1031 Crowdfunding Reviews (2024): Best Crowdfunding Platform For You?

![1031 Crowdfunding Reviews ([year]): Best Crowdfunding Platform For You?](/_next/image/?url=https%3A%2F%2Fcolorful-action-2ff8f86b45.media.strapiapp.com%2F1031_Crowdfunding_Reviews_optimized_7773360d88.avif&w=1920&q=80)

1031 Crowdfunding streamlines the process of transferring ownership (partial or whole) from one (or more) properties to one (or more) new properties, delaying capital gains taxes. Investors who do not now own any real estate can also participate, presumably in anticipation of future 1031 exchanges of those investments.

Here are the pros and risks you should be aware of before investing in this crowdfunding platform.

DISCLAIMER:

This 1031 Crowdfunding review has been thoroughly researched with information and testimonials that are available to anyone in the public. Any conclusions drawn by myself are opinions.

Excellent tax benefits

Large selection

Detailed due diligence materials are supplied

High minimums

Only accredited investors are eligible

Uses complicated legal structure (Delaware Statutory Trusts)

Why Listen To Us

My name is Josiah, and this is my Dad, Joel.

I built that site in 2020, and it still makes me $1,500 per month. It’s a basic 5 page website I built based on a template the program provides.

The best part to me? My dad and I get to do it all together!

So between the:

Ease of reaching $5-$10K per month in income online

Straightforward-ness of the system to do it

Fact that I get to do it w/ my family

Is why I recommend local lead generation as my #1 business model for making money online.

Sure, it takes some work and dedication – but anyone that tells you that there’s a business out there that requires no work is selling you a lemon.

I’m not saying you need to sign up for the same program I did, but I would definitely recommend giving the business model a peek!

1031 Real Estate Crowdfunding Review

This review will go over 1031 Crowdfunding to see if it really is the best real estate crowdfunding platform out there.

You'll learn whether real estate is the right online business for you.

And at the end, you'll find answers some of the most frequently asked questions regarding 1031 Crowdfunding and real estate in general.

But most importantly, you'll see the exact system many others have used to build their own internet marketing business to over $40,000 a month in mostly passive income.

This system made them swear off real estate funds for good, because it uses some of the same skills but in a much more powerful and profitable way!

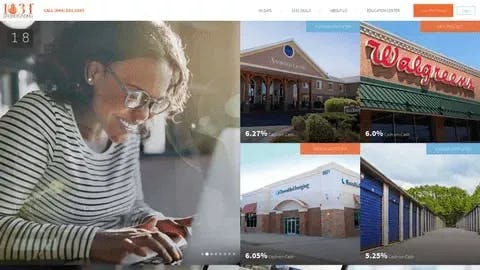

What Is 1031 Crowdfunding?

1031 Crowdfunding is not like the majority of crowdfunding services.

1031 Crowdfunding is not like the majority of crowdfunding services.

It's more like a service that helps investors delay taxes on real estate gains (via an IRS-approved 1031 exchange) while also utilizing some of the benefits of crowdfunding, such as online access to high-quality commercial real estate investments & shared ownership with other investors.

1031 Crowdfunding is a platform that allows investors to buy and own commercial properties that have been pre-vetted by real estate specialists and pre-qualified to meet the IRS standards for a 1031 exchange.

A 1031 exchange enables real estate investors to defer tax liabilities on the sale of an investment property by reinvesting the proceeds to purchase a new property.

The underlying concept is that if the investor does not get any proceeds from the sale, there is no income to tax.

Taxes can be postponed forever if no monetary benefit is received. As a result, a 1031 exchange is one of the finest tax advantages available to real estate investors.

However, it is complicated by IRS laws, and if you do not do everything correctly while completing a 1031 exchange, you will not be eligible for the tax benefit.

This is where 1031 Crowdfunding comes into play. Investors on its platform have access to a ready supply of exchange-qualified real estate that can be purchased fast. This minimizes the possibility of:

Not being able to discover a suitable property to buy.

Missing the deadlines that investors must follow in order to qualify for the 1031 exchange tax benefits.

Is 1031 A Good Investment?

Assume you sell a property for $250,000 with a $150,000 cost basis. On $100,000, you can either pay approximately 53.8 percent in taxes (typically federal tax of 15% to 20% plus state tax of 10% to 12%, depreciation recapture tax of 25%, and investment income tax (i.e., Obamacare) of 3.8 percent), or you can do a 1031 exchange and invest your $250,000 in a like-kind property and defer the tax until you sell the new property.

