s/511d08a4)

AcreTrader Company Profile: Who Is Garrott McClintock?

Garrott McClintock, AcreTrader's VP of farm operations and a fifth-generation family farmer, is a fifth-generation family farmer.

He has extensive farm management experience, having co-managed a portfolio of more than $200 million in active farms and advising agricultural start-ups.

AcreTrader Review: AcreTrader At A Glance

The company currently employs 15 people and has raised more than $5 million in funding. The goal of this platform is to make farmland investment accessible to the average retail investor.

Investors have the chance to purchase shares in farms in all 50 states, a sector of real estate investing that has been notoriously underappreciated.

The platform now claims to provide annual capital appreciation rates of 7-9%.

Because you are not considered a landlord when purchasing farm shares, you have no management duties, as you would when investing in residential and commercial real estate.

What Is An Accredited Investor?

An accredited investor is an individual or business entity that is permitted to trade securities that are not registered with financial authorities.

They are eligible for this privileged access if they meet at least one of the following criteria: income, net worth, asset size, governance standing, or professional experience.

The Securities and Exchange Commission (SEC) uses the term accredited investor in the United States under Regulation D to refer to investors who are financially knowledgeable and have a lesser need for the protection provided by regulatory disclosure filings.

High-net-worth individuals (HNWIs), banks, insurance firms, brokers, and trusts are all examples of an accredited investor.

Quick Facts About Accredited Investors:

- Unregistered security sellers are only permitted to sell to accredited investors because they are considered financially skilled enough to handle the risks.

- Accredited investors may purchase and invest in unregistered securities if they meet one (or more) of the following requirements: income, net worth, asset size, governance status, or professional expertise.

- Unregistered securities are regarded to be inherently riskier since they lack the standard disclosures that accompany SEC registration.

- The United States Congress amended the definition of an accredited investor in 2020 to include registered brokers and investment advisors.

Income Requirements For Accredited Investors

To be an accredited investor, a person must have earned more than $200,000 ($300,000 for joint income) in the previous two years and expect to earn the same or more in the current year.

Over the last two years, an individual must have earned income over the thresholds, either alone or with a spouse. The income test cannot be met by showing one year of an individual's income and the next two years of joint income with a spouse.

An accredited investor is also someone who has a net worth of more than $1 million, either separately or collectively with their spouse.

A person is also considered an accredited investor if they are a general partner, executive officer, or director of the corporation that is issuing the unregistered securities.

A private business development corporation or an organization with assets greater than $5 million is considered an accredited investor.

In addition, if an entity's equity owners are accredited investors, the entity itself is considered an accredited investor.

An organization, on the other hand, cannot be founded solely for the purpose of purchasing specific securities.

If a person can demonstrate adequate education or job experience demonstrating professional knowledge of unregistered securities, they can be deemed an accredited investor as well.

What Is The Minimum Investment Amount In AcreTrader?

While minimum investments vary from deal to deal, AcreTrader claims that they might range from $5,000 to $50,000.

So far, we've observed that $15,000 to $25,000 is a fairly normal range.

AcreTrader's minimum is unquestionably on the low end of the scale for minimum investments in stand-alone real estate deals.

Two Ways An Investor Will Earn Returns With AcreTrader:

-

Capital appreciation as a result of an increase in the value of the land (land appreciation).

-

Dividends are paid to farmers in the form of cash rent payments.

AcreTrader investments are considered long-term, withholding periods ranging from three to five years. AcreTrader will keep some farmland investments for 5 to 10 years.

The company is very selective about which land holdings it chooses to include on its platform. According to their website, they approve less than 1% of the prospects they review.

How Tax Documents Are Handled

Cash distributions are paid out in December each year, and tax documents are delivered by February of the following year.

Each deal on the platform is structured as a partnership, which means that as an investment partner, you will receive a K1 detailing your share of any revenue and losses. You will be able to declare these on your personal tax return and receive any corresponding income or deduction.