Instead of paying $53,800 in taxes and having less than $200,000 to invest, you can invest the entire $250,000.

That is the appeal of a 1031 exchange. But here's the catch: you must identify the property you intend to buy within 45 days of selling, and you must close on the new property acquisition within 180 days of selling the first.

Getting the timing perfect with real estate investments can be difficult. If you don't satisfy those deadlines, you have to pay the tax. In essence, your investment is susceptible to "closure risk," a costly bet that disqualifies many well-intentioned investors who undertake 1031 swaps.

Your closing risk is eliminated with 1031 Crowdfunding since you, along with other investors, purchase an ownership percentage of an already qualifying property, and you may close on the swapped property in three to five days because it has already been pre-funded.

Completing a 1031 exchange is dependent on the investor's ownership structure inside the investment rather than how the money is raised.

Investors obtain an ownership interest in the underlying real estate asset through a Delaware statutory trust (DST) without having to participate actively in the acquisition, management, or sale of the property.

Types Of Investment Opportunities At 1031 Crowdfunding

The platform only provides real estate investments, primarily real estate traded through 1031 exchanges rather than being sold. Exchanges are not taxable, but sales are.

An exchange occurs when a property owner or investor decides to acquire replacement property in a short amount of time after selling their old property.

If you sell your original property, capital gains taxes on gains exceeding $250,000 (single person) or $500,000 (married couple) on a primary home can be in excess of 30% when both state and federal taxes are considered, and the amount can be even higher for a property that is not considered as an owner's primary residence.

You are not subject to capital gains tax on a house sale if you choose to exchange the original property's value for the new property's value rather than cash out.

To qualify as like-kind, an exchange must meet the IRS criteria of being either (a) property held for investment or (b) property held for productive use in a business or trade.

However, a one-to-one exchange or swap is not required for a transaction to qualify. According to IRS regulations, you can sell three different properties, each worth one-third of the value of the property you then buy, and this counts as an exchange.

Selling one high-value property and buying two or three smaller ones works as well, as long as they're of the same "like" kind.

Only accredited investors are the ones who can participate in 1031 Crowdfunding.

What Do You Gain If You Invest In 1031 Crowdfunding?

When you invest through 1031 Crowdfunding, you are purchasing a beneficial interest in a DST. The DST owns equity in a variety of real estate properties and manages the exchanges.

This means you can own real estate without actively managing real estate. The time required is one of the challenges that ordinary investors confront while executing like-kind exchanges.

After selling the original property, you have 45 days to find a replacement property and notify the seller or the seller's agent (not just your own attorney or agent). After that, you have 180 days or until the end of the tax year to finalize the acquisition of the replacement property.

1031 Crowdfunding alleviates part of the stress associated with meeting these deadlines by sending out the necessary notifications and ensuring that purchases are completed on time.

The IRS permits this type of investment for both cash and 1031 exchange participants. Any investor that chooses to invest through a DST is referred to as a cash investor. Through their platform and the usage of a DST, 1031 Crowdfunding enables these investors to become 1031 exchange investors.

How Does 1031 Crowdfunding Generate Revenue?

1031 Crowdfunding's fees are generally standard for a DST but somewhat more than the costs charged by other crowdfunding platforms. Furthermore, the greater minimum investment level of $25,000 creates a higher barrier to entry.

- 3.5% acquisition fee

- 3.5% disposition fee

- 1% financing fee

- Property management fee is 4% of the gross rent

- Fee for refinancing is 1%

Cashflow And Potential Returns

Investing in a 1031 exchange is often a longer-term commitment than other types of crowdfunding investments, such as real estate or other types of investments. Many of the transactions available through the 1031 Crowdfunding platform have a 7 to 10 years debt holding duration. However, some are as low as 5-7 years.

A closer look at the sample deals on 1031 Crowdfunding reveals an average expected cash flow of 5 to 7 percent.

Minimum Investment At 1031 Crowdfunding Investment

The minimum investment required to participate in offerings ranges from $25,000 to $100,000, depending on the investment. Non-1031 offerings require a $500 minimum commitment.

What Are The Fees Associated With 1031 Crowdfunding?

Fees are paid to sponsors when investing in a third-party DST. Fees include a 2% acquisition fee on average, a 25 to 100 basis point yearly asset management fee, and a commission depending on asset appreciation. 1031 Crowdfunding and third-party sponsors do not benefit from asset appreciation; instead, it is passed on to investors.