Furthermore, when the property is sold, the revenues will be taxed as capital gains. These will be taxed at a lower rate if held for more than a year.

AcreTrader Fees

Investing is subject to fees, as is the case with most investment platforms.

Though it is free to sign up for AcreTrader and explore their products, there will be costs if you decide to buy.

The AcreTrader platform charges a 0.75 % asset management fee. This asset management fee is paid annually. In comparison to other crowdsourcing platforms, this is pretty reasonable.

In addition, there is a closing fee with each investment that you make, which varies depending on the deal. The average is about 2% of the total investment amount for such property.

Because AcreTrader also provides services to farm owners, it is vital to remember that they charge a 5% fee when the underlying property is sold. They accomplish this by serving as the transaction's real estate brokerage and participating in the standard commission. This has no bearing on their investors because the fee will be paid by the property's owner.

AcreTrader makes the majority of its money from the 5% fee charged to farm owners, and the annual management fee is relatively break-even for them.

AcreTrader does not charge a performance or incentive fee, unlike many other platforms. This means that all of the upsides go to investors, and there is no cap on possible returns.

How Soon Can You Sell Your AcreTrader Investments?

Most investors should consider their investment committed to a deal for the entire term. Having said that, AcreTrader wants to provide a secondary market, so there may be opportunities for liquidity in the future.

Is There An AcreTrader App?

There is no AcreTrader app, but there is a mobile-optimized website that can be used instead.

It is simple to set up your accounts and fund them and invest in AcreTrader trades using your smartphone as it is on a Desktop computer.

In addition to that, you'll have full access to records, your portfolio, and all of the other resources available on the AcreTrader website's desktop version.

Is AcreTrader Legitimate?

Despite the fact that AcreTrader has only been giving investment options since 2018, the founder is the largest stakeholder, implying that he has a significant personal stake in the company.

All escrow monies are handled by North Capital Private Securities Corporation, which is a member of both SIPC and FINRA.

Because all investments are managed outside of AcreTrader, your money is protected even if the platform goes bankrupt.

AcreTrader has a good A+ rating with the Better Business Bureau as of February 2021, which should relieve most investment partners' concerns about safety.

There is currently no way to predict whether investors on the platform would profit because farmland normally requires a 5-10 year holding period. AcreTrader only completed its initial set of transactions about 2-3 years ago.

Only time will tell if AcreTrader's agricultural properties are a good investment.

AcreTrader Review: Is AcreTrader A Good Investment?

It's worth your time if you're an accredited investment partner looking to diversify your portfolio by investing in less dense or sought-after property.

There are risks, as with any other investment, because extreme weather conditions, such as excessive rain or natural catastrophes, can cause significant damage to farmland or entirely wipe it out.

Water access issues might also reduce land value because certain locations rely on underground water pumps for irrigation.

However, as previously stated, the Farm Team at AcreTrader performs extensive due diligence to minimize these risks.

Having said that, farmland shares will continue to appreciate in value as additional farming property is developed and the population grows, necessitating higher food output to meet rising demand. It has a viable market.

So far, the majority of AcreTrader's deals have been low-risk and debt-free. The initial capital raise includes all capital utilized to finance the project.

AcreTrader Review: What Are The Pros and Cons of AcreTrader?

Pros of AcreTrader

- Investing in farmland, a strong asset class, all throughout the U.S.

- A solid, uncorrelated asset class with a track record of consistently strong returns

- Excellent customer service; Advertising relationship is good

- A highly qualified team that adopts best-in-class underwriting practices.

- Due Diligence — They devote a lot of resources in vetting every offer, visiting hundreds of farms, but only select 1% of the deals that come in.

- The platform has some of the lowest fees in real estate investing.

- Low Minimums for Investors — to qualify to invest, you can participate in land deals with a $5,000 minimum investment for farmland.

Cons of AcreTrader

- At the moment, accredited investors are the only ones who can participate.

- Being a young company, they have a limited track record. They don't have realized deals considering that farmland investments are for the long term. However, AcreTrader produced over 500 payouts to investors through row crop investments in 2020, indicating some promise.

Can You Really Make Money With AcreTrader?

Yes, You can!

But...

There's a lot that comes along with Farmland Investing that many people struggle with.

Now, don't get the wrong idea...

It's not impossible to make money with farmland, but if you're gonna put in the amount of grueling work to do this business (which isn't easy), you might as well bring in some REAL money while you're learning the ropes.

The program that helped skyrocket many online businesses to over $40,000+ per month is so simple that making money really does become second nature.

AcreTrader Review: Is AcreTrader The Right Real Estate Investing Platform For You?

AcreTrader is suitable for you if you are willing to wait it out and are interested in an asset class that is potentially profitable.

If you're new to investing in farmland and want to know more details, it's a good idea to get more information.

What Customer Support Is Available?

AcreTrader's website has a FAQ area as well as a full instructional center. On their "contact us" page, they also provide a phone number and an email address. As a relatively young business, it's easy to contact them.

Where Can We Find More Information On AcreTrader?

Accredited investors can learn more about how to invest in farmland and how real estate investing platforms operate by visiting their website and exploring the learning center.

They have videos, articles, and other content that focuses on the agricultural sector, commercial real estate, and other real estate investment options.

Their investment platform does not have any apps. Their website, however, is optimized for mobile-friendly surfing.

AcreTrader Review: Conclusion

In light of the fact that farmland has emerged as one of the most promising asset classes in recent years, as well as the ease of access that AcreTrader gives, even if it is a relatively new company, AcreTrader is worth exploring.

There is a solid legal support for them, and they are certified and go to great pains to vet the farms that are being offered.

Investment deals are more sophisticated here because they are only available to an accredited business partner. Although risky, it's a wise decision that will offer some diversity to your portfolio of investments.

It is necessary to consistently mitigate risks associated with farmland investment, such as poor weather conditions, soil sustainability, and other factors. AcreTrader, on the other hand, has shown to be a reputable and increasingly popular investment avenue for those looking to invest in farmland.

What Is Our Top Recommendation For Making Money Online In 2024?

Where these real estate investments fall short is in scalability. Because in order to make a good amount of money with real estate, you have to own several different houses.

And who has that kind of capital to start?

But what if you went local?

With Local Lead Generation, you will be getting service requests from multiple sites at every minute of the day from people who are willing to pay a lot of money for what you can provide them.

I was watching a YouTube video once where the host made a comment that it isn’t about making a lot of money from one website… it’s about making a little bit of money from lots of different websites.

So, think of it this way….

What if you could have streams of investment income where you operated 10 rental units that you could charge anywhere from $750-1,000 per month?

That’s $7,500-10,000 per month in passive income!

What If You Invested Into 100 Rental Units?

But instead of spending $Millions to build houses or apartment complexes… you spend a couple hundred dollars to build websites.

You then get those websites ranked in the search engines for specific home-based services that customers are searching for.

Next, you offer your lead generation system to local business owners who are looking for customers and are willing to pay you for their information.

And Then…

BAM!

You’ve just created a Digital Leasing Investment Empire that is potentially earning you 4-5 figures in PASSIVE INCOME on a monthly basis without spending a single dime on ads.

With conventional Digital Leasing, you have to compete with thousands, if not millions of others who are selling the SAME product to the SAME customers.

Once the training program is completed you will also have access to a Facebook group much better than the AcreTrader group in our opinion. This group is much more active.

Unlike AcreTrader, where you’re profiting maybe $250 per property, you could be getting 5-10X THAT.

With Local Lead Generation, the competition is virtually nothing and your profit margins are 85-90%.

Now, I could go on and on, but I’m sure you have tons of questions...

So, learn how you can create Digital Leasing assets and start building YOUR digital empire!

#1 Business Recommendation

We each make around $10,000 per month with the help of this system.

yes, show me more