When considering a 1031 exchange, you might expect to pay between 8% and 17% of the purchase price, depending on the agreement and your circumstances.

You must sum up all expenses and decide whether it is more cost-effective to go through the hassle or pay the tax.

You must, for example, continue to use an IRS-approved 1031 exchange trustee—and pay for the services of an intermediary.

Because the qualified intermediary must be an unaffiliated third party whose sole purpose is to administer the 1031 property exchange, a crowdfunding site cannot act as your intermediary and sell the goods.

The fees charged by qualified intermediaries vary, but most sources estimate that a usual deferred 1031 exchange costs between $600 and $1,200.

Can You Lose Money W/ Real Estate Crowdfunding?

Real estate crowdfunded investments are often unsecured investments, which means that if the platform fails, investors may lose their money.

While most investors are aware of the risk, the nature of investment security may be changing, and attorneys advise investors to keep an eye on this subject.

Is Crowdfunding A Safe Investment?

The following are the primary risks of investment-based crowdfunding:

- The company in which you invest may fail. Because many new firms fail in their first few years, you may lose all of your money.

- The return cannot be guaranteed.

- It may be challenging to sell the shares.

- The crowdfunding platform itself could fail.

Thus, before making an investment decision, you must ask for legal or tax advice.

What Is A 1031 Fund?

The term "1031 exchange" comes from Section 1031 of the United States Internal Revenue Code, which enables you to avoid paying capital gains taxes when you sell an investment property & reinvest the proceeds w/in particular time limits in a property or properties of like kind and equal or greater value.

Can You Make Money With 1031 Crowdfunding?

Yes, you can make money by owning real estate with 1031 Crowdfunding.

But...

There's a lot that comes along with real estate that many people struggle with.

Now, don't get the wrong idea...

It's not impossible to make money with real estate, but if you're gonna put in the amount of grueling work to do this business (which, trust us, isn't easy), you might as well bring in some REAL money while you're learning the ropes.

The program that helped skyrocket many online businesses to over $40,000+ per month is so simple that making money really does become second nature.

Is 1031 Crowdfunding A Scam?

1031 Crowdfunding is a legit real estate crowdfunding site.

It is entirely possible to build a profitable, successful real estate business... But there are better ways to build a business other than with real estate.

Is 1031 Crowdfunding Legit?

1031 Crowdfunding is legit. It has already raised billions of combined real estate transactions.

But, when it comes to building a business, you have plenty of options.

Keep in mind, I don't get paid to promote any of the programs I review. I personally think real estate is a great business model, but you could end up leaving way too much money on the table.

What Is Our Top Recommendation For Making Money Online In 2024?

1031 Crowdfunding is legit. It has already raised billions of combined real estate transactions.

But, when it comes to building a business, you have plenty of options.

Keep in mind, I don't get paid to promote any of the programs I review. I personally think real estate is a great business model, but you could end up leaving way too much money on the table.

With Local Lead Generation, you will be getting service requests from multiple sites at every minute of the day from people who are willing to pay a lot of money for what you can provide them.

I was watching a YouTube video once where the host made a comment that it isn’t about making a lot of money from one website… it’s about making a little bit of money from lots of different websites.

So, think of it this way….

What if you could have streams of investment income where you operated 10 rental units that you could charge anywhere from $750-1,000 per month?

That’s $7,500-10,000 per month in passive income!

What If You Invested Into 100 Rental Units?

But instead of spending $Millions to build houses or apartment complexes… you spend a couple hundred dollars to build websites.

You then get those websites ranked in the search engines for specific home-based services that customers are searching for.

Next, you offer your lead generation system to local business owners who are looking for customers and are willing to pay you for their information.

And Then…

BAM!

You’ve just created a Digital Leasing Investment Empire that is potentially earning you 4-5 figures in PASSIVE INCOME on a monthly basis without spending a single dime on ads.

With conventional Digital Leasing, you have to compete with thousands, if not millions of others who are selling the SAME product to the SAME customers.

Once the training program is completed you will also have access to a Facebook group much better than the Crowdfunding group in our opinion. This group is much more active.

Unlike real estate, where you’re profiting maybe $250 per property, you could be getting 5-10X THAT.

With Local Lead Generation, the competition is virtually nothing and your profit margins are 85-90%.

Now, I could go on and on, but I’m sure you have tons of questions about how to create Digital Leasing assets and start building YOUR digital empire!

#1 Business Recommendation

We each make around $10,000 per month with the help of this system.

yes, show me more